Costco’s stock experienced weakness ahead of this week’s earnings, after hitting an all-time high a few days ago, but bounced back as the positive outcome spurred a rally. Since the favorable business conditions are unlikely to change, the uptrend should continue in the foreseeable future. It is estimated that the share price would cross the $400-mark next year and that is enough reason for investors to add the stock to their portfolios. Currently, experts strongly recommend buying COST.

Record Comps

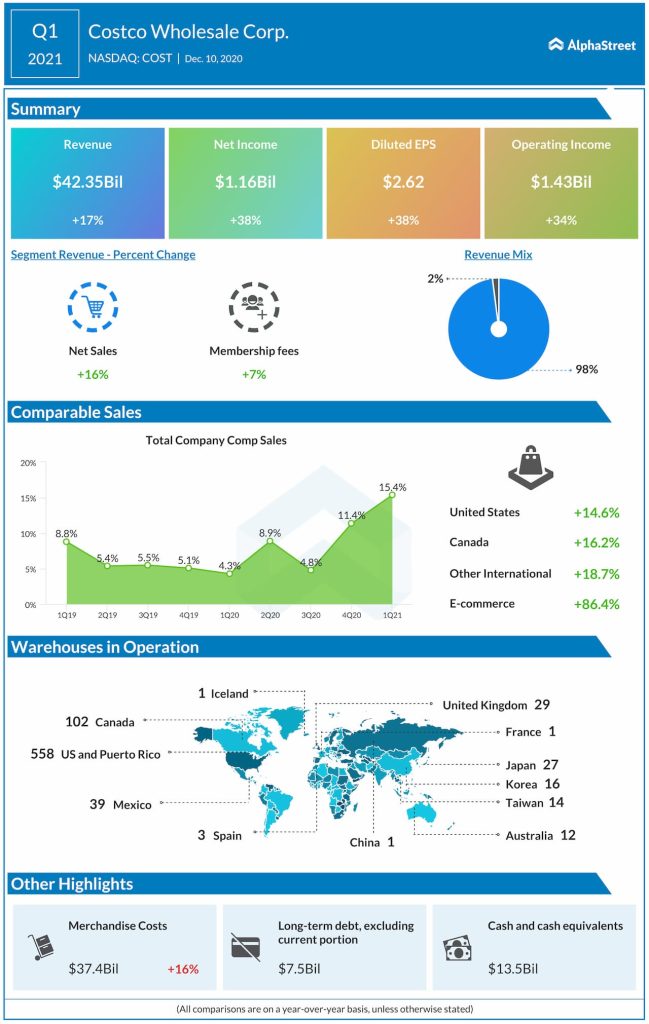

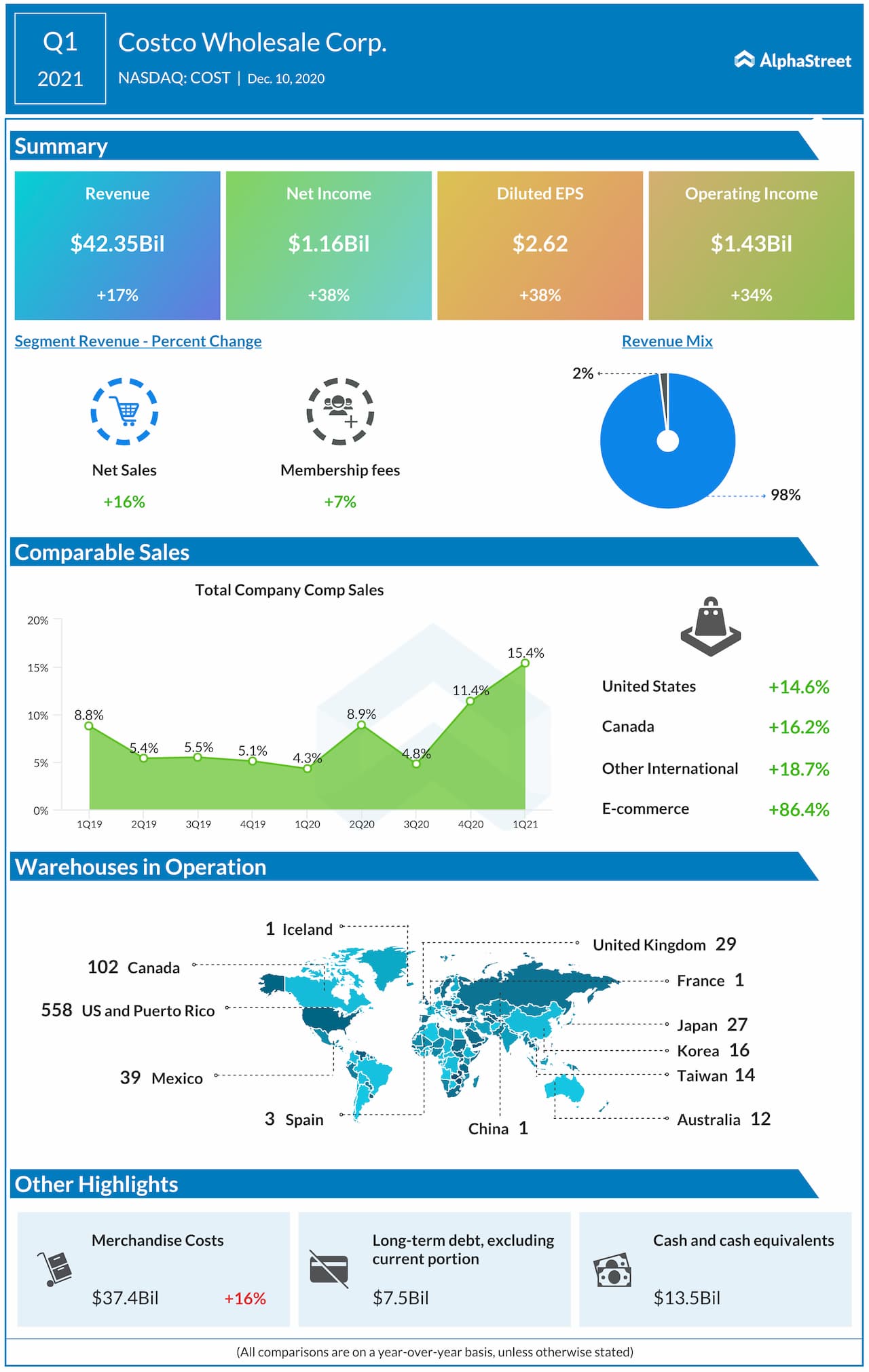

The acceleration in comparable-store sales growth continued in the first quarter and reached 14.5%. Growth was widespread across all geographical segments. Net profit climbed 38% to $2.62 per share. What caught the market’s attention is the 86% growth in e-commerce sales, reflecting the management’s efforts to ramp up the online platform. There was a threefold spike in online grocery sales.

We continue to generate strong sales in food and sundries and health and beauty aids and fresh foods and alike and we’ve also benefited from improved sales and products and items for the home. As people are spending less on air and travel and hotel and dining out, they seem to have redirected at least some of those dollars to categories like electronics, furniture and mattresses, exercise equipment, housewares, cookware, domestics, etc.

ADVERTISEMENTCostco’s chief financial officer Richard Galanti

Warehouse Expansion

