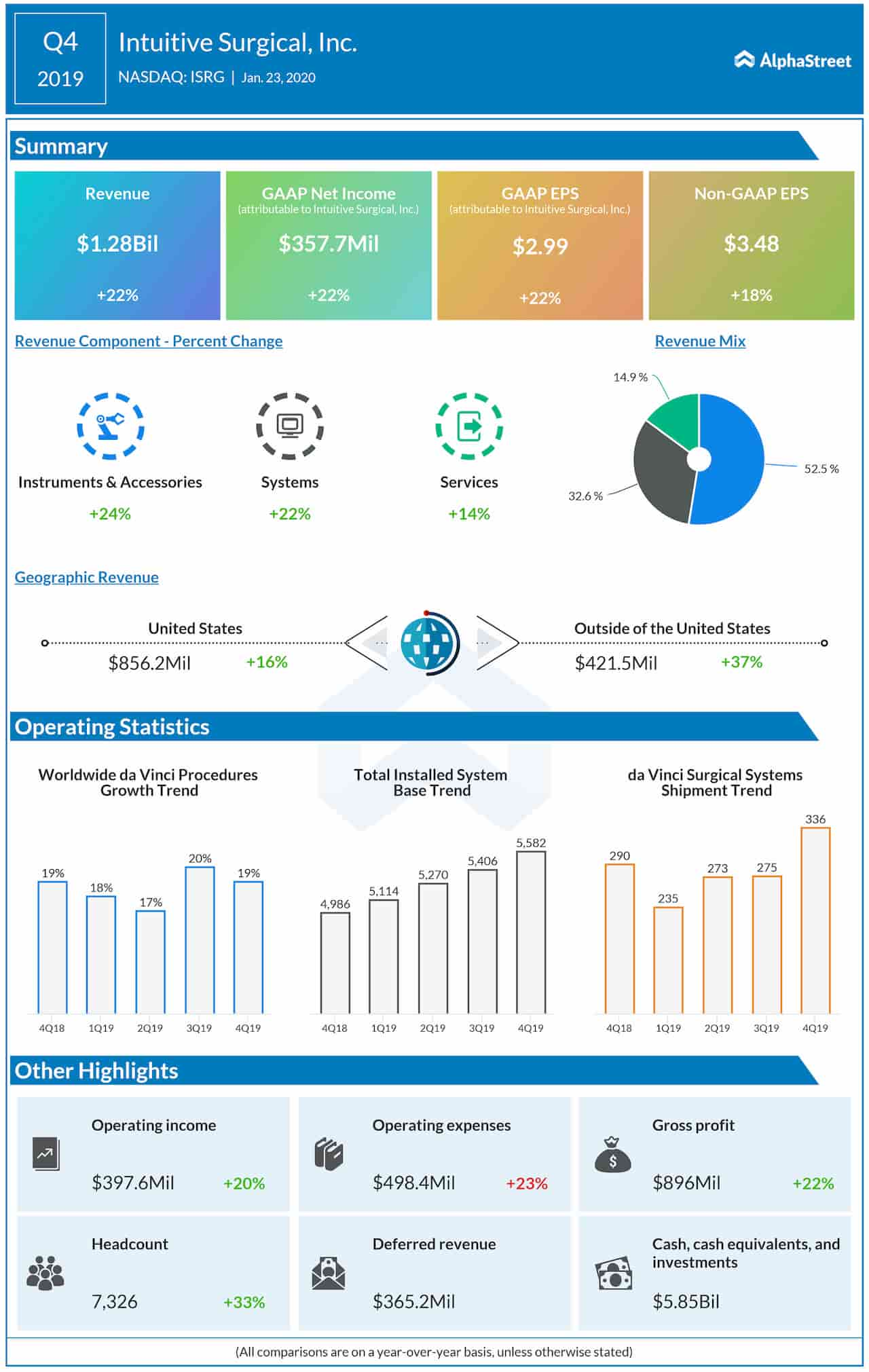

Total revenue moved up 22% year-over-year to $1.28 billion, beating the consensus estimate. The top-line growth was driven by an increase in procedures and system placements. Instruments and accessories revenue increased by 24% to $671 million, helped by double-digit growth in da Vinci procedure volume.

At $416 million, systems revenue was up 22%. System shipments included 126 units shipped under operating lease and usage-based arrangements, compared to 84 last year.

Net income for the quarter was $358 million or $2.99 per share, compared to $293 million or $2.45 per share in the prior-year quarter. Earnings, adjusted for special items, rose to $3.48 per share from $2.96 per share in the fourth quarter of 2018. Analysts had forecast slower growth.

Related: Intuitive Surgical Inc Q3 2019 Earnings Call Transcript

During the quarter, worldwide da Vinci procedures grew nearly 19% versus last year, driven mainly by growth in US general surgery procedures and worldwide urologic procedures. Intuitive shipped 336 da Vinci Surgical Systems, which was up 16% from the prior-year period, and grew its da Vinci Surgical System installed base to 5,582 systems, reflecting a year-over-year increase of 12% from last year.

Shares of Intuitive Surgical climbed to an all-time high this week, continuing the uptrend seen since the beginning of the year. The stock gained 19% in the past twelve months. It closed Thursday’s regular session higher.