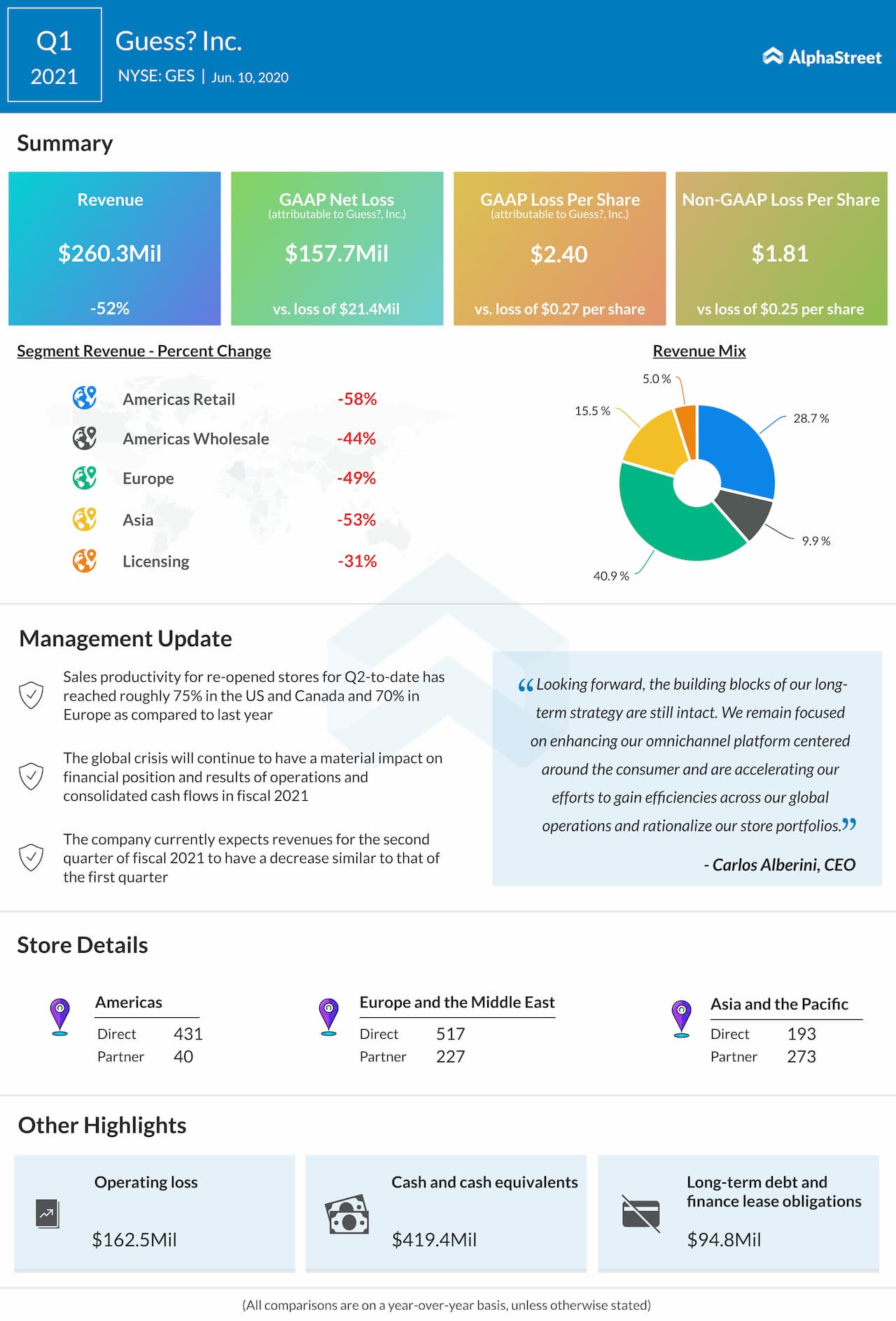

Guess? Inc. (NYSE: GES) reported a wider loss in the first quarter of 2021 due to lower revenue, asset impairment charges as well as additional inventory valuation reserves and higher allowances for markdowns and doubtful accounts. The COVID-19 crisis has had a material impact on the company’s operations and financial results.

To minimize loss and protect liquidity, the company challenged every aspect of its business which was being significantly impacted by extensive store closures and lower customer demand. In addition to postponing decisions related to the payment of the quarterly dividend, the company was able to lower expenses, adjust inventory levels and purchases, lower capital expenditures, and extend vendor payment terms to react to the crisis.

The company has all its stores open in Asia, over 400 stores in Europe, and over 180 stores in the US and Canada. The company’s sales productivity for re-opened stores for the second quarter-to-date has reached roughly 75% in the US and Canada and 70% in Europe as compared to last year’s level.

The company expects that the global crisis will continue to have a material impact on its financial position, operations results, and consolidated cash flows in fiscal 2021. Given the dynamic situation, the company has not provided detailed guidance for Q2 of 2021 or the full-year 2021. However, the company now expects Q2 revenue to have a decrease similar to that of Q1.

Take a look at our Retail articles here