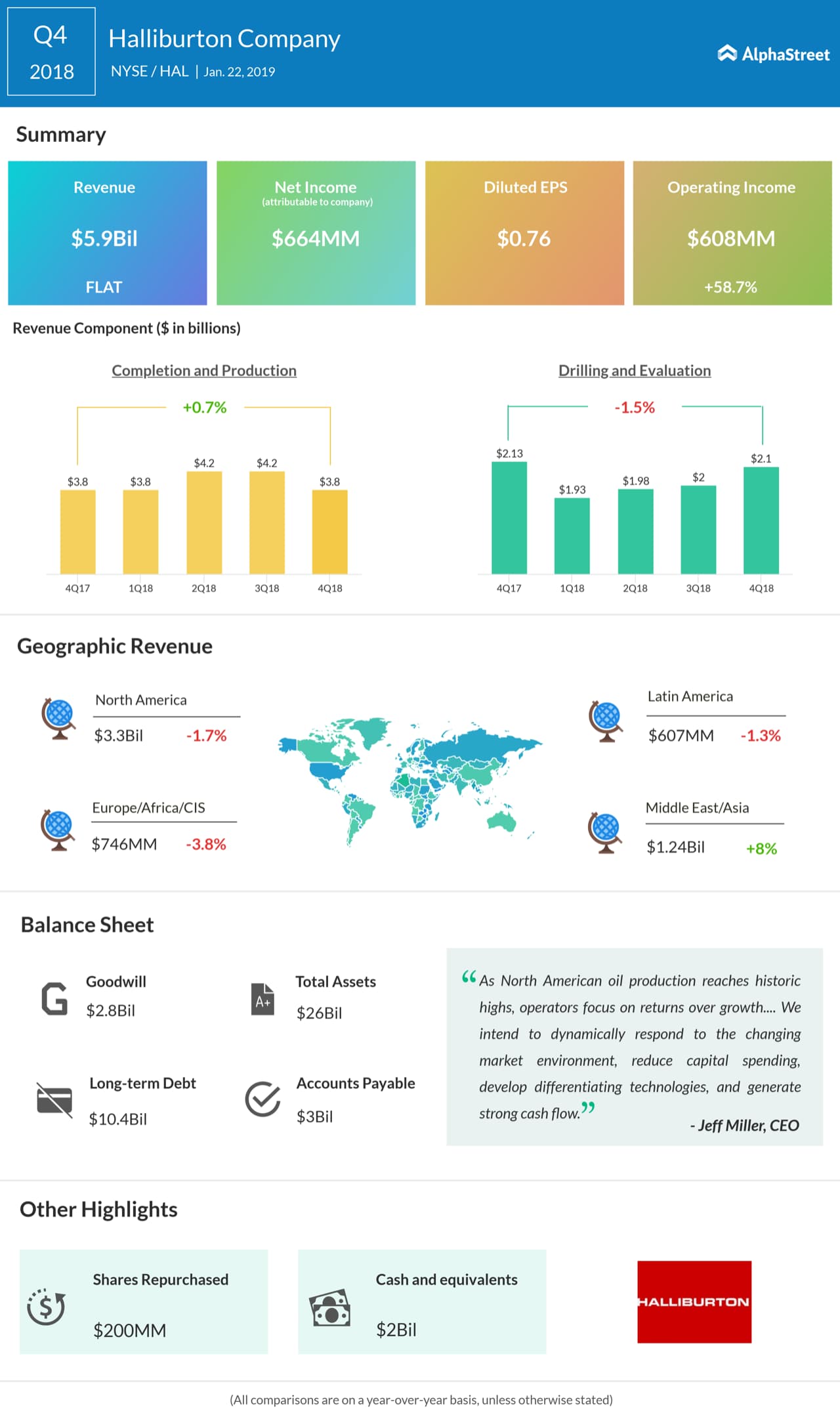

Jeff Miller, Chairman, President and CEO said, “As North American oil production reaches historic highs, operators focus on returns over growth, and the international recovery continues, Halliburton is well prepared to thrive. We intend to dynamically respond to the changing market environment, reduce capital spending, develop differentiating technologies, and generate strong cash flow.”

Also see: Halliburton Q4 2018 Earnings Conference Call Transcript

During the quarter, revenues in the Completion and Production segment and the Drilling and Evaluation segment did not see much change compared to the prior-year period. On a sequential basis, revenues in Completion and Production fell 8% mainly due to lower activity and pricing for stimulation services in North America.

Drilling and Evaluation revenue grew 5% sequentially mainly due to year-end software sales, increased fluids activity in the Gulf of Mexico and improved project management activity in Latin America.

Earnings Preview: Slide in crude oil prices could hurt Halliburton in Q4

On a year-over-year basis, Halliburton posted revenues declines across most regions except for Middle East/Asia which delivered revenue growth of 8%. On a sequential basis, revenue in North America dropped 11% due to lower activity and pricing in stimulation services. International revenue improved 7% sequentially helped by higher product and software sales in the Middle East/Asia and Latin America regions.

During the quarter, Halliburton acquired SmartFibres, a producer of fiber optic pressure gauges, and also signed two contracts with Eni Iraq BV to drill development wells over the next two years.