Earnings of technology conglomerate IBM (IBM) declined in the first quarter, despite strong cloud revenue lifting the top line. However, earnings adjusted for special items increased 4%. Shares of the company lost nearly 5% in the extended trading hours after its full-year outlook fell short of expectations.

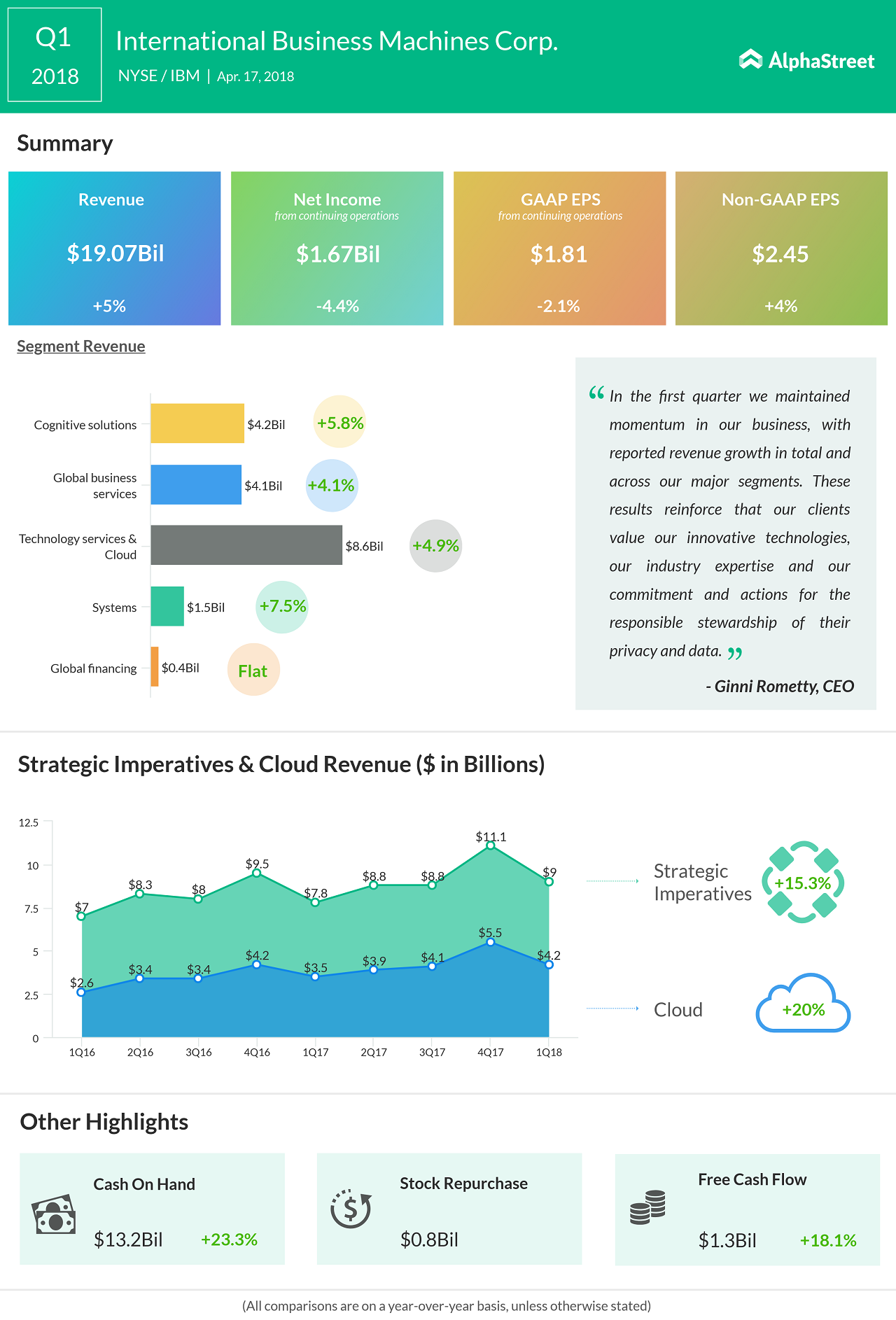

Net income dropped 2.2% to $1.81 per share during the quarter. Excluding one-time items, operating earnings increased to $2.45 per share. First quarter revenues grew 5% year-on-year to $19.1 billion, continuing the rebound that began in the previous quarter.

Driving the overall top-line growth, revenues of the Strategic Imperatives segment rose 12% to $37.7 billion, with cloud revenue jumping 22% annually.

Segment wise, Cognitive Solutions revenue moved up 6% and Global Business Services advanced 4%. Revenue of Technology Services & Cloud Platforms rose 5%, while that of Systems rose 8%. Meanwhile, Global Financing revenue was flat during the quarter.

Revenues rose for the second consecutive quarter, continuing the recovery that began in Q4

“The multi-year shift in our investment strategy is paying off as IBM leads in the emerging, high-value segments of the enterprise IT industry. Revenue, operating net income and free cash flow increased in the quarter, with broad-based improvement in our gross margin trajectory, as we continue to deliver shareholder value,” said IBM CFO James Kavanaugh.

The diversified tech giant reaffirmed its outlook for full-year adjusted operating income at $13.80 per share and adjusted net earnings at $11.58 per share. The outlook falls short of the consensus estimate. The company continues to expect free cash flow of about $12 billion in fiscal 2018.

Among IBM’s rivals in the software business, Oracle (ORCL) reported adjusted earnings of $0.83 per share in the third quarter, up 16% compared to the prior-year quarter. Microsoft (MSFT) is scheduled to report its third-quarter earnings on April 26.