For the second quarter, Wall Street expects earnings to grow to $2.87 per share, compared to $2.76 per share a year ago. The company will badly want to stay ahead of estimates this time, after missing the street figure in the trailing two quarters. The misses had sent the stock plunging both times.

So far this year,

the stock has gained 12.4%, underperforming the S&P500 index’s 19.6%

growth.

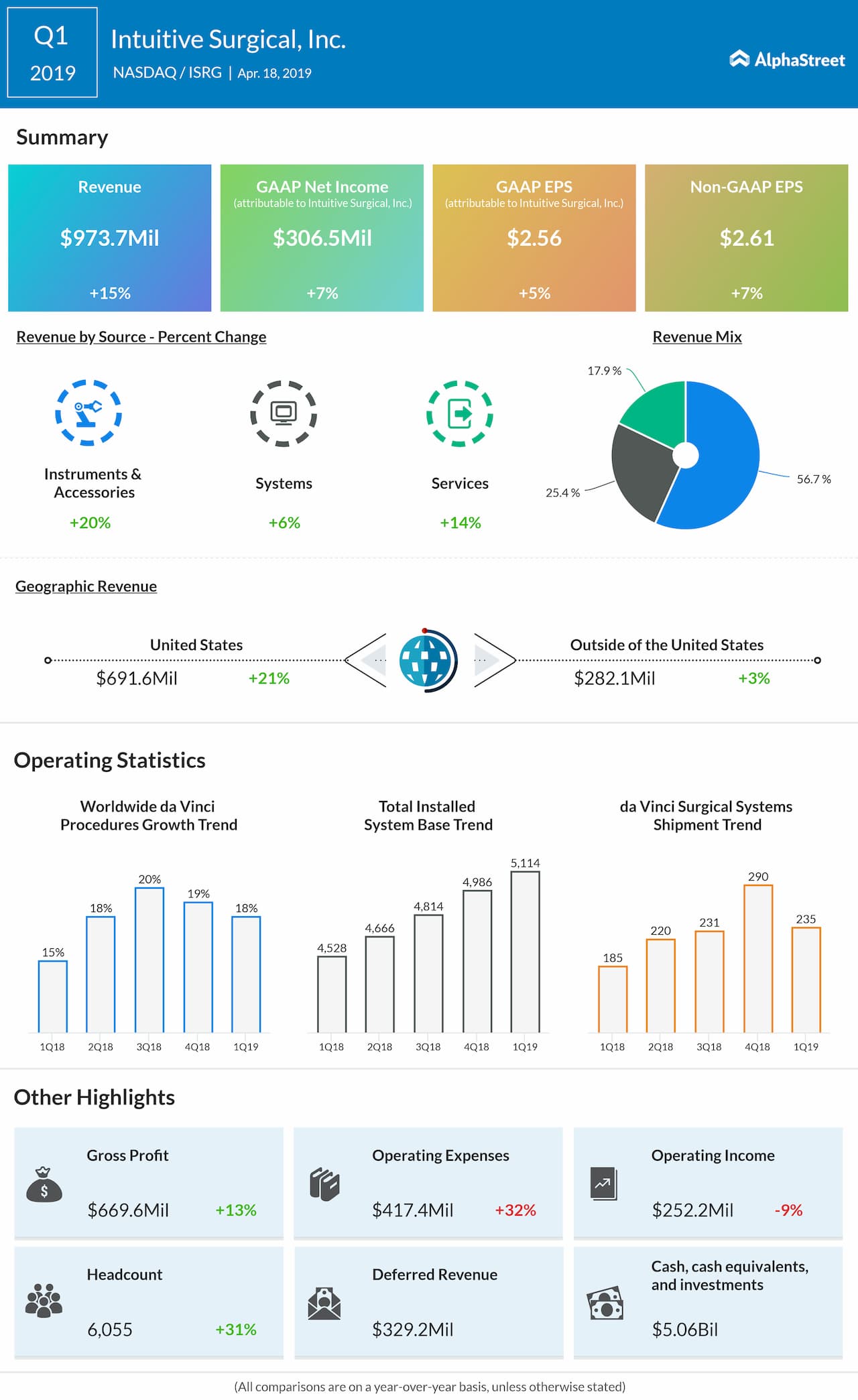

The Instruments and Accessories is expected to continue its strong growth, after reporting a 20% gain in the last quarter.

The company had a slew of FDA approvals earlier this year. Back in February, ISRG received FDA clearance for its Ion endoluminal system — a robotic-assisted catheter-based platform, designed to navigate through very small lung airways to reach peripheral nodules for biopsies.

READ: Abbott exceeds Q2 earnings estimates; raises 2019 outlook

In the same month, the company also received FDA approval for the IRIS augmented reality product, designed to aid surgeons in both pre- and intra-operative settings by delivering a 3D image of the patient anatomy.

Then,

in March, Intuitive Surgical received FDA clearance for the da Vinci SP

Surgical System for use in certain transoral otolaryngology procedures in

adults.

Marketing of these products

strengthened during the second quarter, which should help lift the results.

ISRG has a 12-month average price target of $568.88, which was at a 9% upside from Wednesday’s trading price. The stock has a Moderate Buy rating, based on nine analysts covering the stock.