Quarterly performance

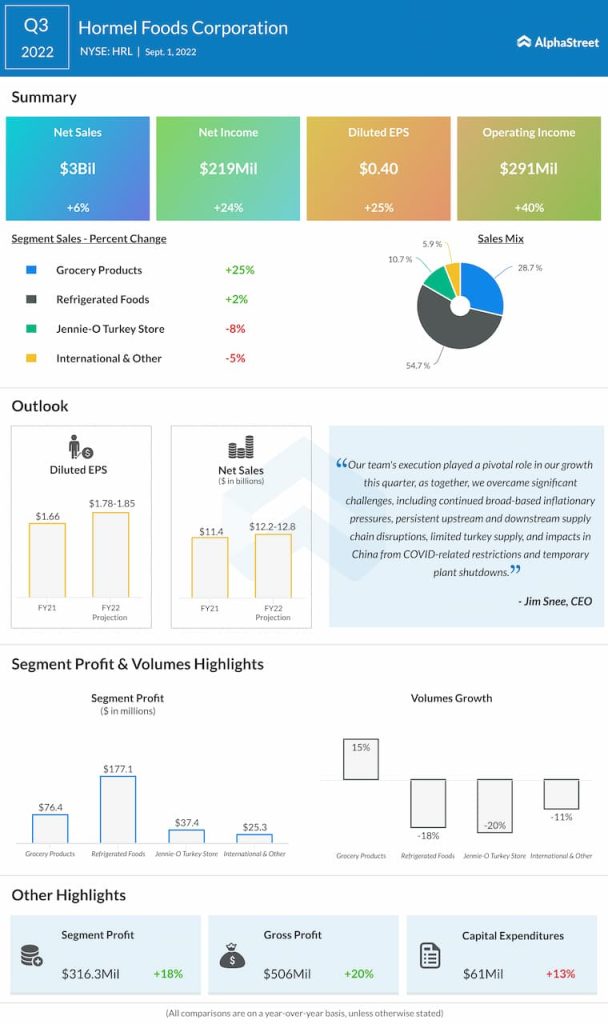

EPS increased 25% YoY to $0.40, which narrowly missed estimates. Operating income rose 40% to $291 million while operating margin improved to 9.6% from 7.2% last year. SG&A expenses dropped 1.8% to $222.1 million.

Trends

For the third quarter, the Grocery Products division delivered the highest sales and volume growth, driven by strong demand for nut butters and simple meals, the inclusion of the Planters business, as well as pricing. Net sales rose 25% while volume was up 15%. Gains in products such as SKIPPY spreads, WHOLLY Guacamole, and Dinty Moore beef stew helped drive organic sales growth of 13%.

The Refrigerated Foods segment posted sales growth of 2% on a reported basis and 1% on an organic basis, driven by strength in foodservice, gains in retail products like Applegate meats and Hormel Gatherings party trays, as well as pricing. Volume declined 18% due to lower commodity sales resulting from Hormel’s new pork supply agreement.

The Jennie-O-Turkey Store and International & Other segments witnessed sales and volume declines during the quarter due to supply chain issues, lower export sales and volumes as well as pandemic-related headwinds in China.

New reporting structure

As part of its strategic Go Forward (GoFWD) initiative, Hormel is reorganizing its business into three operating segments – Retail, Foodservice and International. The company will begin reporting earnings under this new structure from the first quarter of 2023. The new model is expected to help drive sustainable growth over the long term.

Outlook

Hormel raised its sales guidance for the full year of 2022 based on strong demand for its foodservice and center store grocery brands, higher turkey markets and pricing actions that it implemented across its portfolio. The company now expects net sales of $12.2-12.8 billion for the year versus the prior outlook of $11.7-12.5 billion.

However, the company expects cost inflation to remain high which led it to lower its full-year earnings outlook. Hormel now expects its FY2022 EPS to be $1.78-1.85 versus the previous range of $1.87-1.97.

Click here to access the full transcripts of the latest earnings conference calls