Shares of Hewlett Packard Enterprises (NYSE: HPE) were down over 5% in midday trade on Wednesday, a day after the company missed revenue estimates for the first quarter of 2020 and provided a bleak outlook for the near-term. The stock has dropped 19% in the past one month.

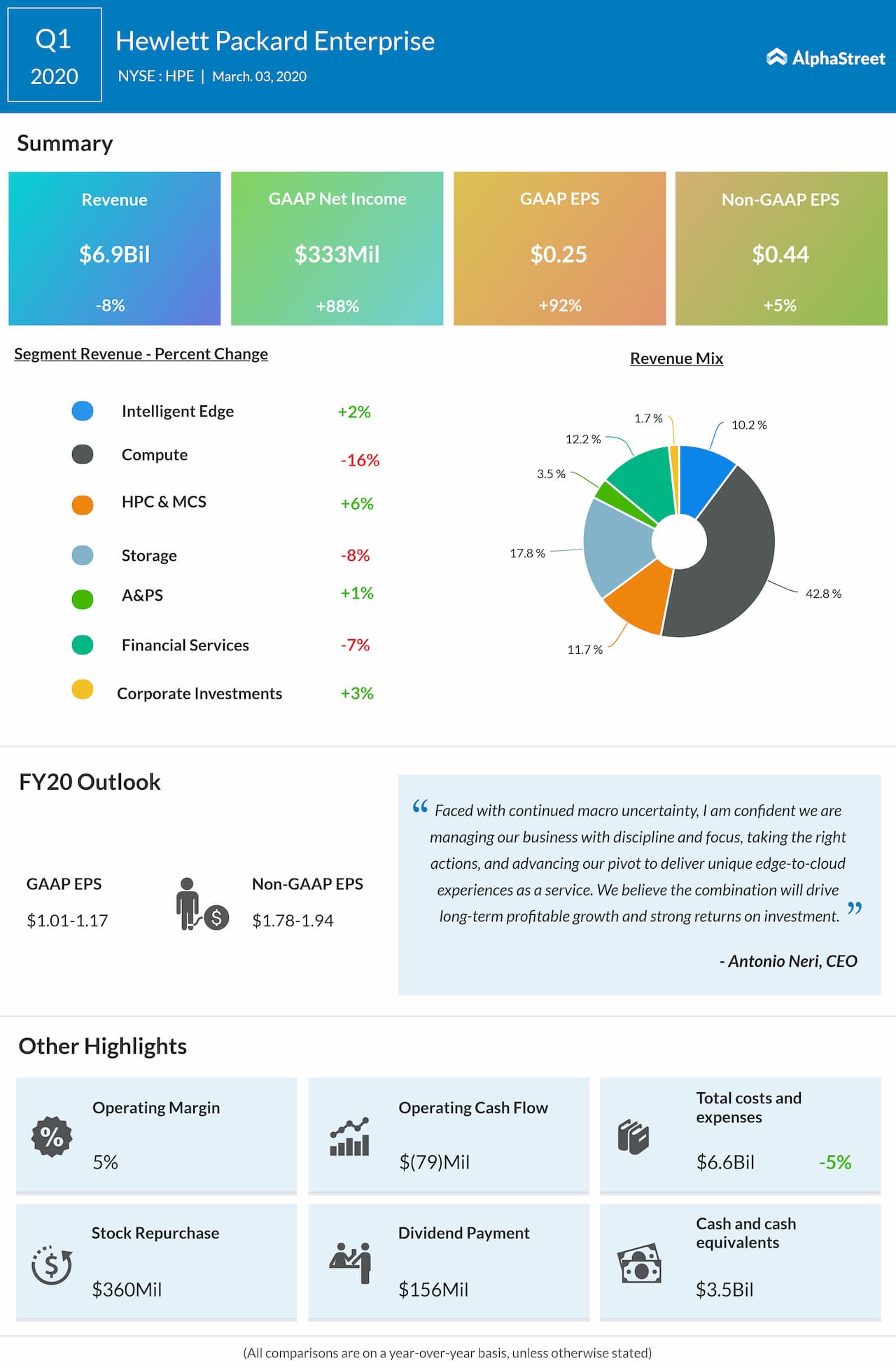

Net revenues fell 8% year-over-year, hurt by unstable demand due to uncertainty in the macro environment, which caused longer sales cycles and delays in customer decisions. In its quarterly conference call, the company said that impediments to supply and shortages in components, which impacted the ability to meet customer demand, also took a toll on revenue.

Component manufacturing was impacted by the coronavirus

outbreak leading to higher backlogs at the end of the quarter. HPE also faced

an issue with the consolidation of its North American manufacturing site and

this affected the Compute business in particular, which saw a 16% drop in

revenue from last year.

HPE believes it will continue to face challenges due to

component shortages but expects the situation to get better as the year

progresses. The company is also tackling near-term execution challenges due to

the North American manufacturing site consolidation but it believes supply

chain efficiencies will improve going forward.

The coronavirus outbreak continues to disrupt supply and demand and although HPE is unable to determine the exact impact at this time, it continues to work with its suppliers to reduce the effects on its operations.

Since the potential impacts of the coronavirus remain unknown, uncertainty prevails for the near term, due to which HPE refrained from providing guidance for its second quarter. The company also expects negative impacts to its cash conversion cycle due to supply constraints and long sales cycles. This led HPE to cut its free cash flow outlook for FY2020 to a range of $1.9 billion to $2.1 billion from the previous range of $1.6 billion to $1.8 billion.

However, not all seems bleak. HPE continues to see increasing demand for hybrid solutions and believes it is well-positioned to capitalize on this trend. The Intelligent Edge business outperformed competitors, posting growth across all geographies, and the company expects this momentum to continue. HPE is also seeing strong demand in its high performance computing business.

HPE is shifting its portfolio to higher margin software-defined solutions and is working on offering its full portfolio as a service by 2022. This will help drive sustainable profitability and increase shareholder value in the long term. Despite the near-term challenges, it appears HPE will see light at the end of this tunnel.