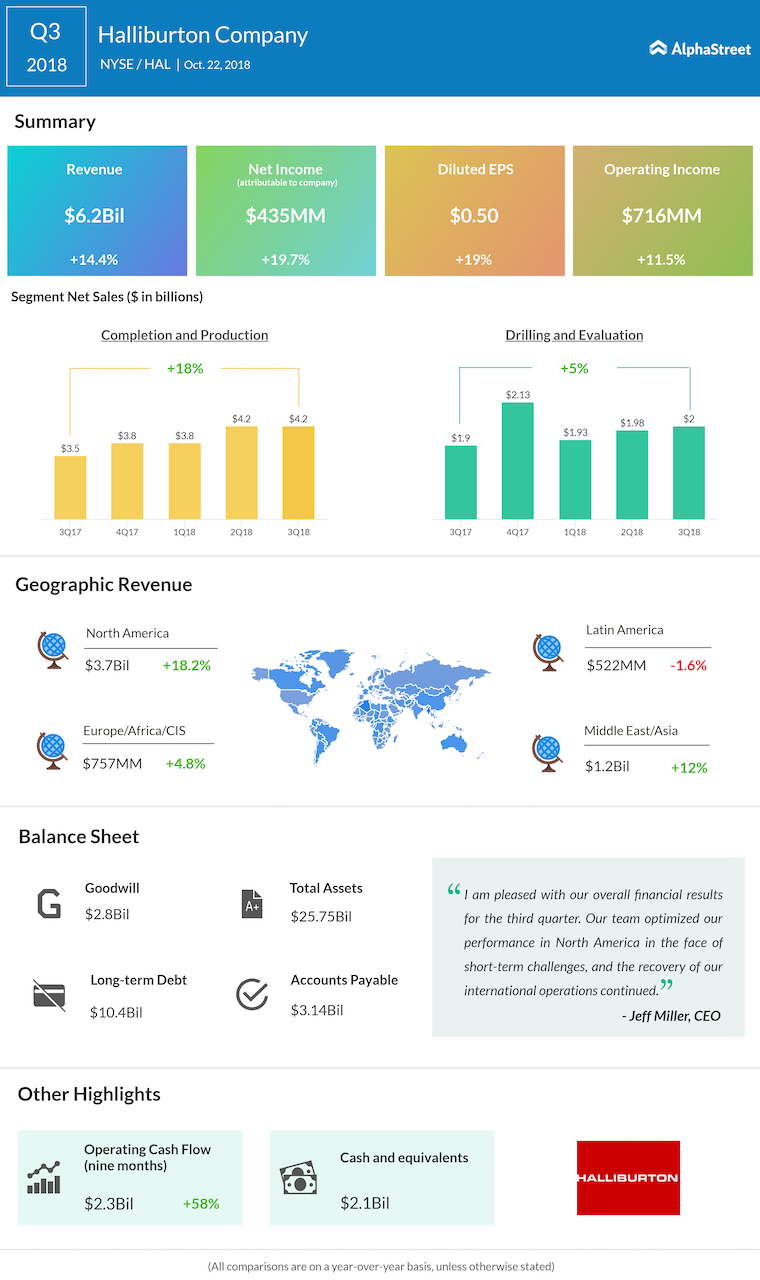

Revenues climbed 12% year-on-year to $6.17 billion during the three-month period, exceeding expectations. The Completion and Production segment registered an 18% revenue growth, while the Drilling and Evaluation segment gained 5%.

Results of the energy management company benefitted from the ongoing recovery in operations, both overseas and in the US, especially in the Permian basin and the Middle East. In recent months, the North American operations were negatively impacted by inclement weather.

Third-quarter results benefitted from the ongoing recovery in operations, both overseas and in the US

The company repurchased $200 million of its common shares in the third quarter and repaid $400 million of debt that matured during the period. The management expects the softness in the demand for completion services in the North American market will improve in the coming months, supported by operational efficiency and improved customer budgets.

“I am confident that Halliburton has the right strategy, technology, and services to deliver industry-leading returns. We remain the leader in North America, which we believe is poised for a better 2019, and Halliburton is better positioned than it has ever been for the international recovery,” said CEO Jeff Miller.

Halliburton reports upbeat revenue in Q2, meets earnings estimate

Last week, Halliburton’s competitor Schlumberger (SLB) reported above-consensus earnings for the fourth quarter, when the company’s revenues increased owing to strong demand but missed estimates. Among others, Baker Hughes (BHGE) is scheduled to report results for the latest quarter on October 30.

Halliburton shares dropped 12% over the past twelve months and slipped 28% since the beginning of the year. The stock closed the previous trading session lower but gained modestly in the pre-market trading Monday following the announcement.