On a seasonally adjusted basis, new home sales inched 3.7% higher to an annual rate of 621,000 units.

However, single-family home sales rose by only 1.5% in 2018, while new home sales slipped 2.4% from a year ago.

Spiking mortgage rates, higher costs of lumber, and labor shortage had made homes less affordable last year. And this HUD report also showed that homebuilding dropped in December.

With the reasons mentioned above still being prevalent, the Street expects a weaker housing market.

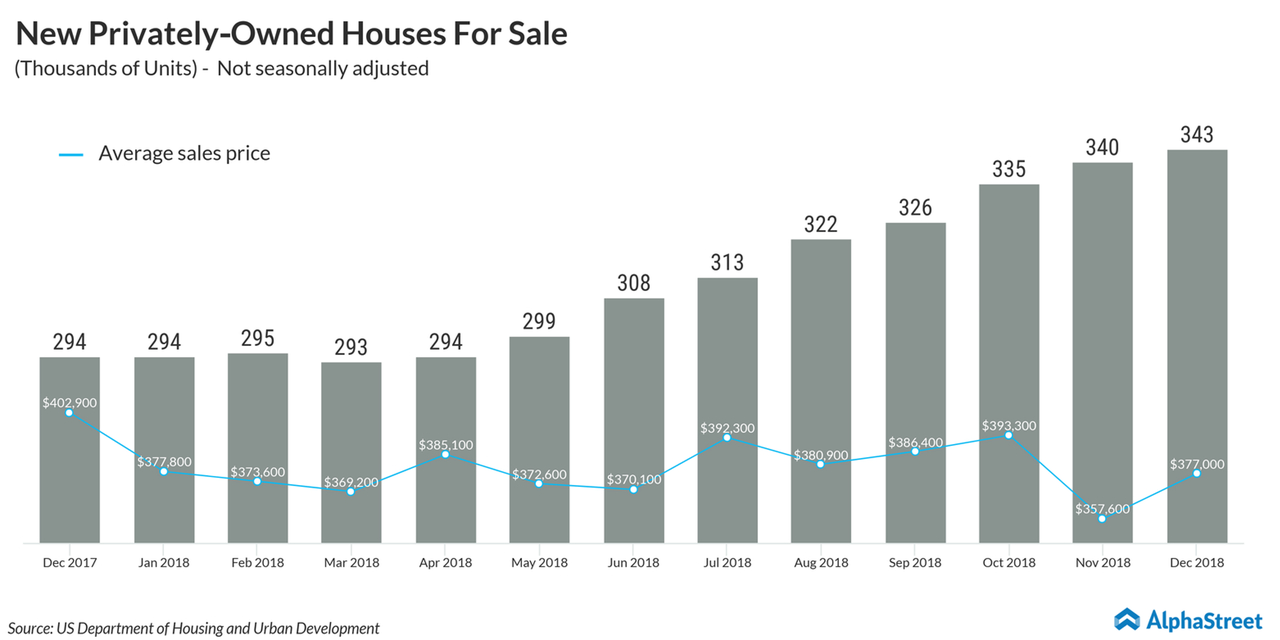

On a non-adjusted basis, new privately-owned houses for sale at the end of December 2018 were 343,000 at an average sales price of $377,000 per unit, compared to 294,000 in December 2017 at an average sales price of $402,900 per unit.

These show a ground reality of the real estate sector. And the latest downward revision of November number carries a negative implication, which could affect the housing sector further.