Worldwide PC shipments

Early this month, market research firm Gartner reported that worldwide PC shipments totaled 64.8 million units in the second quarter of 2020, a 2.8% increase from the second quarter of 2019. The shipment growth in the second quarter reflected a short-term recovery after the PC supply chain was severely disrupted in early 2020 due to the COVID-19 pandemic.

Q1 results

For the first three months of 2020, PC demand increased due to work-from-home and online learning. Also, strength in data center demand grew as cloud service providers increased their capacity. However, weakness in the industrial and retail verticals drove weaker demand in Internet of Things Group business for Intel.

Data Center Group

In Q1 2020, revenue in the cloud service providers market was up 53% as cloud service providers added capacity to meet the demand. The enterprise and government market segment was up 34%, and the communications service providers’ market segment was up 33% year over year.

Recent acquisitions, divestiture and customer loss

In May, the Santa Clara, California-based firm acquired Moovit, an Israel-based journey planner app in a $900 million deal. The same month, Intel acquired WiFi technology developer Rivet Networks for an undisclosed amount. In April, the company sold majority of its Home Gateway Platform, a division of Client Computing Group. This transaction is expected to close in the third quarter of 2020.

[irp posts=”58045″]

In June, iPhone maker Apple (NASDAQ: AAPL) announced that it will use its own chips to make Mac computers. Apple’s own processors will be available by the end of 2020 and the switching from Intel to Apple silicon would take about two years. Losing a customer like Apple will be a real blow for Intel.

Other players

Intel is dealing with fierce competition from Advanced Micro Devices (NASDAQ: AMD) in PCs and servers. While Intel is making 10-nm chips, AMD is producing 7-nm chips. Recently, another rival Nvidia’s (NASDAQ: NVDA) market cap surpassed Intel’s market cap. Texas Instruments (NASDAQ: TXN), which reports its earnings today after the bell, will be the first semiconductor company to report earnings in this quarter.

Outlook

Based on demand signals from customers, Intel had projected the strength in cloud service providers and communications service providers to continue in Q2, while IOTG and Mobileye were projected to face a lower demand driven by COVID-19 for the rest of the year. However, demand in the enterprise and government segment is expected to weaken in the second half of 2020. As global GDP estimates were revised down, Intel expects PC TAM to decline in the second half of the year.

The company had projected Q2 revenue to be $18.5 billion with PC-centric revenue approximately flat to slightly up year-over-year and data-centric revenue up approximately 25% year-over-year. Intel had projected Q2 earnings to come in about $1.10 per share.

Stock movement

After reaching a yearly high ($69.29) in January of this year, INTC stock plunged to 52-week low ($43.63) in March due to the COVID-19 crash. Intel stock had bounced back like other semiconductor stocks and is up 40% now from its yearly low.

[irp posts=”58090″]

