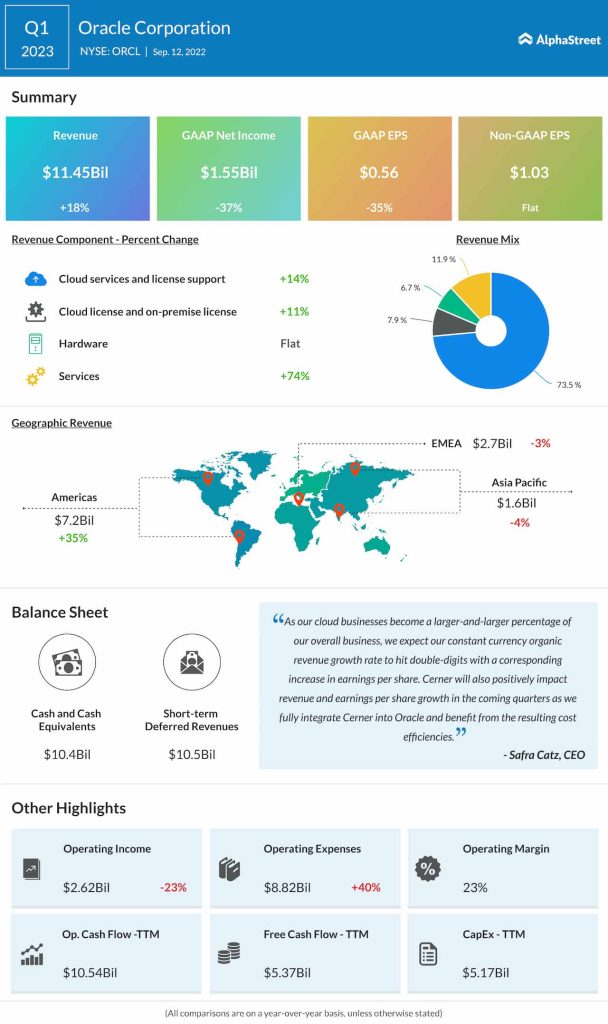

At $11.45 billion, revenues were up 18% year-over-year in the first three months of fiscal 2023. The top line also slightly exceeded the market’s projection.

Adjusted earnings were unchanged year-over-year at $1.03 per share in the most recent quarter. Net income, including one-off items, was $1.55 billion or $0.56 per share, compared to $2.46 billion or $0.86 per share last year.

Check this space to read management/analysts’ comments on Oracle’s Q1 results

“In Q1 we expanded our relationship with Microsoft by providing all versions of the Oracle database directly to Microsoft Azure customers. Now all Microsoft customers can directly access the Oracle Exadata Cloud Service, the Oracle Autonomous Database and every other Oracle Database version directly from the Azure Cloud,” said Oracle’s CTO Larry Ellison.