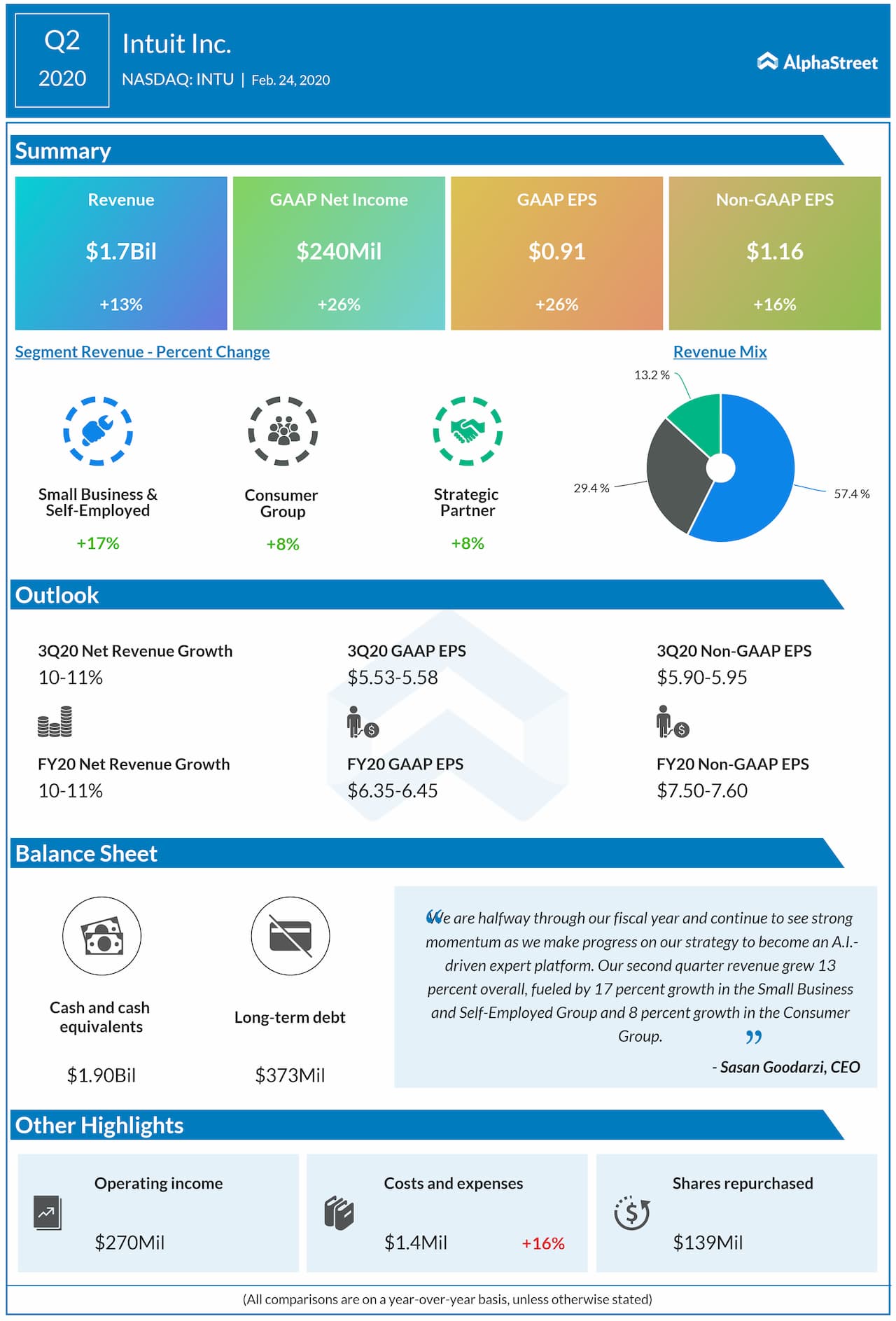

Intuit Inc. (NASDAQ: INTU) reported better-than-expected revenue and earnings for the second quarter of 2020, sending the stock climbing 2.3% in aftermarket hours on Monday.

Total revenue of $1.7 billion was up 13% year-over-year and ahead of estimates of $1.68 billion. The topline results were driven by a 17% increase in Small Business and Self-Employed Group and an 8% increase in Consumer Group.

GAAP net income

was $240 million, or $0.91 per share, compared to $189 million, or $0.72 per

share, in the prior-year period. Adjusted EPS rose 16% to $1.16, beating forecasts

of $1.03 per share.

During the

quarter, Small Business Online Ecosystem revenue grew by 35%. Strong

customer growth, coupled with higher prices and mix-shift, drove a 43% increase

in QuickBooks online accounting revenue. Online Services revenues increased 23%,

aided by QuickBooks Online payroll and QuickBooks Online payments.

For the third quarter of 2020, Intuit expects revenue to grow 10-11%. The company expects GAAP EPS of $5.53 to $5.58, and adjusted EPS of $5.90 to $5.95.

For full-year

2020, revenue is expected to grow 10-11% to a range of $7.44 billion to $7.54

billion. GAAP EPS is estimated to grow 8-10% to $6.35 to $6.45 and adjusted EPS

is projected to increase 11-13% to $7.50 to $7.60.

The Board

approved a quarterly dividend of $0.53 per share, payable April 20, 2020,

representing a 13% increase compared to the year-ago period.

Intuit announced its agreement to acquire personal finance platform Credit Karma for approx. $7.1 billion in cash and stock. The deal, which is anticipated to close in the second half of calendar year 2020, is expected to be neutral to accretive to adjusted EPS in the first full fiscal year after closure.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.