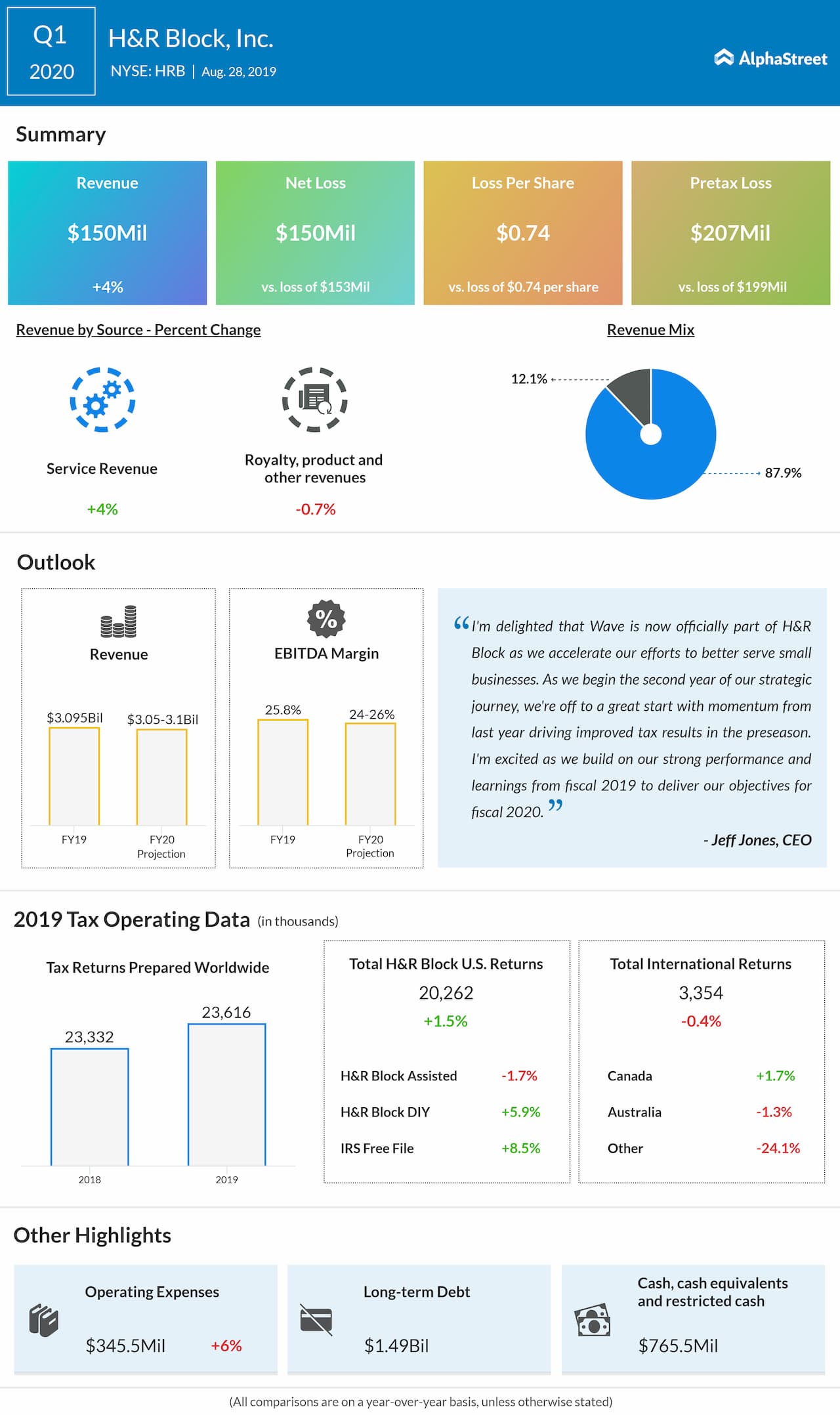

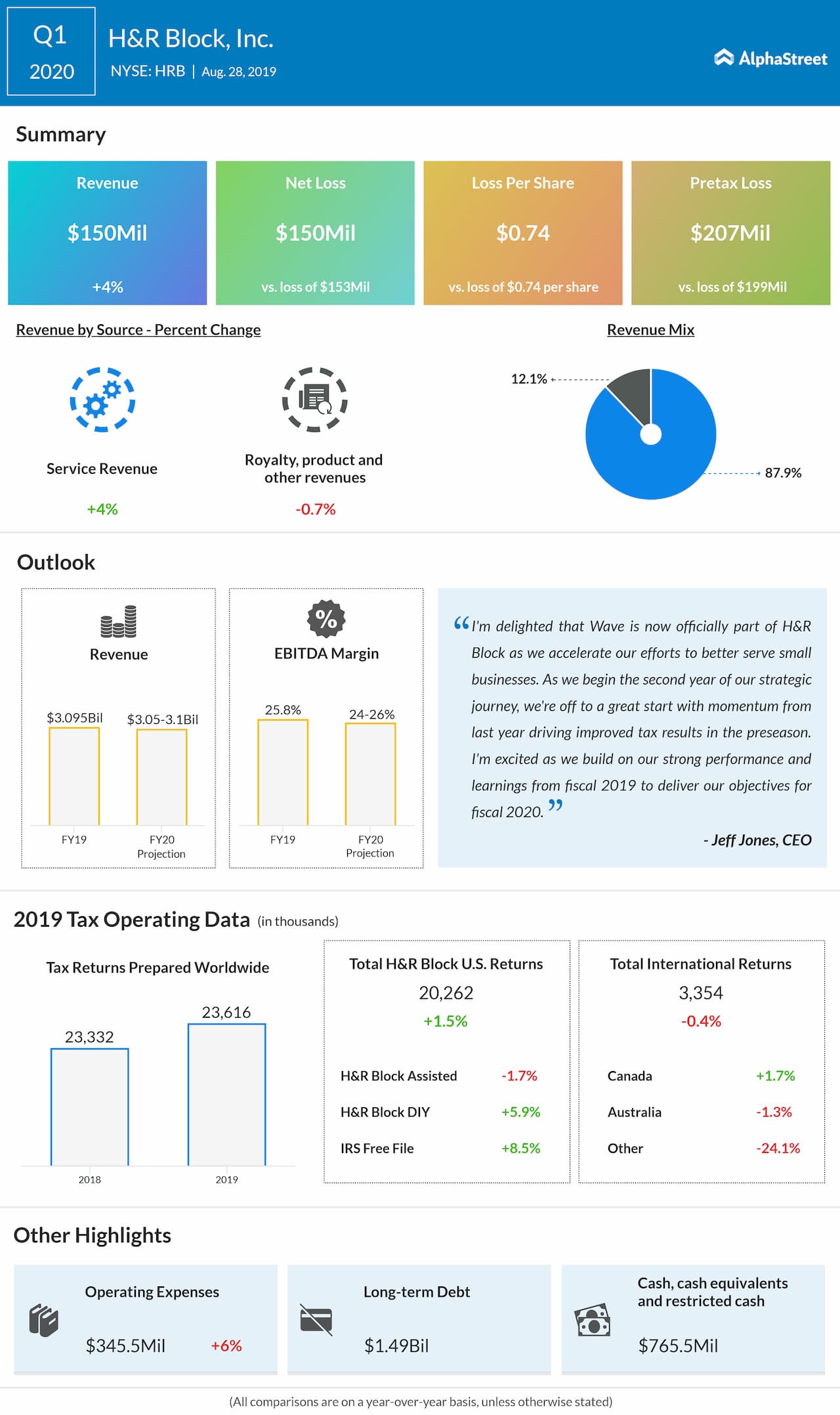

H&R Block (NYSE: HRB) reported a narrower loss in the first quarter of 2020 helped by higher revenues. The bottom line was narrower than the analysts’ expectations while the top line exceeded consensus estimates.

Net loss was $150.25 million compared to a loss of $152.67 million in the previous year quarter. On a per-share basis, loss remained unchanged from the last year at $0.74 due to lower shares outstanding. The company normally reports a first-quarter loss due to the seasonality of its tax business.

Revenue increased by 4% to $150 million. This was due to activity related to Wave, improved tax return volumes in both US Assisted and do-it-yourself (DIY), and increased international tax preparation fees.

For the first quarter, total operating expenses rose by 5.6% due to planned increases in compensation and other expenses. These increases primarily resulted from investments related to its technology roadmap and Wave and were partially offset by lower depreciation and amortization expense.

As of July 31, 2019, the company had cash and cash equivalents of $607.67 million, down by 38% from last year. Long-term debt stood virtually unchanged from the previous year at $1.49 billion.

The company had a great start this year with momentum from last year driving improved tax results in the preseason. The company remained on track to achieve its revenue and margin outlook for the fiscal year.

Rival Intuit Inc. (NASDAQ: INTU), the developer popular tax preparation software TurboTax, last week reported a 15% growth in fourth-quarter revenues backed by higher online ecosystem revenue. As a result, the company swung to a profit from last year’s loss.