Sales and profitability

Business performance

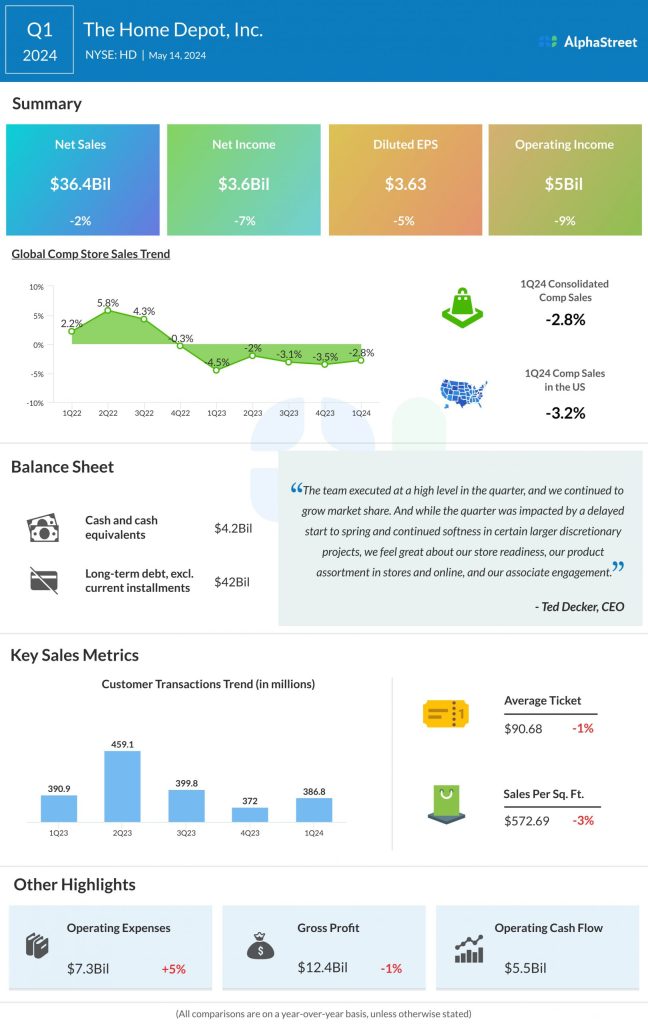

In the first quarter, Home Depot and Lowe’s continued to see pressure in big ticket discretionary spending, as customers continued to put off larger projects while taking on smaller ones. The delayed start to spring impacted Home Depot’s sales while Lowe’s delivered better-than-expected spring seasonal sales.

Home Depot’s comp transactions decreased 1.5% and comp average ticket decreased 1.3% in Q1. Big-ticket comp transactions, which are over $1,000, were down 6.5%. Lowe’s comparable transactions declined 3.1% and comparable average ticket fell 1%.

Home Depot and Lowe’s are both focused on improving their share with the Pro customer, whose backlogs remain stable and healthy. These retailers continue to invest in improving the shopping experience for this customer, as they look to expand their position in this fragmented market.

Home Depot is focused on the residential Pro contractor, who shops across several categories of home improvement products while working on complex projects. It estimates this particular customer segment comprises a total addressable market worth approx. $250 billion.

Meanwhile Lowe’s continues to focus on expanding its share with the small to medium-sized Pros such as repair and remodel contractors and property managers. It estimates that these Pro customers make up half of the $500 billion Pro market.

Outlook

For fiscal year 2024, Home Depot expects total sales and EPS to grow approx. 1% for the 53-week period and comparable sales to decline around 1% for the 52-week period. For FY2024, Lowe’s has forecasted total sales of $84-85 billion and EPS of approx. $12.00-12.30. It expects comparable sales to be down 2-3% from the previous year.

Shares of Home Depot and Lowe’s have dropped 13% and 10% respectively in the past three months.