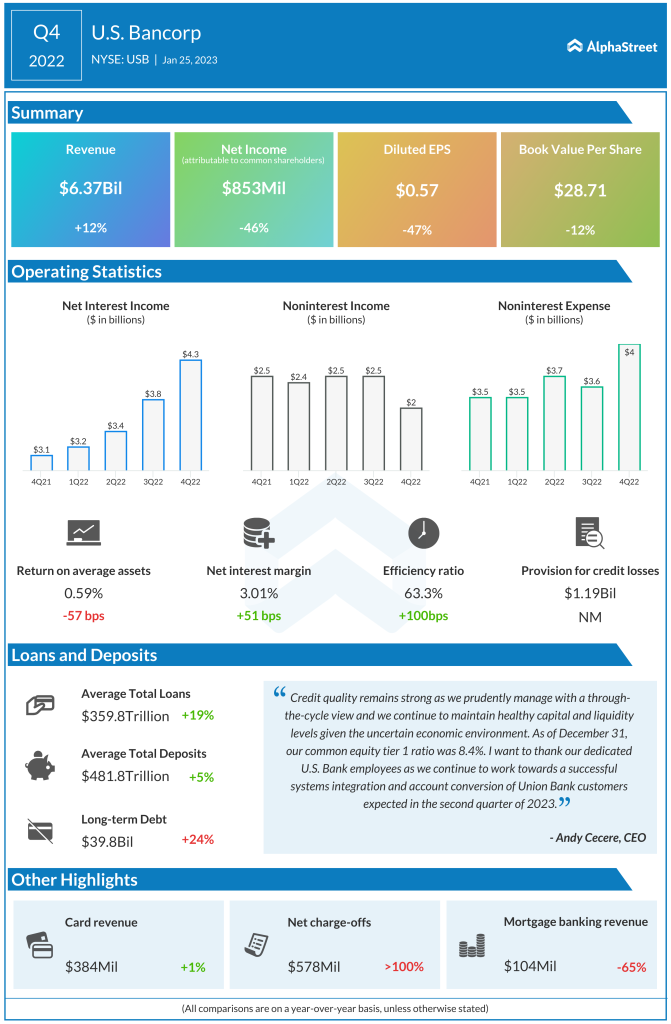

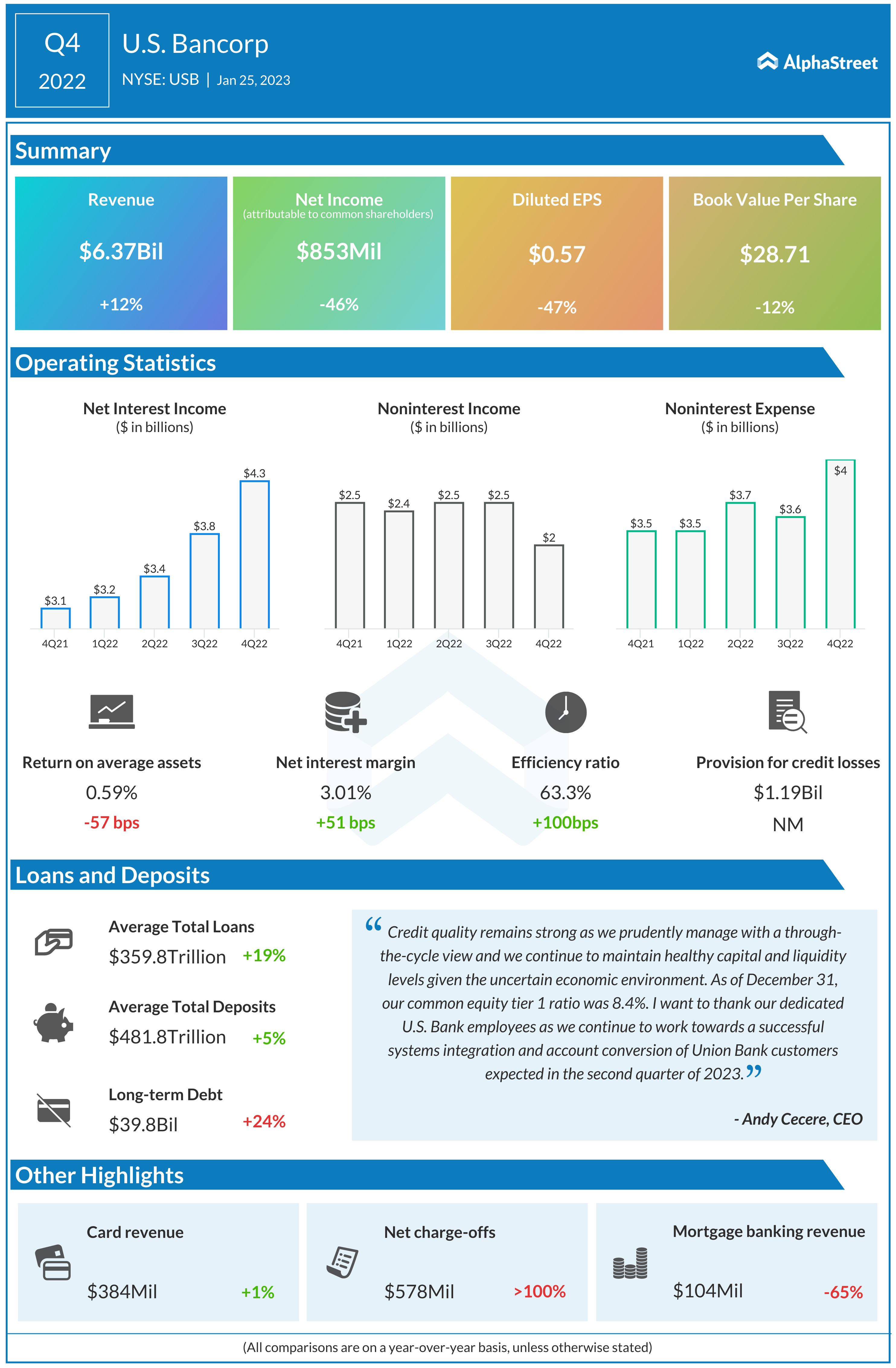

Net revenue increased 12% year-over-year to $6.37 billion in the fourth quarter. Net income applicable to the company’s shareholders was $853 million or $0.57 per share, compared to $1.58 billion or $1.07 per share a year earlier.

“Full-year results, as adjusted, were highlighted by strong pre-provision earnings growth, driven by solid net interest income, wider net interest margin, and positive operating leverage over 230 basis points. On December 1 we completed the acquisition of MUFG Union Bank, which meaningfully increased our market share in California by adding one million consumers, 700 commercial, and 190,000 business banking customers,” said the bank’s CEO Andy Cecere.

.