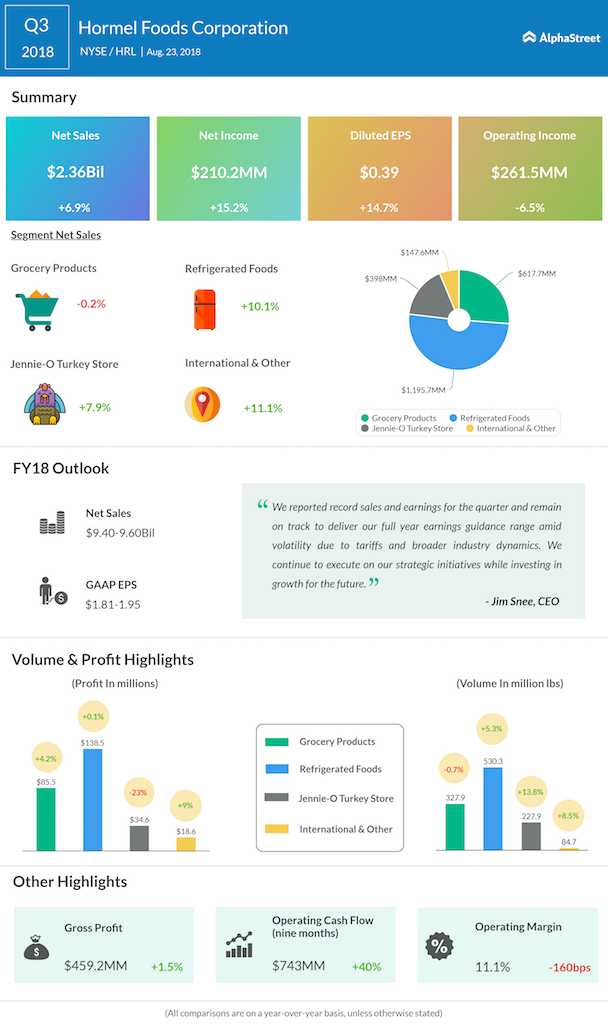

Net income totaled $210 million or $0.39 per diluted share during the quarter, reflecting a growth of 15% from the same period last year.

Hormel saw sales increases across all its segments except Grocery Products, where net sales remained flat. Sales in the Refrigerated Foods and International segments benefited from the Columbus Craft Meats, Fontanini, and Ceratti acquisitions, all three of which are progressing as expected. Strength in the Austin Blues, SPAM and Skippy brands also benefited segment sales.

Despite volatility from tariffs and other industrial factors, Hormel is on track to achieve its full-year EPS guidance. The company reaffirmed its earnings guidance of $1.81 to $1.95 for 2018. Net sales are now expected to come in at $9.40 billion to $9.60 billion versus the prior range of $9.70 billion to $10.10 billion.

Hormel is planning to sell its Fremont processing facility to WholeStone Farms for $30 million. The transaction, which is expected to be completed this December, includes a multi-year agreement for the supply of pork raw materials to Hormel. The company expects to incur expenses of $15 million to $20 million in fiscal 2019 related to this deal.