At the end of the first quarter, GX browser had nearly 9 million users, representing a 190% year-over-year growth. In an interview with AlphaStreet, Opera CFO Frode Jacobsen said the product’s success is attributable to its unique functionalities, as well as the gaming look and feel.

“The product has grown tremendously and keeps adding users. We see the product’s growth trajectory as the first building block in the broader gaming efforts that we are pursuing.”

Opera has been undertaking numerous initiatives to drive traffic to its gaming segment, including the acquisition of YoYo Games, the creator of GameMaker Studio 2, earlier this year. Last month, the company announced an initiative that allows Twitch subscribers to team up with professional gamers, as well as receive training from experts.

Derrick Nueman, Vice President of Investors Relations at Opera, pointed out the company is using influencers to drive awareness as part of its non-traditional grassroots marketing efforts.

Strong Q1 performance

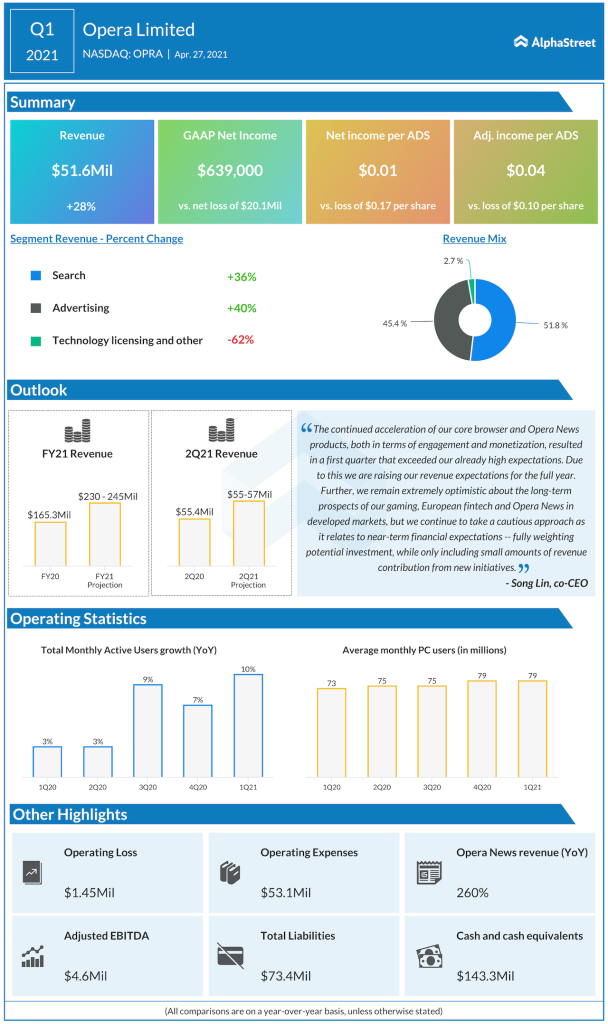

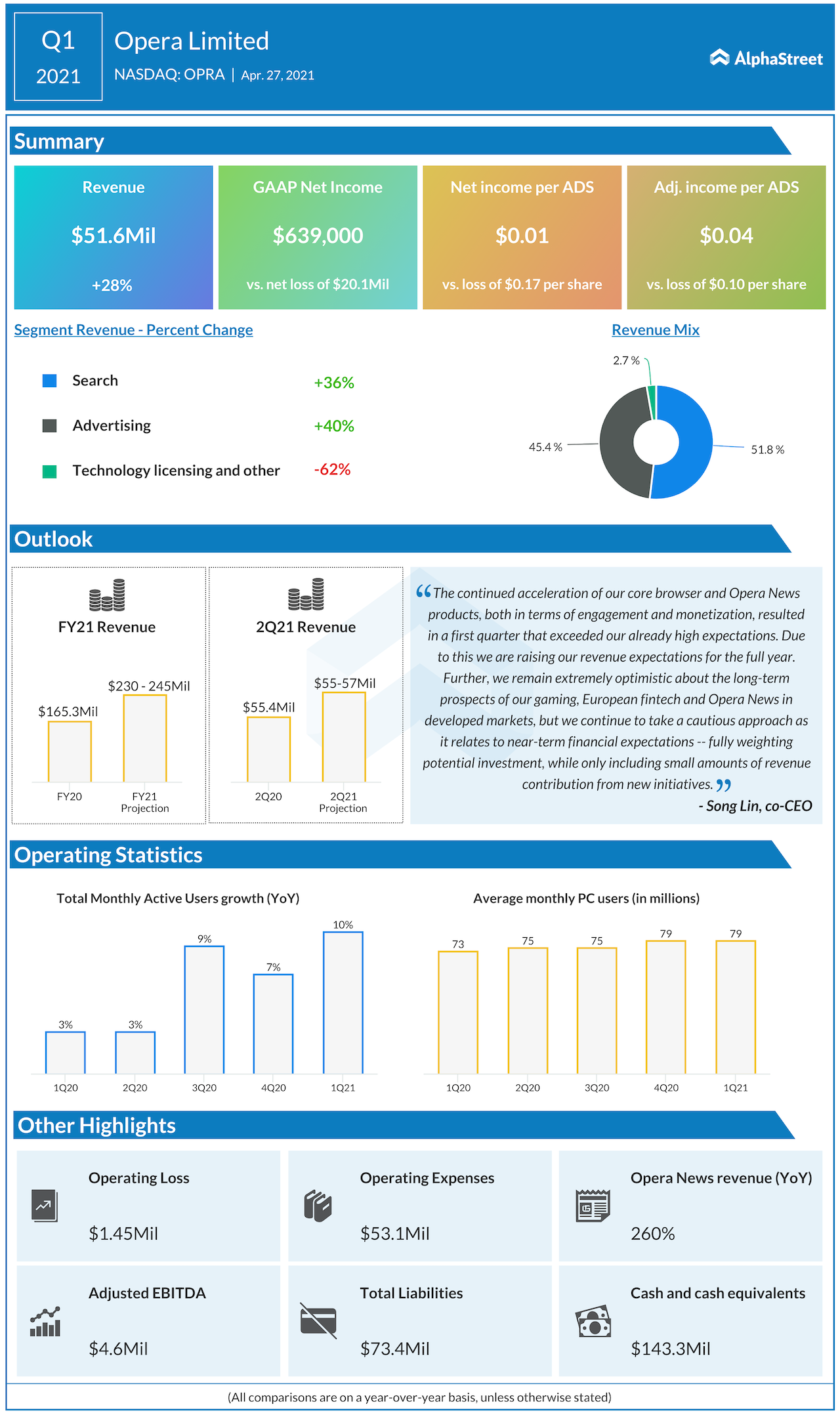

Earlier this week, the Oslo-based firm reported strong growth for the Q1 topline, riding on a 38% year-over-year increase in search and advertising revenues. The company also swung to a profit of 4 cents per share, from a loss of 10 cents per share a year ago, helped by better margins.

