According to a report by MotorCycles Data, total industry sales in India increased nearly 11% to 1.73 million in August versus the same period last year. Two-wheeler sales rose 10.5%. However, Harley-Davidson is finding it difficult to continue in India, a market where low-cost players rule the roost and which in turn generates low margins.

Rewire and Hardwire

As part of its Rewire strategy, Harley-Davidson revamped its operating model to reduce duplication and inefficiency and to simplify operations. The streamlined structure led to a reduction of 700 positions globally.

The company is streamlining its planned motorcycle models by approx. 30% and balancing its investments between existing strong categories and new segments with high growth potential. It is also expanding the product offerings of its most popular motorcycles and focusing more on its Parts & Accessories and General Merchandise businesses to provide customers with a more customized experience.

Harley plans to focus on around 50 markets mainly in North America, Europe and parts of Asia Pacific where it has major volume and growth potential, and to exit international markets where volumes and profits do not match its expectations. The company will shift its resources into markets that have more growth potential.

Harley-Davidson is currently working on its strategic plan for 2021-2025, The Hardwire, which the company plans to disclose during the fourth quarter of 2020.

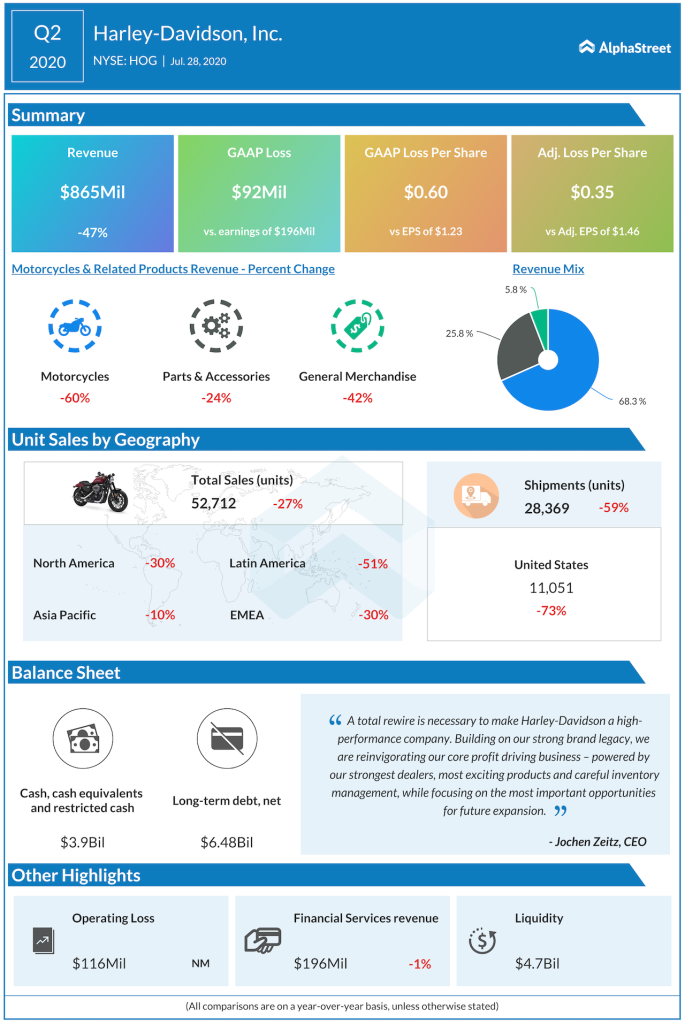

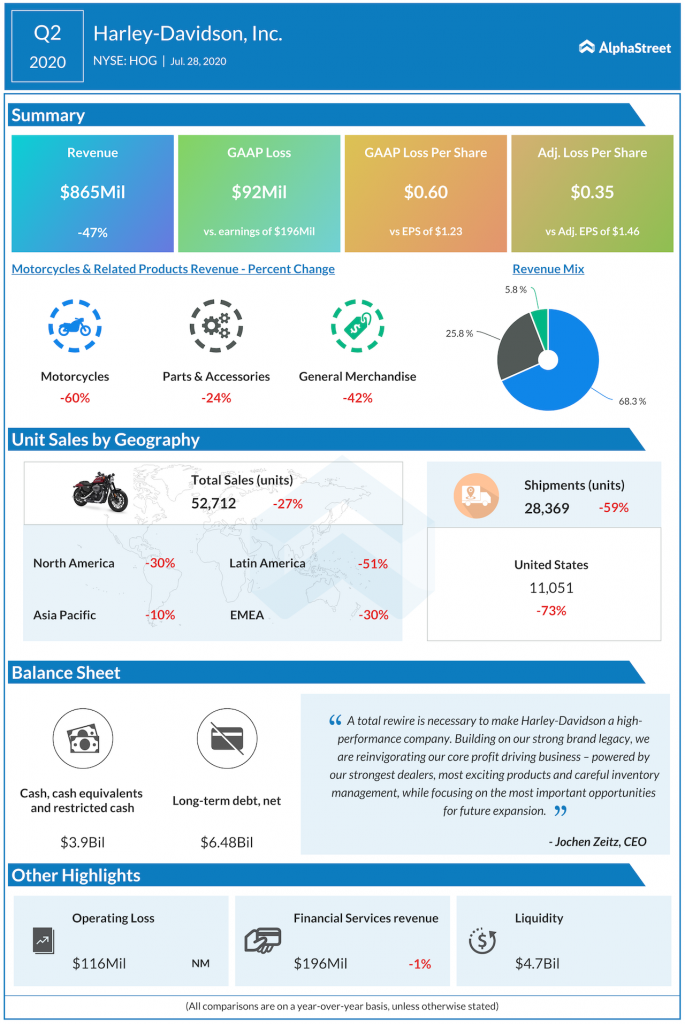

Quarterly performance

In the first half of 2020, Harley-Davidson saw a 28% decrease in consolidated revenues while earnings on a GAAP basis fell triple-digits. Adjusted EPS dropped 93% to $0.16. The results were impacted significantly by the COVID-19 pandemic and the actions taken to rewire the company.

Total revenues in the Motorcycles and Related Products segment fell 33%, with a 36% drop in Motorcycles revenue. Parts & Accessories were down 20%. Global retail motorcycle sales decreased 23% in the first half while sales in the US were down 22% hurt by the pandemic. Latin America saw the highest sales decrease of 37%.

Stock

Shares have fallen 38% since the beginning of this year and over 19% in the past one month. The stock was down 1% in afternoon trade on Friday.

Click here to read the full transcript of Harley-Davidson Q2 2020 earnings call