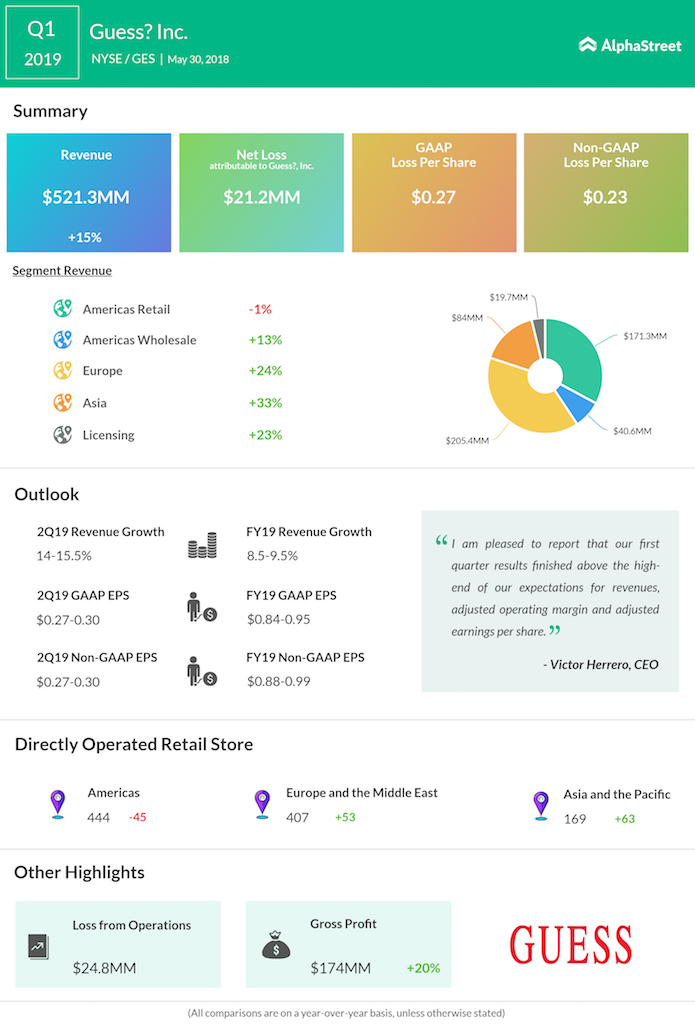

Guess? (GES) reported that its first quarter revenue grew 15% to $521 million aided by the strong performance from its Europe and Asian regions, and adjusted loss reduced to $0.23 per share from $0.24 per share reported last year. The company’s revenue topped analysts’ estimates, while loss per share came in line with Street consensus. Shares of the lifestyle products maker dropped nearly 2% in the extended hours of trading.

Europe and Asian divisions continued its stellar growth posting double-digit sales growth of 24.2% and 32.6%, respectively. Guess? has been investing heavily in both these regions by opening more stores and bolstering its digital presence. Both of these regions are expected to witness strong growth which in turn will boost the company’s revenues in fiscal 2019.

Guess? also has been keeping a close tab on its costs and improving margins through various initiatives like making its supply chain efficient by entering into partnerships with suppliers which are long in tenure and gives economy of scale to the firm.

Americas region has been a drag on the earnings as Guess? continues to face tough competition and lower footfalls due to the tough retail environment in US and Canada. Americas Retail division saw a sales drop of 1.4% in the quarter. The silver lining in the quarter was a 2% increase in same-store sales due to a reduction in promotions which has resulted in improved margins for the division. Revenue for Americas Wholesale segment improved 13.4%.

Based on the strong first quarter results, the company has guided revenues to increase 14% to 15.5% in the current quarter and in the range of 8.5% to 9.5% for fiscal 2019. Earnings, on an adjusted basis, is forecasted to be between $0.27 and $0.30 per share for the second quarter and $0.88 to $0.99 per share for the full year.

In January, model Kate Upton made sexual harassment allegations on Guess? co-founder Paul Marciano, which shocked the entire fashion world. In response to Upton’s complaints, Marciano has stepped down from his daily responsibilities until the investigation is complete and has denied the claims made by Upton. The company’s board is yet to complete its investigation.

The fashion retailer’s turnaround strategy has been given thumbs up by the investors lifting the stock price more than 44% in 2018, and for the past 12 months, it has more than doubled and trading in the $24 range compared to $12 range last year.