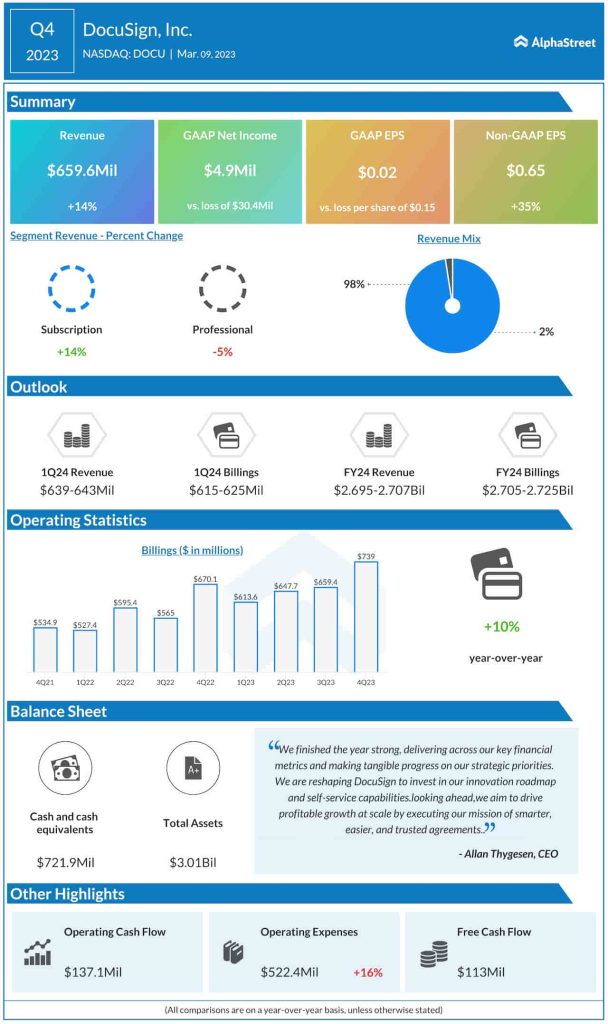

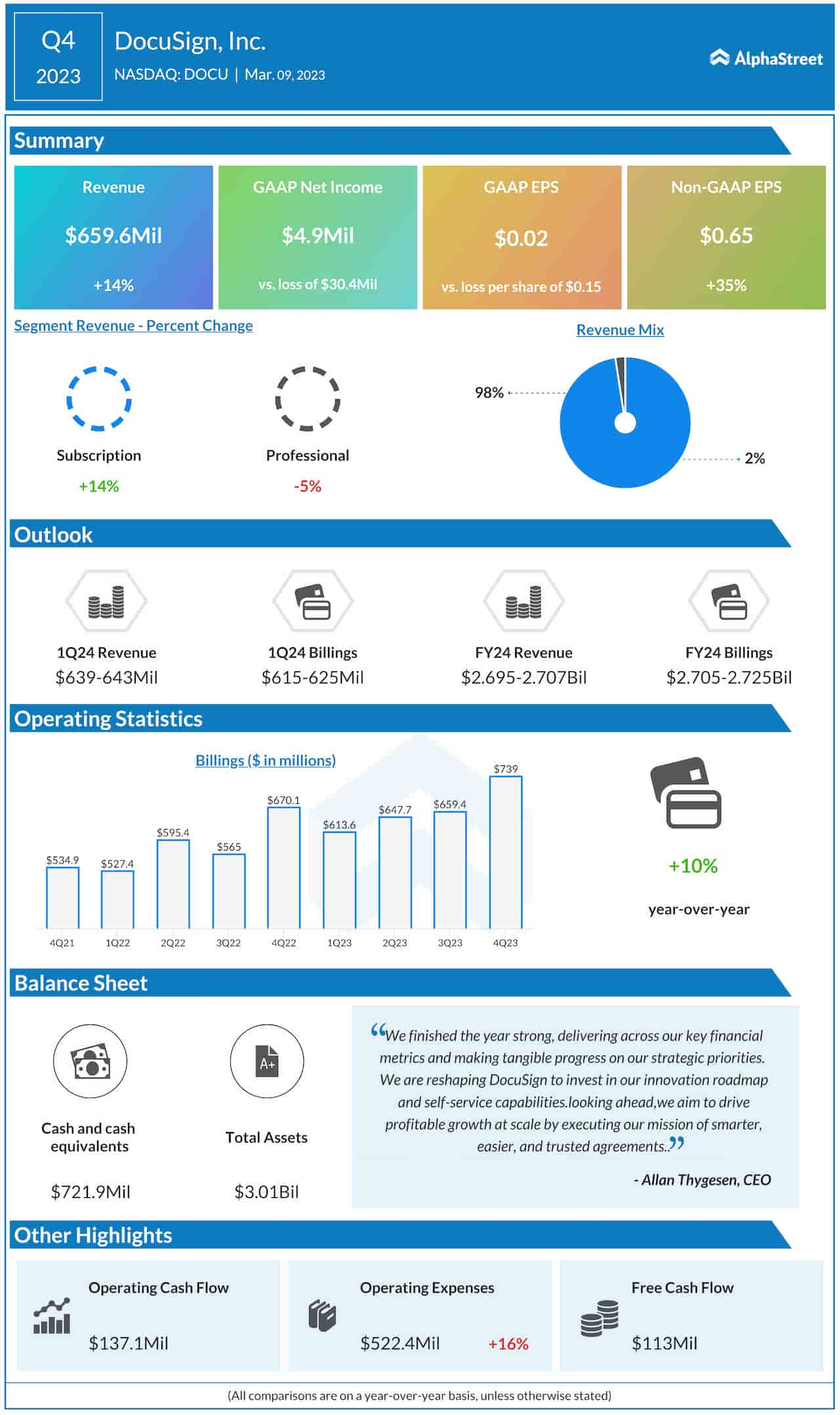

The subscription segment accounted for about 98% of total revenues, while the remaining came from the professional services division. Billings increased 10% year-over-year to $739 million. Cash, cash equivalents, restricted cash, and investments were $1.2 billion at the end of the quarter.

In fiscal 2023, the net loss widened to $97.5 million due to a 20% increase in operating expenses, and the management expects the trend to persist in the coming quarters.

Outlook

For the first quarter of 2024, total revenue is expected to be in the range of $639 million to $643 million. Subscription revenue is forecast to be between $625 million and $629 million, while billings are expected to be in the $615-$625-million range. For fiscal 2024, revenue is expected to be between $2.695 billion and $2.707 billion, and billings in the range of $2.705 billion to $2.725 billion.