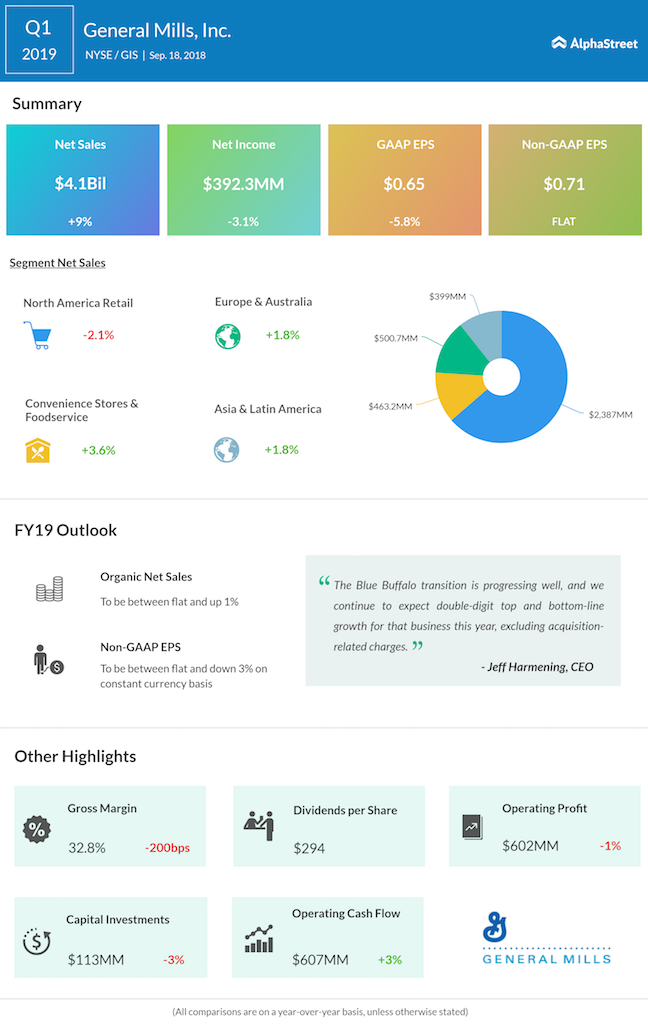

Net sales rose 9% annually to $4.09 billion during the first quarter, when organic sales gained modestly. The top-line was broadly in line with Wall Street expectations. A 2% decline in North America retail was more than offset by a 3.6% growth in Convenience Stores and Foodservice. Europe & Australia and Asia & Latin America registered 1.8% growth each.

“We drove organic net sales growth for the fourth consecutive quarter. The Blue Buffalo transition is progressing well, and we continue to expect double-digit top and bottom-line growth for that business this year, excluding acquisition-related charges,” said General Mills CEO Jeff Harmening.

A 2% decline in North America retail was more than offset by a 3.6% growth in Convenience Stores and Foodservice

The company, which makes ready-to-eat snacks like Cheerios cereal and Yoplait yogurt, reiterated the outlook for its full-year 2019 adjusted earnings between flat and down 3% year-on-year. It continues to expect full-year net sales to rise in the range of 9% to 10% and sees organic sales between flat and up 1%.

General Mills shares witnessed a 19% fall so far this year, underperforming the market. Currently, the stock is in the recovery mode, and closed the last trading session slightly higher. Following the announcement, the stock dropped nearly 4% in premarket trading Tuesday.