Q3 Results

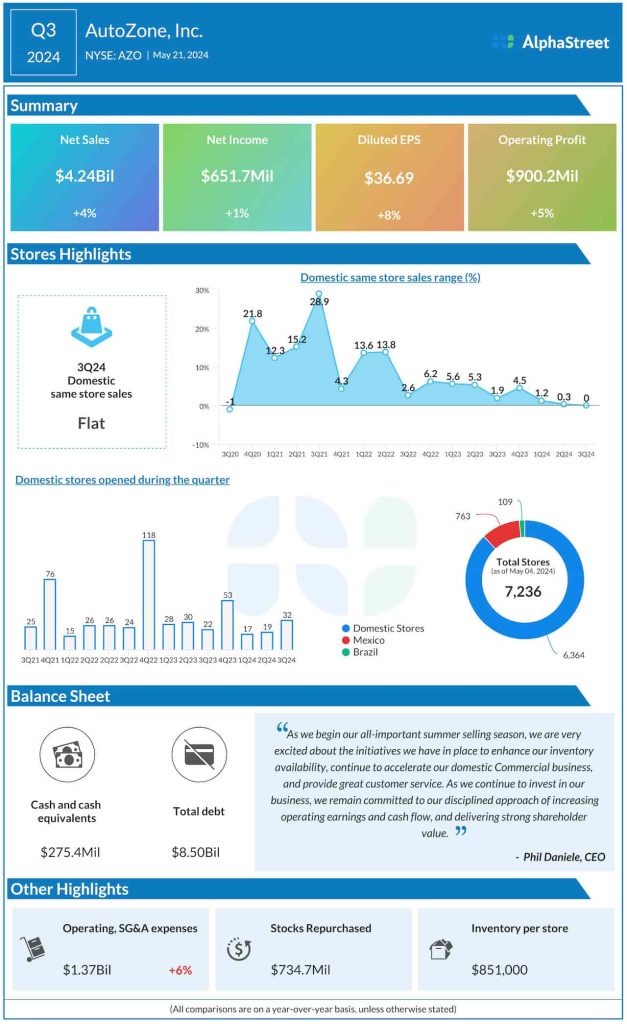

In the three months ended April 30, 2024, AutoZone generated revenues of $4.24 billion, which is up 4% from the same period of fiscal 2023, but below analysts’ estimates. Total same-store sales, or sales at domestic and international stores open at least one year, rose 1.9% during the three months. Q3 net income moved up to $651.7 million or $36.69 per share from $647.7 million or $34.12 per share in the corresponding period of last year. In the past five years, the company’s quarterly earnings consistently beat estimates.

“With our continued focus on providing what we call WOW! Customer Service, our AutoZoners delivered our total sales increase of 3.5%, total company same-store sales up 1.9%, and on a constant currency basis, total company same-store sales of 0.9%. Also, our operating profit grew 4.9% while our earnings per share grew 7.5%. In spite of our lower-than-planned sales, we managed our business well and we were able to deliver bottom-line results that continued to build on the phenomenal results we’ve had over the last several years,” said AutoZone’s CEO Phil Daniele during the post-earnings interaction with customers.

Sales Trend

Sales picked up significant momentum after recovering from the pandemic-induced slump. Of late, the company’s non-US business has witnessed a steady upswing, thanks to the growing international store network which accounts for about 12% of the total. As part of its efforts to boost sales, AutoZone is expanding store capacity and streamlining the distribution network.

Over the last year, store traffic has been bit by elevated inflation to some extent, but things should improve in the coming months as inflation pressure eases and economic conditions stabilize. Accelerating store growth remains a key strategy for the firm’s leadership. The continued strong momentum in used car sales is a positive for the company as it drives the demand for spare parts.

AutoZone’s shares have lost about 13% since their March peak. The stock traded lower throughout Tuesday, after opening the session at $2,877.15.