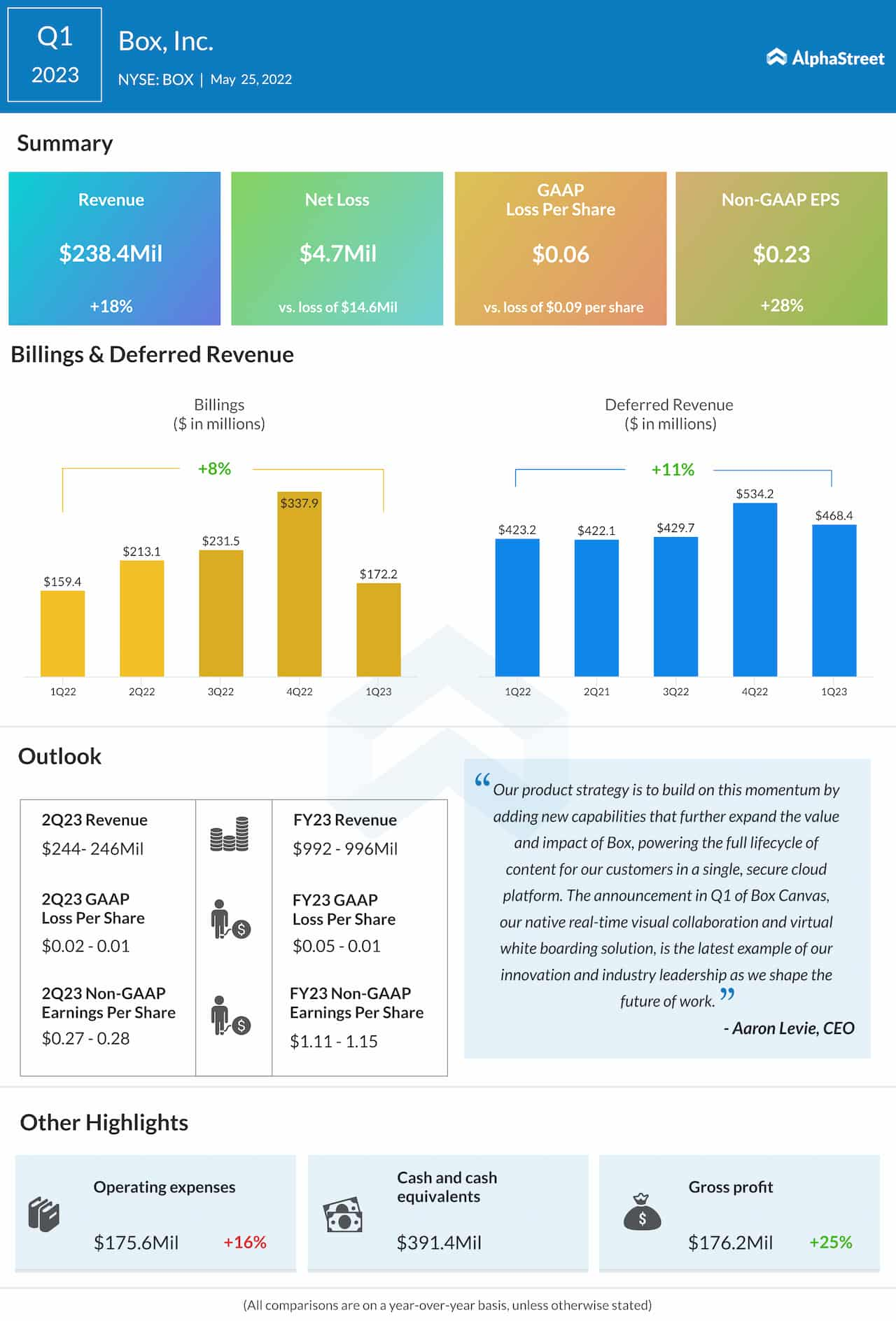

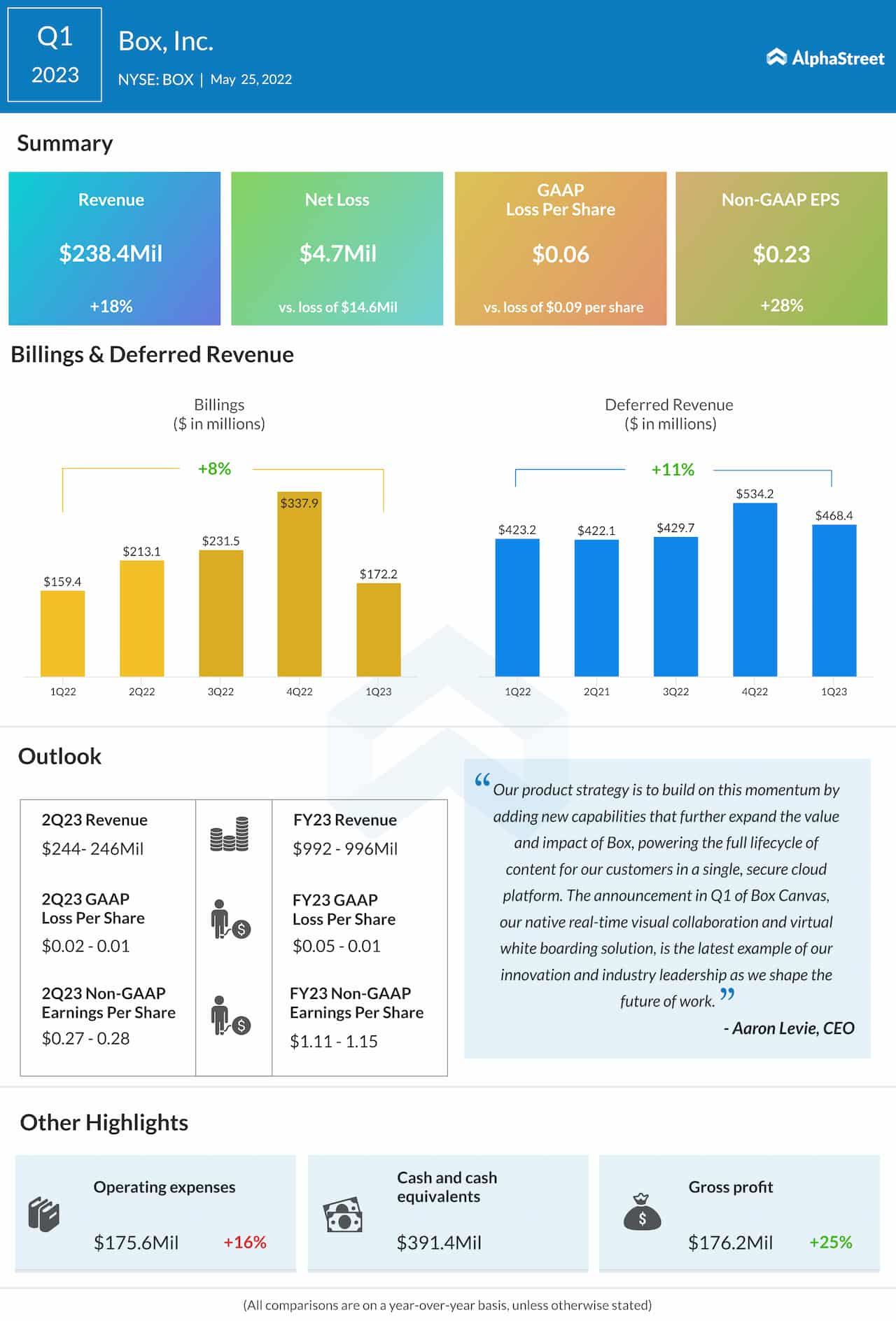

Content management platform Box Inc. (NYSE: BOX) has reported higher adjusted earnings and revenues for the first quarter of 2023. Both the top line and profit exceeded analysts’ expectations.

First-quarter net income, on an adjusted basis, was $0.23 per share, compared to $0.18 per share in the same period of 2022. On an unadjusted basis, it was a net loss of $4.7 million or $0.06 per share, compared to a loss of $14.6 million or $0.09 per share in the prior-year period.

At $238.4 million, revenues were up 18%, while billings increased 8% annually to $172.2 million. At the end of the quarter, the company had total deferred revenues of $468.4 million, up 11%.

Read management/analysts’ comments on quarterly reports

This week, shares of Box traded broadly at the levels seen at the beginning of the year. The stock closed the last session lower and extended the weakness early Wednesday.