With conditions in China not improving meaningfully, the slowdown might have persisted in the region where the company is planning to launch several new models. Meanwhile, the market will be eager to know if the management’s cost-cutting efforts helped in easing the strain on margins. The effect of last year’s reorganization, marked by discontinuation of non-viable production facilities and workforce reduction, is unlikely to reflect in the December-quarter results.

Road Ahead

As far as the top-line performance is concerned, one positive factor is the stable performance of the Financial segment, which is estimated to have registered a modest growth this time. Also, it needs to be noted that GM performed better than most of its peers at a time when the sector as a whole is facing a cyclical slump. Going forward, the company might consider discontinuing some of its under-performing sedan models, as it did earlier.

Q3 Outcome

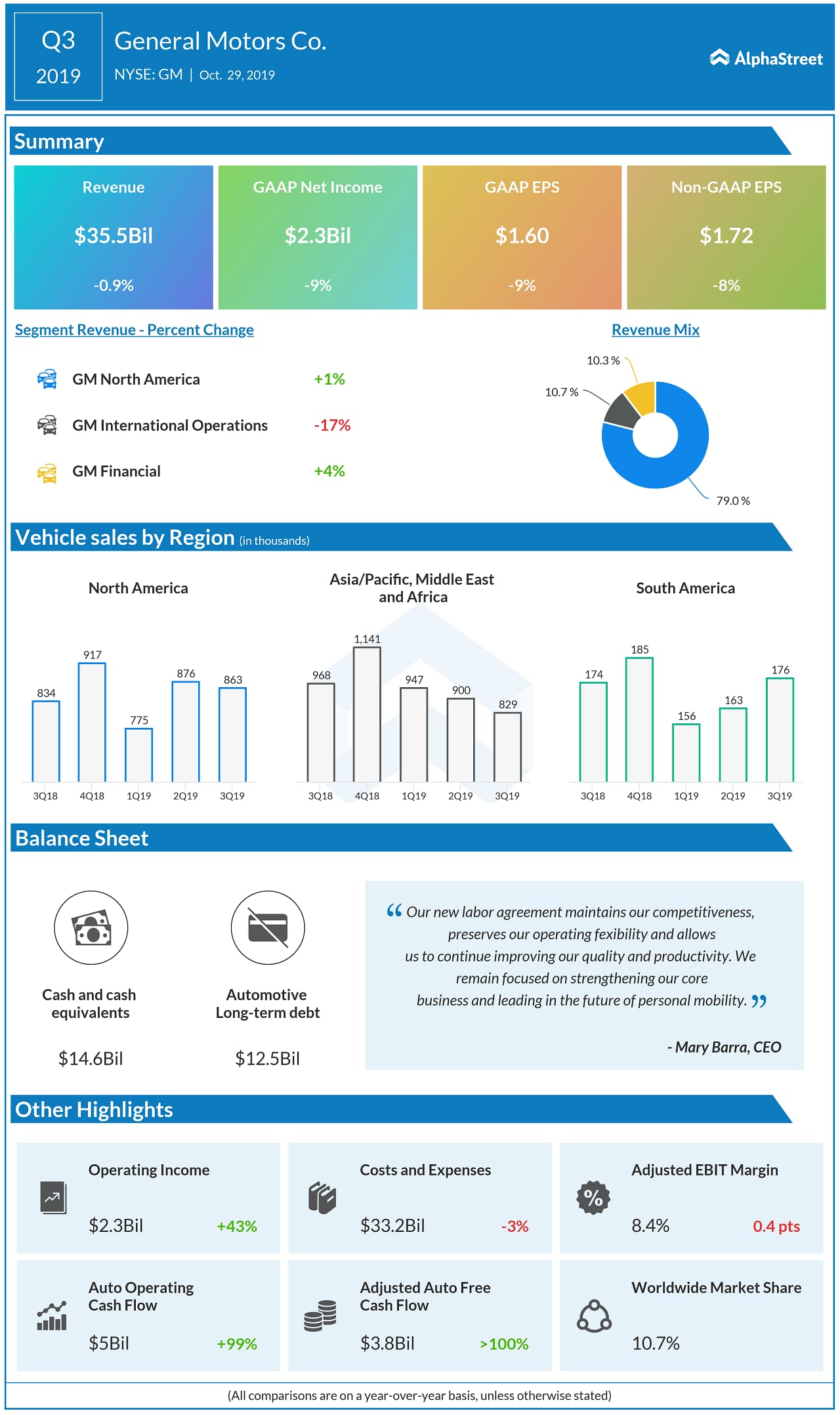

Production disruptions caused by the months-long agitation and weakness in the Chinese market took a toll on the company’s performance in the third quarter when earnings fell 8% to $1.72 per share on muted sales. Revenues dropped modestly to $35.5 billion during the three-month period. However, the results exceeded the market’s estimates.

On Fast Track

Last week, Tesla (TSLA) said its fourth-quarter adjusted earnings rose to $2.14 per share and topped the Street view on revenues of $7.38 billion, which represents a 2% annual growth. The top-line benefited from higher deliveries, which was partially offset by an unfavorable lease mix.

GM lost significant market value in 2019, with the shares losing about 14% during the year. Unfortunately, the downtrend continued in the current year and the stock dropped about 9% since the beginning of the year to an eight-month low.