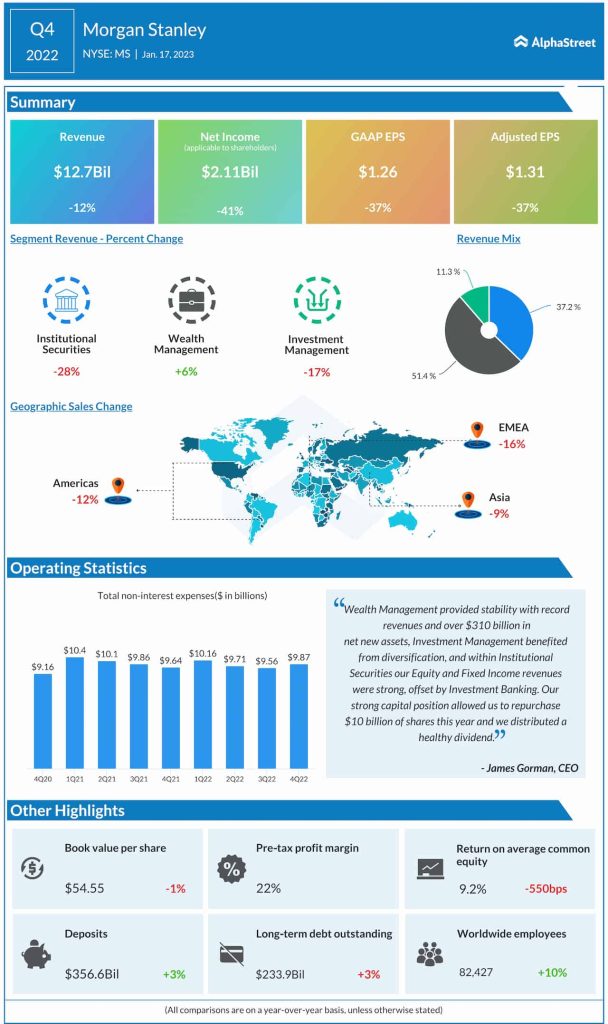

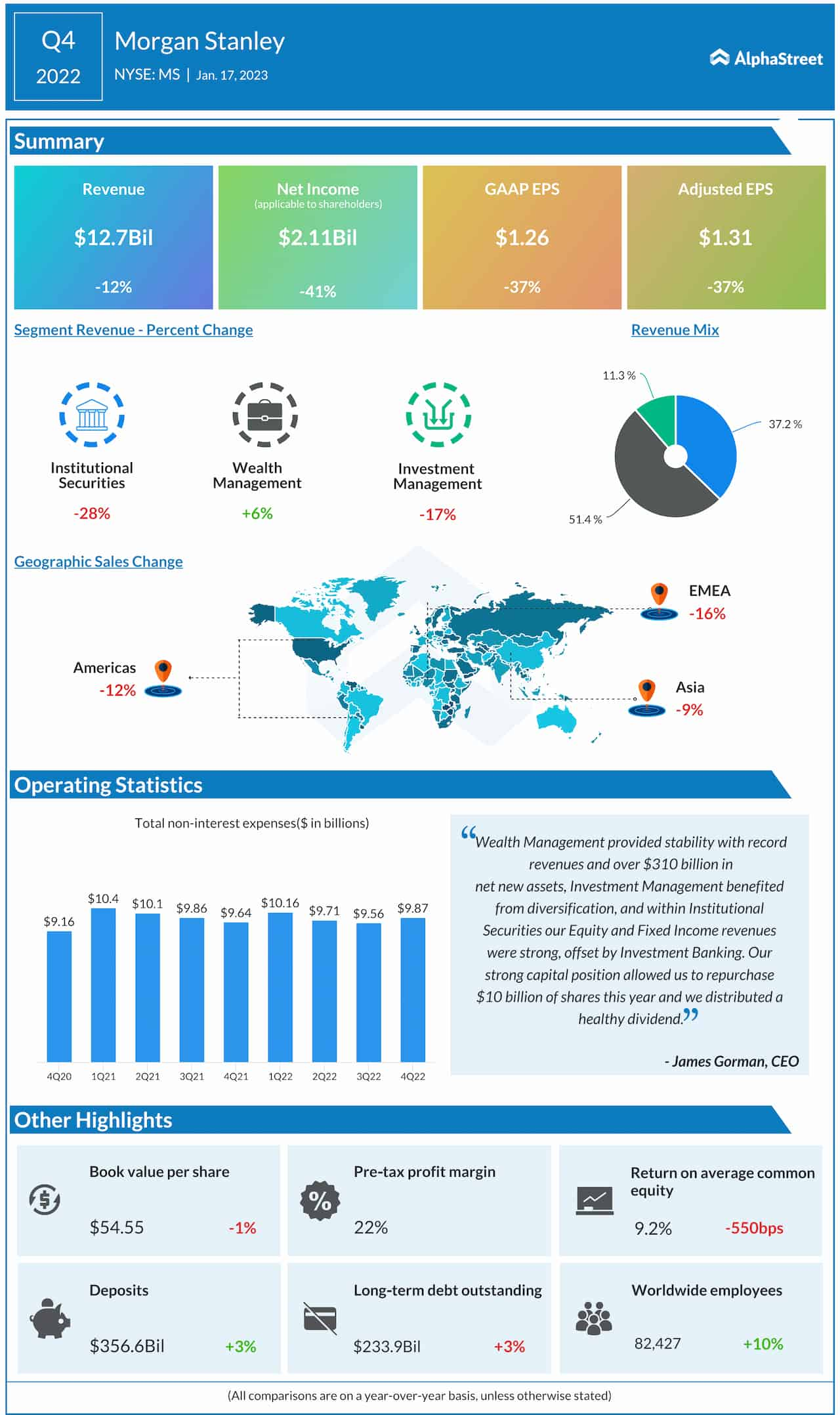

Net income applicable to shareholders was $2.2 billion or $1.26 per share in the fourth quarter of 2022, compared to $3.7 billion or $2.01 per share in the same period a year ago. Adjusted earnings dropped to $1.31 per share from $2.08 per share last year.

The bottom line was hurt by a 12% decrease in revenues to $12.7 billion. The company delivered ROTCE of 12.6%.

Check this space to read management/analysts’ comments on Morgan Stanley’s Q4 2022 earnings

James Gorman, chief executive officer of Morgan Stanley, said, “we reported solid fourth-quarter results amidst a difficult market environment. Overall, 2022 was a strong year for the Firm as our clear strategy and balanced business model enabled us to deliver an ROTCE of 16% despite the complex macro backdrop.”