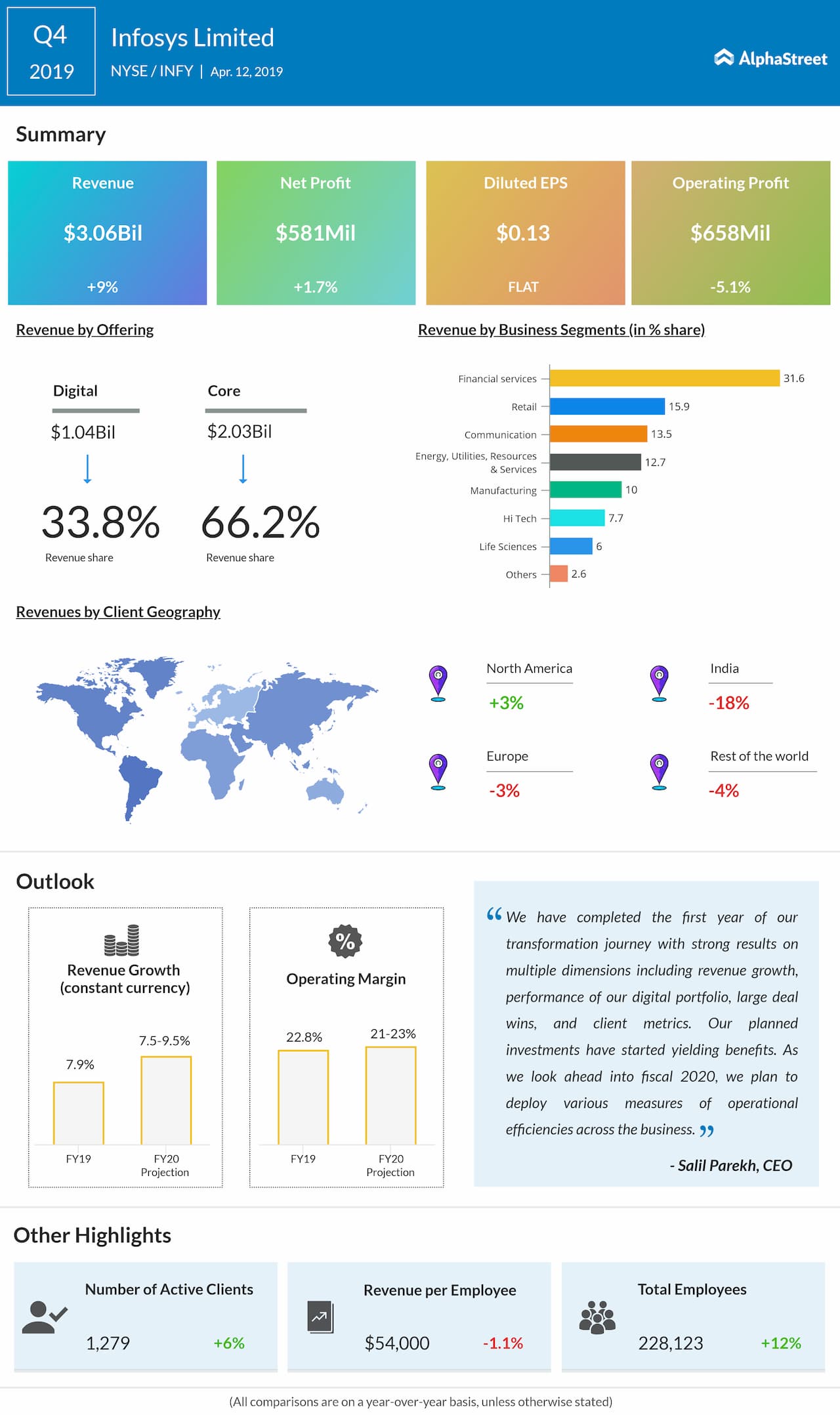

In the last-reported quarter, the company reported a 2% increase in earnings, helped by higher revenues as well as lower income tax expenses. Net profit rose 2% to $581 million, while revenues grew by 9.1% to $3.06 billion.

Infosys also predicted fiscal 2020 revenue growth in the range of 7.5% to 9.5% in constant currency and operating margin in the range of 21% to 23%. The management had vowed to deploy certain steps to improve operational efficiencies, about which they are likely to brief during the earnings conference call.

Infosys shares have mostly traded sidewise in the past 12 months. Since the start of this year, the stock has gained 10%.

Peer firms Wipro Limited (NYSE: WIT) and International Business Machines (NYSE: IBM) are scheduled to post quarterly results on July 16. Late last month, meanwhile, Accenture (NYSE: ACN) reported a 4% increase in revenues in the third quarter of 2019 to $11.1 billion, surpassing the Wall Street projection of $11.04 billion.