Costco opened more than a dozen new stores in fiscal 2020 and is on track to open more this year, at a time when most retailers are struggling to maintain footfall in their existing outlets. Interestingly, the warehouses are mostly back to regular hours. The reason is very simple – the popular membership model and competitive pricing, combined with the omnichannel capabilities, continue to give the company an edge over its rivals. And, that explains its stock market success, which experts believe would be sustained in the coming years.

On the flip side, the omnichannel shift has come at a small price. There are costs related to adding new locations for fulfillment and ramping up the digital infrastructure. “Overall, e-commerce is a little less profitable. You’ve got category-wise, it’s profitable. Category-wise, you’ve got merchandise categories that don’t include some of the highest gross margin components of our business. Like fresh, like apparel in a big way, in terms of penetration. You’ve got electronics, which is a lower than average margin business both in-store and online and so much bigger percentage of penetration online,” added Galanti.

Headwinds

For the management, the main challenge is the continuing supply chain disruption in certain areas, despite making efforts to ease the situation. Also, transportation remains a problem due to the shortage of proper shipping facilities, which eventually resulted in some items going out of stock.

Read management/analysts’ comments on Costco’s Q1 earnings

Though Costco’s stock opened on a bullish note on Friday, fuelled by yesterday’s impressive earnings report, the momentum did not last for long. The stock pulled back as the session progressed but traded slightly higher in the afternoon. COST has gained 28% in the past twelve months.