Content – the King

Thor: Love and Thunder, Disney’s latest movie based on the character of Thor, marks the first time it released a fourth movie based on a single Marvel character. This is an indication of the longevity of Disney’s characters and the potential for more stories based on these characters over the long term. Another example is Black Panther: Wakanda Forever. In 2023, Disney has three more Marvel movies coming up – Ant-Man and the Wasp: Quantumania, Guardians of the Galaxy Volume 3, and The Marvels.

Similarly, series like Ms. Marvel and She-Hulk: Attorney at Law helped drive subscriber growth and engagement during the fourth quarter of 2022. In addition, the series Andor, which is based on a character from the Rogue One movie, is an example of how content can be extended from the big screen to the streaming platform.

Disney is also bringing out sequels to many of the popular older movies under its umbrella in the form of both films and series. Some examples of these are Hocus Pocus 2, Disenchanted, Avatar: The Way of Water, and Willow. This points to yet another opportunity for the company with regards to content creation.

Meanwhile, Netflix has been investing in original content and this strategy has been paying off well, with the company seeing success with titles like Squid Game, Stranger Things, and The Sandman. Its original films like The Gray Man and Purple Hearts have also done well. In addition, Netflix is producing regional content for its international markets which is expected to drive further growth. However, even though Netflix’s titles have a fan base of their own, they do not quite match the broad footprint of Disney’s content.

Subscriber growth

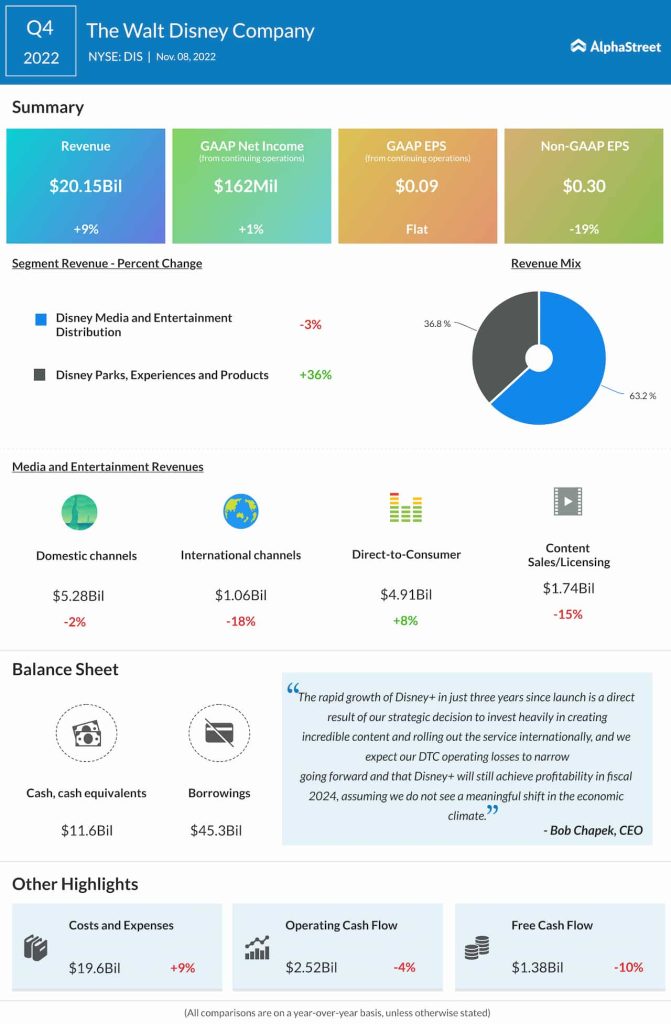

Disney continues to exceed Netflix in terms of subscribers. At the end of the fourth quarter of 2022, Disney had a total of over 235 million subscribers across its direct-to-consumer services while Netflix reported a total of 223 million subscribers for the third quarter of 2022.

In Q4, Disney+ added over 12 million global subscribers, of which over 9 million were in core Disney+ and just under 3 million were at Disney+ Hotstar. Hulu and ESPN+ added approx. 1 million and 1.5 million subscribers respectively during the quarter. After losing subscribers in the first two quarters of 2022, Netflix rebounded in Q3 with paid net additions of 2.41 million.

Outlook

Disney expects ESPN+ and Hulu to continue to add new subscribers in the first quarter of 2023 but it anticipates only a slight increase in core Disney+ subscribers. Core Disney+ subscriber growth is expected to pick up in the second quarter of 2023, driven mostly by international markets. For the fourth quarter of 2022, Netflix expects paid net additions of 4.50 million and paid memberships to reach 227.59 million.

Click here to read the full transcript of Disney’s Q4 2022 earnings conference call