While the full-year guidance was generally seen as conservative, Jacobsen said the management was pleased with the projected 44% year-over-year increase at the midpoint. “We are careful to not be too aggressive in particular as it relates to our newer initiatives. As always, we work hard to meet them, and let’s see if we can also exceed the range.”

Opera Ltd. (OPRA) Q1 2021 Earnings Call Transcript

ADVERTISEMENT

Fintech push

Apart from the financial performance, Opera made strong progress with its fintech arm. Dify, Opera’s in-browser payments solution, launched a cashback offering in Europe, besides partnering with Mastercard for virtual debit cards. The CFO said the integration of payment solutions into a browser that is used to make online transactions represents a potential simplification for end users.

“For us, that represents a foothold and a starting point, that gives us a strong advantage in building a European payments and fintech business,” he added.

Interestingly, Opera was one of the early adopters of blockchain technology in browsing applications. As early as in 2019, the company had added a crypto wallet to its browsers on all platform. Taking a step forward, the company this week announced full integration with blockchain domain name provider Unstoppable Domains, allowing its users to access decentralized websites without a browser extension.

Single-seat EVs will help businesses cut costs: ElectraMeccanica CFO

With a lot of activity going on, OPRA stock has almost doubled over the past 12 months. The stock has an average price target of $17, suggesting a further 52% increase from Thursday’s trading price.

(Written by Arjun Vijay)

______