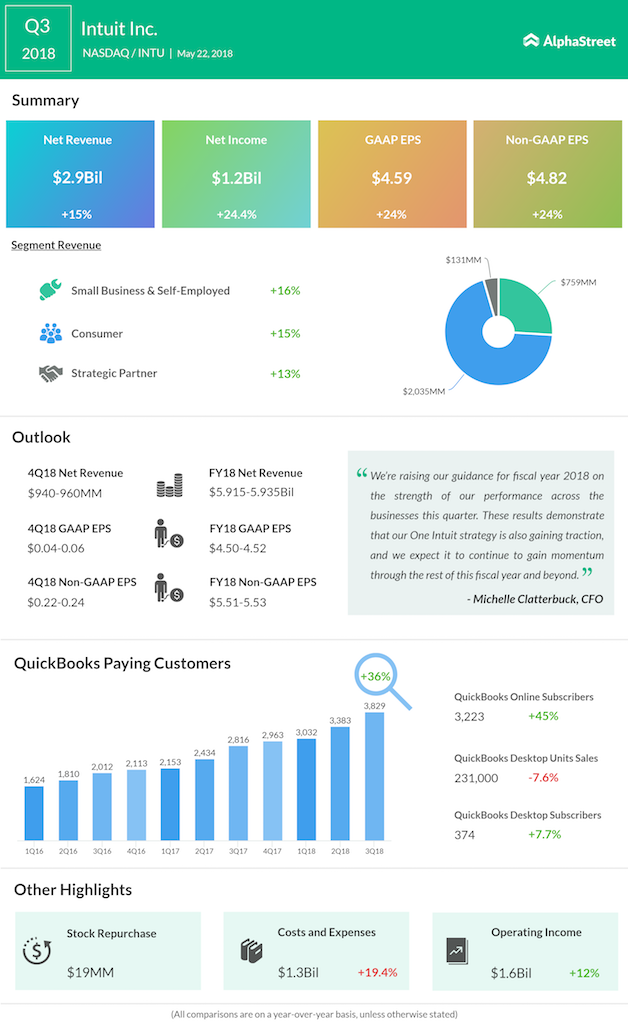

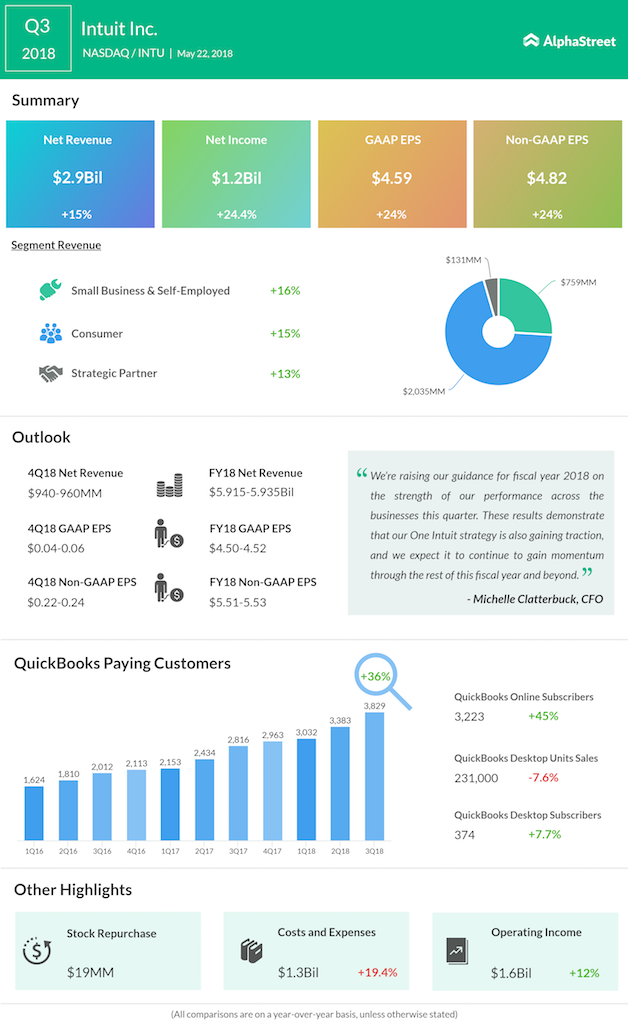

Intuit (INTU) reported better-than-expected results for the third quarter, beating analyst estimates on both revenue and earnings front. Revenues climbed by 15% to almost $2.93 billion, while adjusted earnings of $4.82 per share witnessed a 24% jump compared to the prior year period. Shares of the Mountain View, California-based company inched down marginally during the extended hours of trading due to weak earnings guidance provided for the current quarter.

The strong result in the quarter was primarily driven by strong sales growth across all its divisions. The financial software firm’s result was bolstered by online ecosystem sales jumping 41%, which continues its stellar growth from the previous quarter.

Thanks to the strong tax season, Intuit sold 4% more TurboTax units in the quarter, which also includes the contribution of TurboTax Online which saw a 6% growth. The company launched TurboTax Live, a video-based tax preparation tool, at the end of last year to provide online help to tax filers. The assisted tax preparation market is expected to be worth $20 billion and result in consistent revenue growth in the future.

Accounting software QuickBooks Online ended the quarter with 3.2 million users, which is a 45% jump in user subscription over last year. Self-Employed user base nearly doubled to 683,000 users compared to 360,000 in the prior year period.

Backed by the strong third quarter results, Intuit lifted its full-year guidance. The company now expects its revenue to come between $5.915 billion and $5.935 billion, and earnings, on an adjusted basis, is projected in the range of $5.51 to $5.53 per share.

For the current quarter, the financial software firm forecasts revenue of $940 million to $960 million and adjusted earnings of $0.22 to $0.24 per share. Shares of Intuit shot up nearly 21% in 2018 and soared nearly 50% over the last 12 months.