Looking ahead into the third quarter, Intel projects earnings of $1.09 on a revenue of around $18.1 billion. Adjusted EPS is estimated to be around $1.15.

For 2018, the company now predicts revenue of approximately $69.5 billion. GAAP EPS is anticipated to come at around $4.10, while on an adjusted basis, it is expected to be around $4.15.

Revenue in the PC-centric business rose 6% driven by strong demand for Intel’s performance leading products with particular strength in gaming and commercial. The Cloud Computing Group launched several new 8th Gen Intel Core processors, including Core i9 for laptops, Core vPro processors for business, and Core i7-8086K limited-edition processor for gaming.

Meanwhile, Intel’s revenue from Programmable Solutions Group grew 18% on higher demand for its field-programmable gate arrays. The company’s memory, Internet of Things Group, and Mobileye businesses each achieved record quarterly revenue. The increase in the adoption of advanced driver-assistance systems drove Mobileye revenue higher by 37%.

Intel is in the midst of searching for a new executive chief after the resignation of Brian Krzanich last month. Also, speculations are rife that an ex-employee, Diane Bryant, who resigned as COO from Alphabet’s (GOOGL) Google Cloud, might return to handle the executive chief position.

Related: AMD defies crypto blues; stock jumps as Q2 results beat street view

Intel’s rival Advanced Micro Devices (AMD) yesterday reported stellar second-quarter results helped by strong demand for products in the PC and server markets. Revenue increased 53% year-over-year to $1.76 billion and adjusted earnings came in at $0.14 per share, beating the street’s estimates.

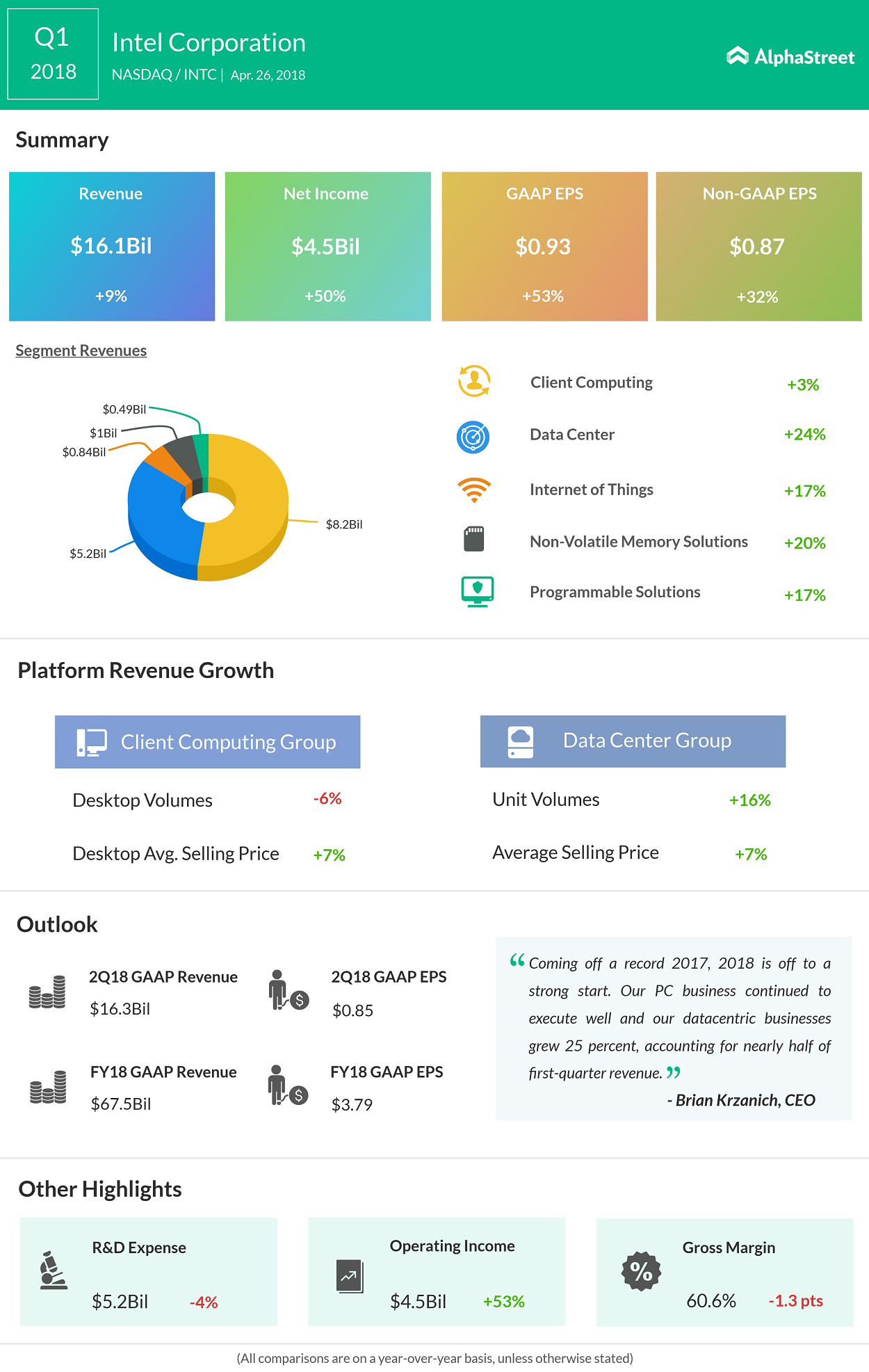

Related Infographics: Q1 Earnings