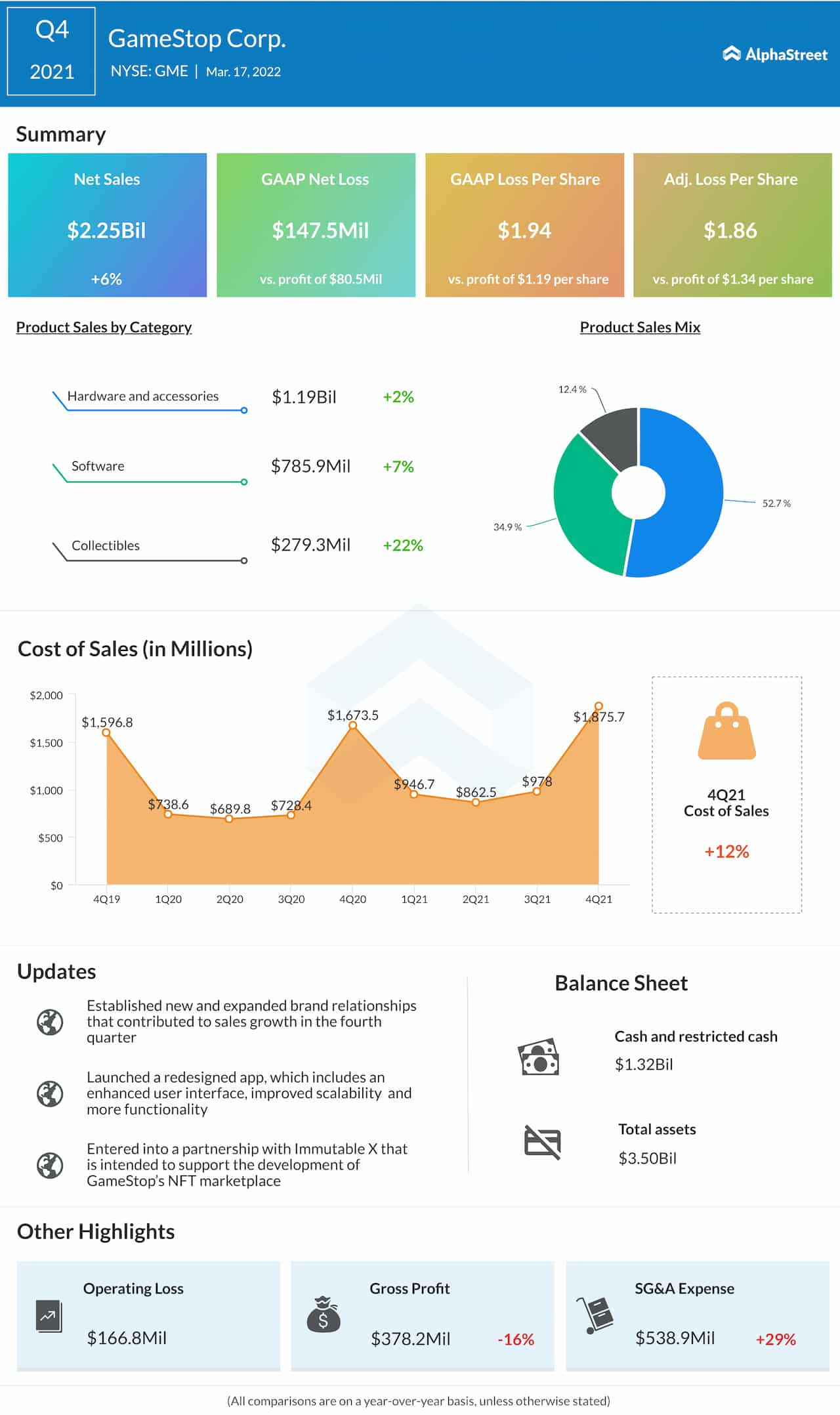

GameStop Corp. (NYSE: GME) has reported a surprise loss for the fourth quarter of 2021, compared to profit last year. Meanwhile, sales increased 6% and topped analysts’ expectations.

The company reported a net loss of $147.5 million or $1.94 per share for the latest quarter, on an unadjusted basis, compared to a profit of $80.5 million or $1.19 per share in the same period of last year. The adjusted loss was $1.86 per share, compared to earnings of $1.34 per share in the prior-year quarter.

At $2.25 billion, foruth-quarter net sales were up 6% from the year-ago period. The top-line also exceeded analysts’ estimates.

Read management/analysts’ comments on GameStop’s Q4 2021 earnings

During the quarter, the company established new and expanded brand relationships, including with PC gaming companies such as Alienware, Corsair, and Lenovo, that contributed to sales growth. It also grew PowerUp Rewards Pro members by 32% on a year-over-year basis, taking total membership to about 5.8 million.