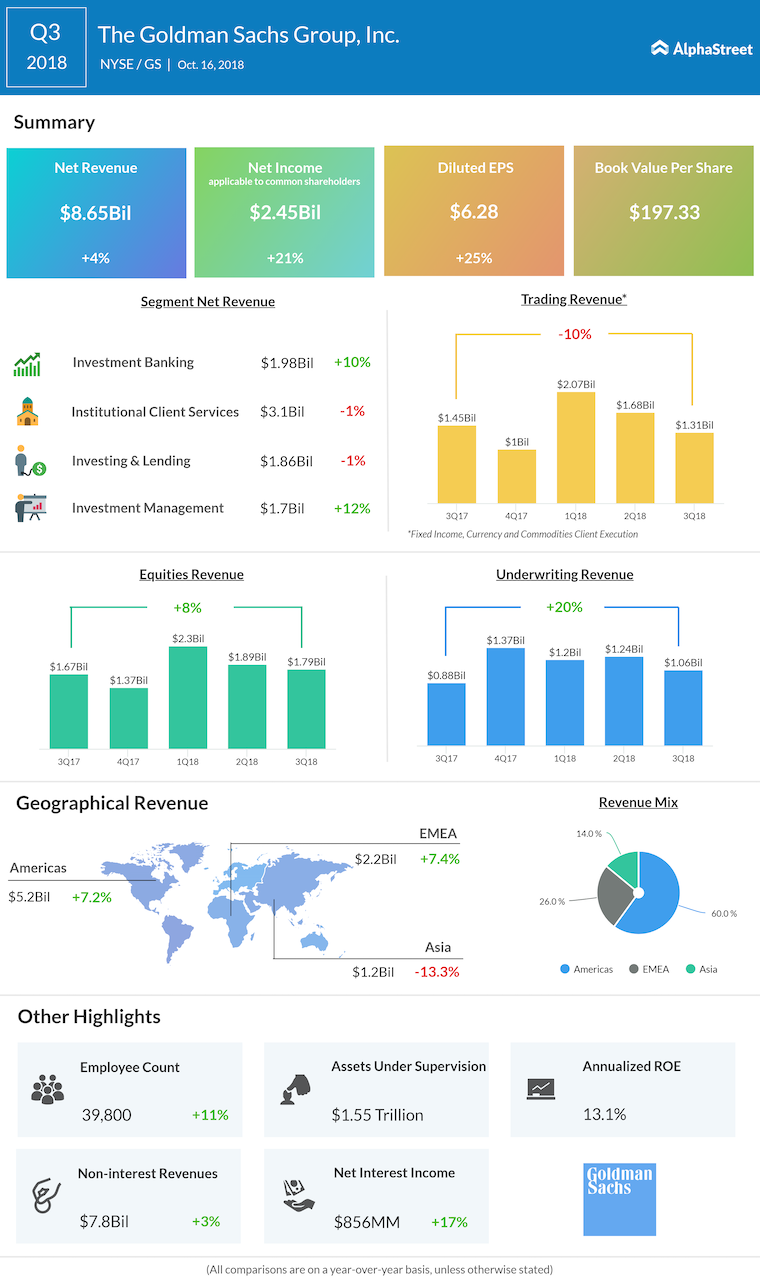

Net earnings applicable to common shareholders rose 21% to $2.45 billion and EPS grew 25% to $6.28 versus last year. EPS for the year-to-date period was $19.21, the highest in the company’s history.

Total non-interest revenues improved 3% to $7.7 billion while net interest income increased 17% to $856 million.

Investment Banking revenues grew double-digits with particular strength in underwriting, led by higher equity underwriting revenues fueled by IPOs. This growth was dampened by lower debt underwriting revenues which reflected lower investment-grade activity.

Institutional Client Services revenues dropped slightly from last year with lower revenues in FICC caused by revenue declines in interest rate products as well as credit products and mortgages. Strength in equities client execution and derivatives drove revenue growth in equities during the quarter.

Investing & Lending revenues saw a slight decline hurt by a 20% decrease in equity securities which reflected weakness in public equities investments. Solid growth in net interest income helped push debt securities and loans revenues up by 52%.

Investment Management revenues grew 12% due to higher management and other fees, reflecting higher average assets under supervision and impacts from new revenue recognition standards.

Earnings Preview: It’s a new age for Goldman Sachs under David Solomon

Operating expenses grew 4% during the quarter due to higher non-compensation expenses.

Annualized return on average common shareholders’ equity was 13.1% for the quarter while book value per common share as of September 30 was $186.62.

On October 15, the board declared a dividend of $0.80 per common share payable on December 28 to shareholders of record on November 30, 2018.

Goldman’s peer Morgan Stanley (MS) also reported third quarter earnings on Tuesday, beating market expectations on revenues and profits.

Goldman Sachs’ stock is down over 15% so far this year while over the past one month, the stock is down 6%.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.