Cybersecurity company CrowdStrike Holdings, Inc. (NASDAQ: CRWD) Thursday reported higher earnings and revenues for the first quarter of 2023 as demand conditions remained favorable due to strong digital transformation and cloud adoption. The results also beat the estimates.

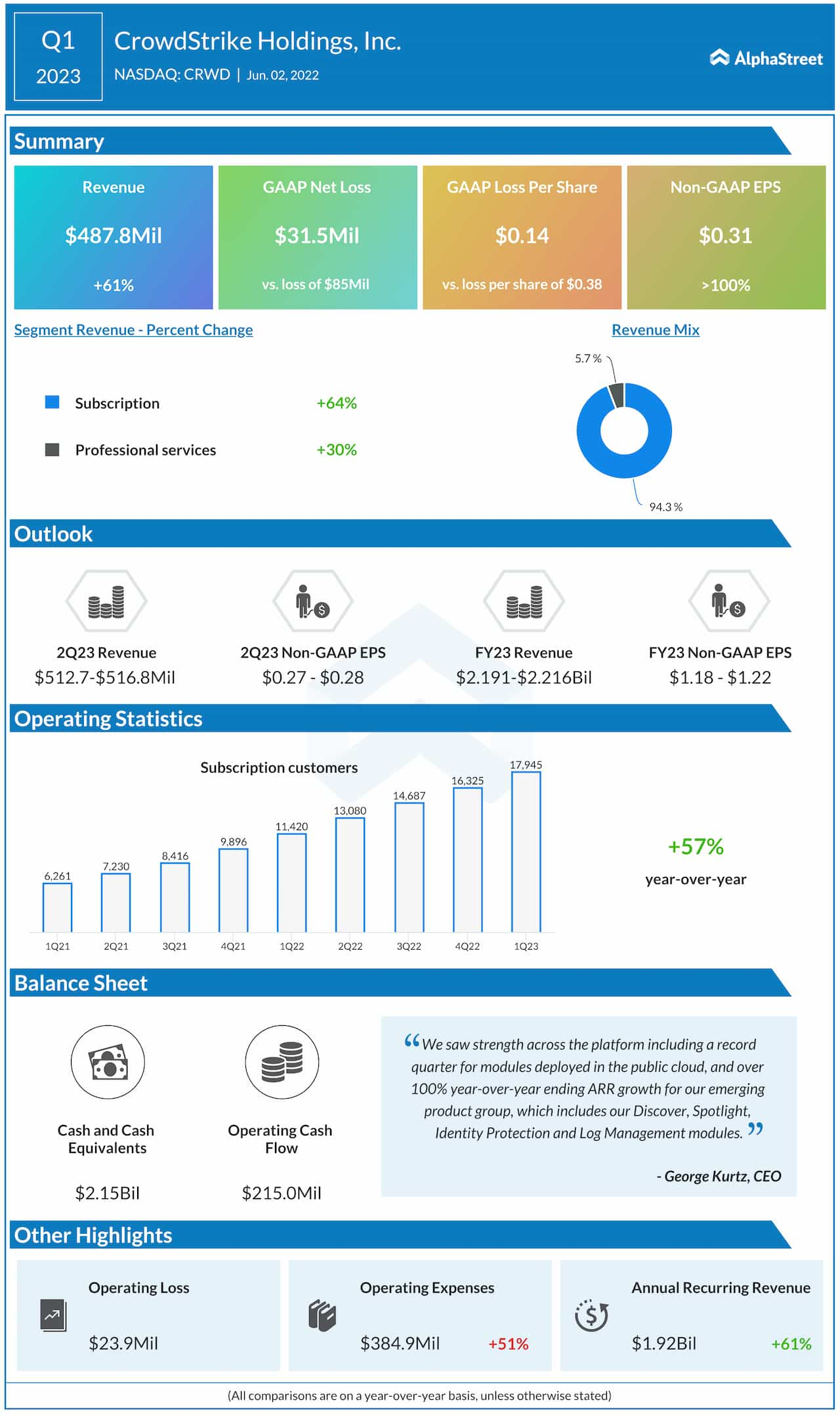

First-quarter net income, excluding special items, rose to $0.31 per share from $0.10 per share a year earlier, surpassing the consensus forecast. On an unadjusted basis, it was a net loss of $31.5 million or $0.14 per share, compared to a loss of $85.0 million or $0.38 per share in the first quarter of 2022.

The positive earnings performance, on an adjusted basis, reflects a 61% increase in first-quarter revenues to $487.8 million, which also came in above the market’s prediction.

Check this space to read management/analysts’ comments on CrowdStrike’s Q1 earnings

Shares of CrowdStrike declined during Thursday’s extended trading, after closing the regular session higher.