“

Chipmaker Intel Corporation (NASDAQ: INTC) reported a 20% growth in second-quarter revenues, reflecting the strong demand for cloud services during the COVID-related shutdown. However, the stock declined on Thursday evening due to the weak guidance issued by the management. Earnings, excluding special items, moved up to $1.23 per share from $1.06 per share in the […]

· July 23, 2020

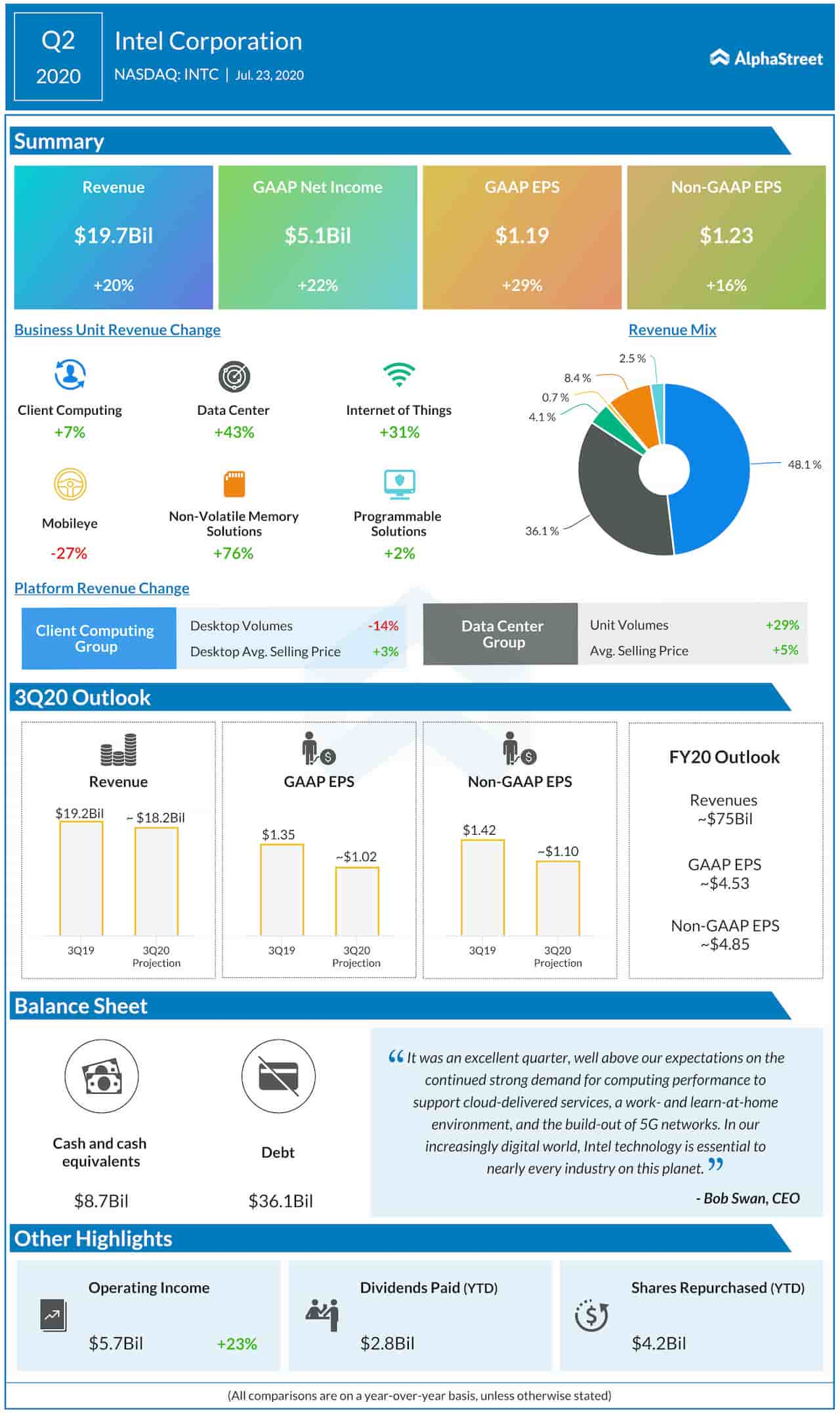

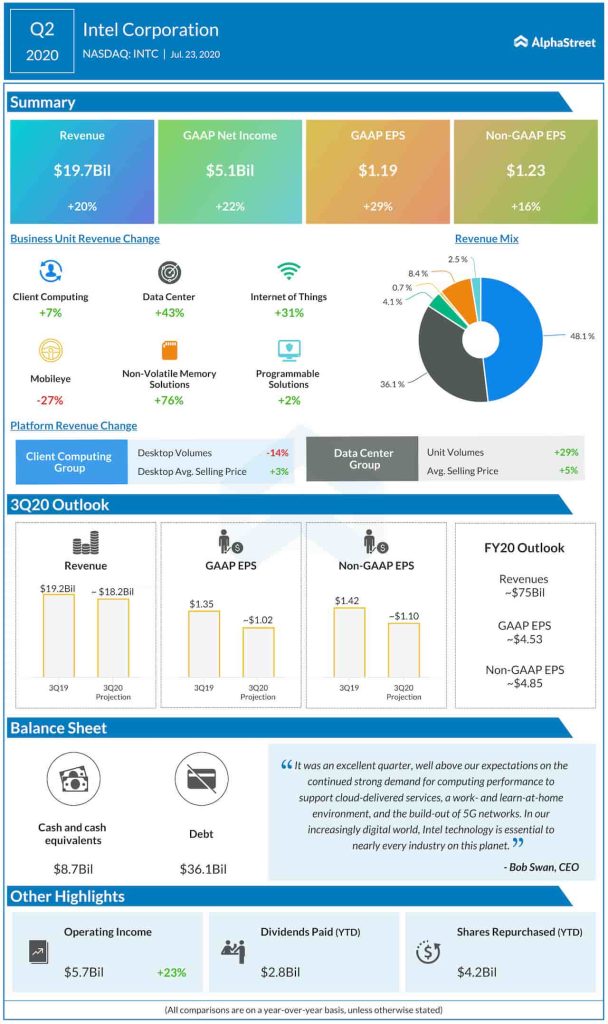

Chipmaker Intel Corporation (NASDAQ: INTC) reported a 20% growth in second-quarter revenues, reflecting the strong demand for cloud services during the COVID-related shutdown. However, the stock declined on Thursday evening due to the weak guidance issued by the management.

Earnings, excluding special items, moved up to $1.23 per share from $1.06 per share in the second quarter of last year. Unadjusted net income rose to $5.1 billion or $1.19 per share from $4.2 billion or $0.92 per share a year earlier. The bottom line topped expectations.