Overview

Income Statement Performance

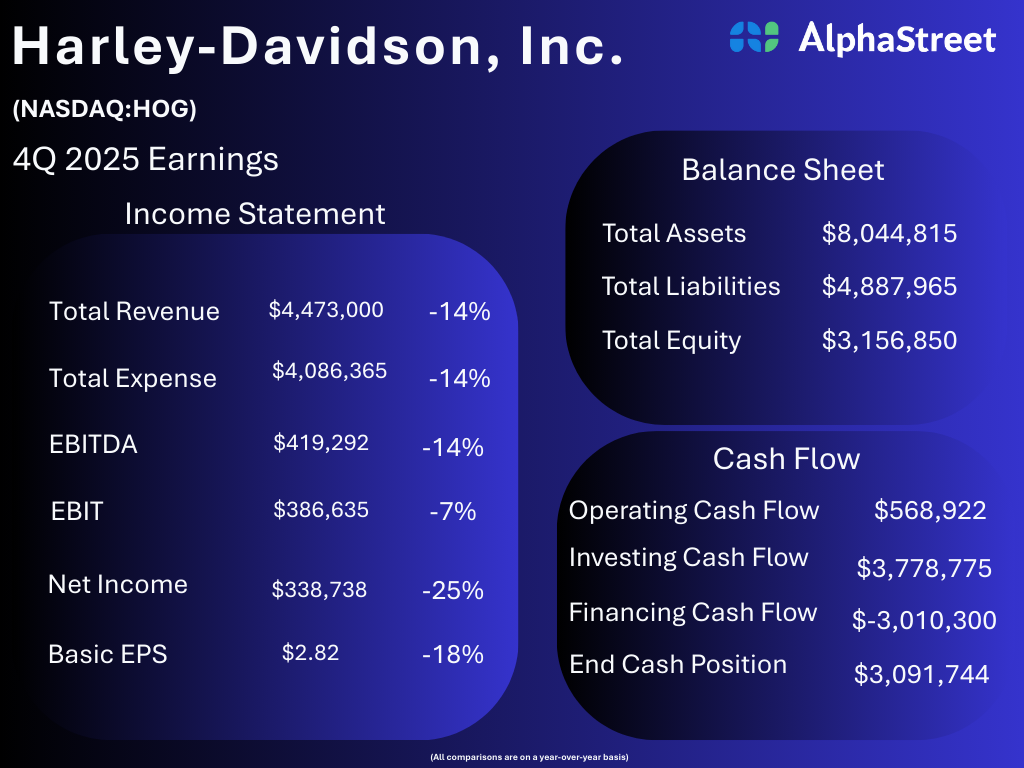

EBITDA is reported at $419,292, a 14% decrease, reflecting lower operating scale and margin compression. Operating income (EBIT) of $386,635 declined 7%, suggesting that while profitability has softened, the operating margin contraction is less severe than the revenue decline. Net income of $338,738, down 25%, underscores more pronounced pressure at the bottom line. Basic earnings per share of $2.82, a decline of 18%, mirrors this trend.

Collectively, these figures point to a year characterized by softer demand and lower earnings power, partially mitigated by expense discipline.

Balance Sheet Position

Harley-Davidson ended the period with total assets of $8,044,815, supported by total equity of $3,156,850. Total liabilities stand at $4,887,965, resulting in a balanced capital structure with equity representing a meaningful portion of total capitalization. This balance suggests a stable financial foundation despite earnings pressure.

Cash Flow and Liquidity

Operating cash flow amounted to $568,922, demonstrating that the core business continues to generate positive cash. Investing cash flow was $3,778,775, while financing cash flow was -$3,010,300. The company closed the period with an end cash position of $3,091,744, a notably strong level that enhances financial flexibility.

Conclusion

The data reflect a challenging earnings environment in Q4 2025, marked by declining revenue and profitability, but also highlight Harley-Davidson’s ability to manage costs and maintain a robust liquidity position.