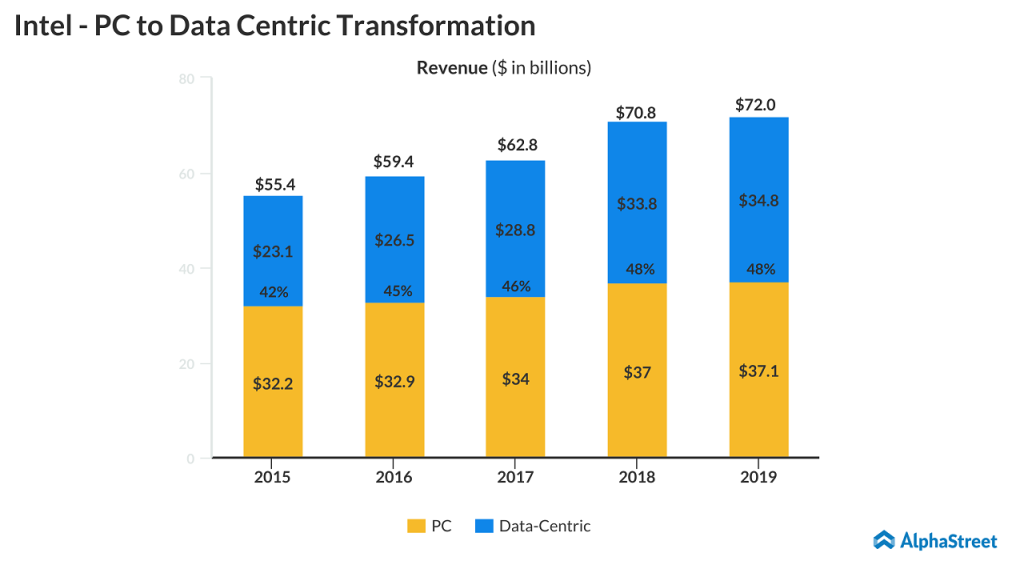

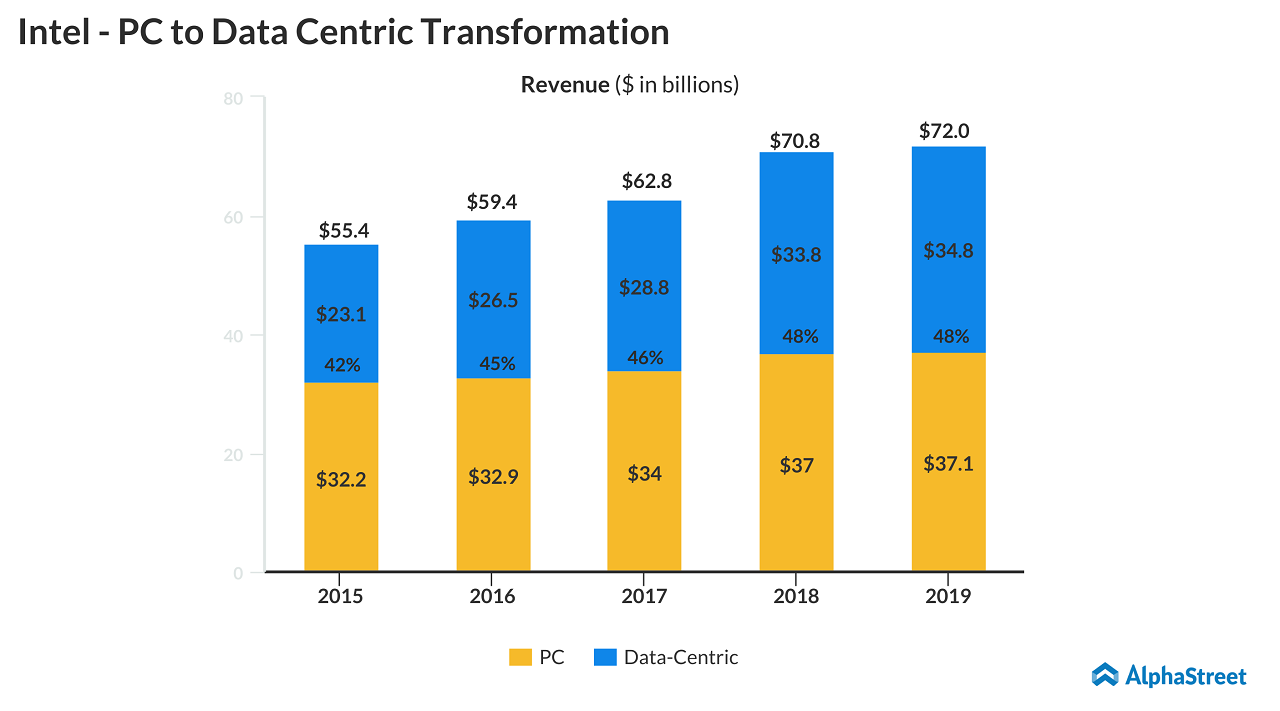

Even though Intel looks weaker compared to other semiconductor giants now, the company’s transformation of PC to data-centric model is expected to yield the desired results for it once the current uncertainty subsides.