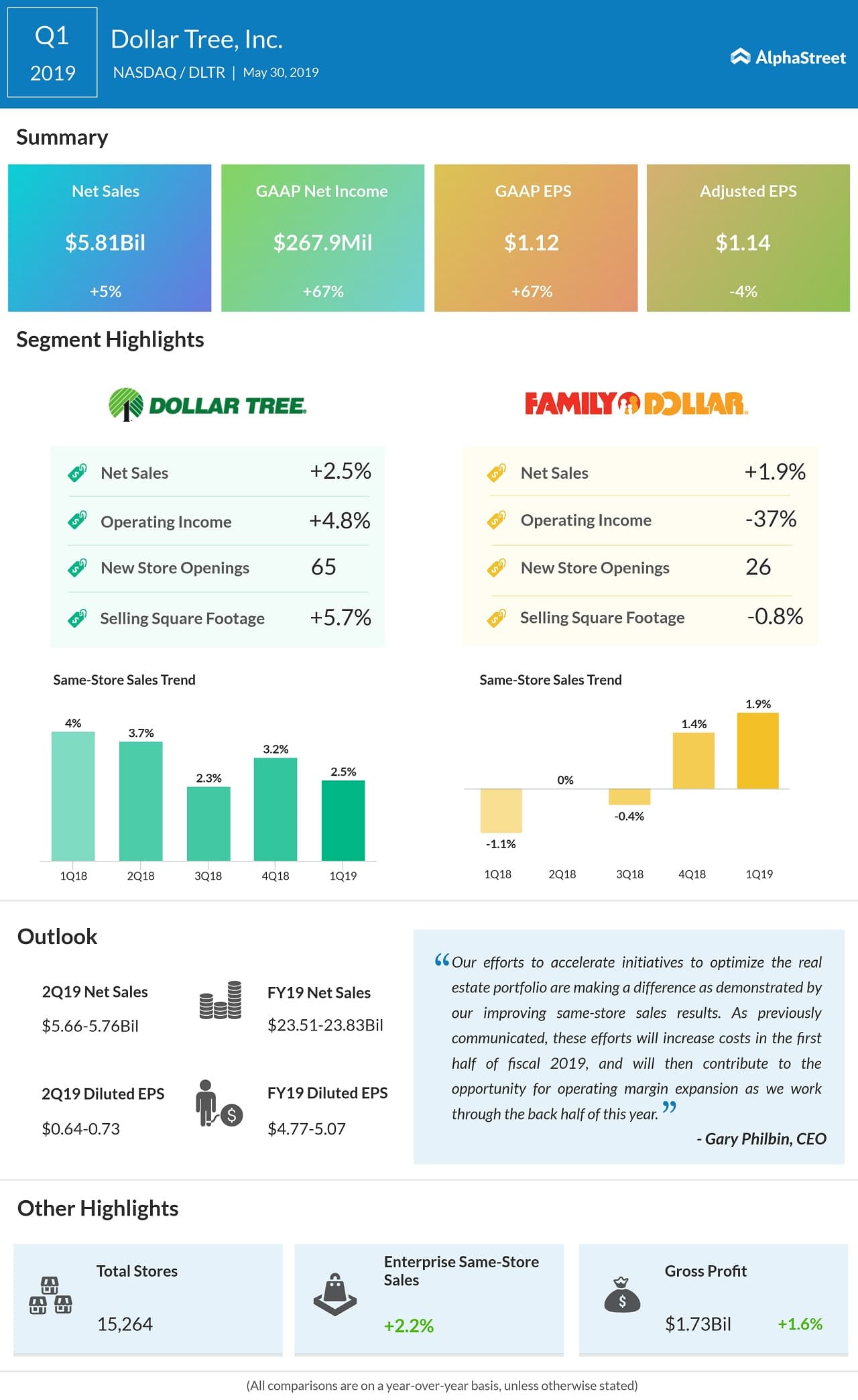

The store performance was primarily driven by its Dollar Tree unit,

where same-store sales improved 2.5% on a constant currency basis. Meanwhile,

it rose just 1.9% in the Family Dollar segment.

On a reported basis, net income grew 67% to $1.12 per share.

Outlook

The Chesapeake, Virginia-based firm estimates consolidated net sales for

the second quarter of 2019 to range from $5.66 billion to $5.76 billion, based

on a low single-digit increase in same-store sales for the combined enterprise.

Diluted EPS is estimated to be in the range of $0.64 to $0.73.

READ: EXPRESS INC SWINGS TO LOSS BUT SURPRISES WALL STREET IN Q1

For the full year, Dollar Tree expects net sales of 23.51 billion to

$23.83 billion. This estimate is based on a low single-digit increase in

same-store sales.

Diluted EPS for this period is projected in the range of $4.77 to $5.07.

DLTR stock has gained 4.5% so far this year.

Peer company Dollar General Corporation (NYSE: DG) also reported quarterly results on Thursday. Dollar General reported an 8% increase in first-quarter sales, supported by strong comparable store sales. Consequently, earnings rose sharply and exceeded estimates, driving the stock higher in premarket trading Thursday. The company also reaffirmed its full-year guidance.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.