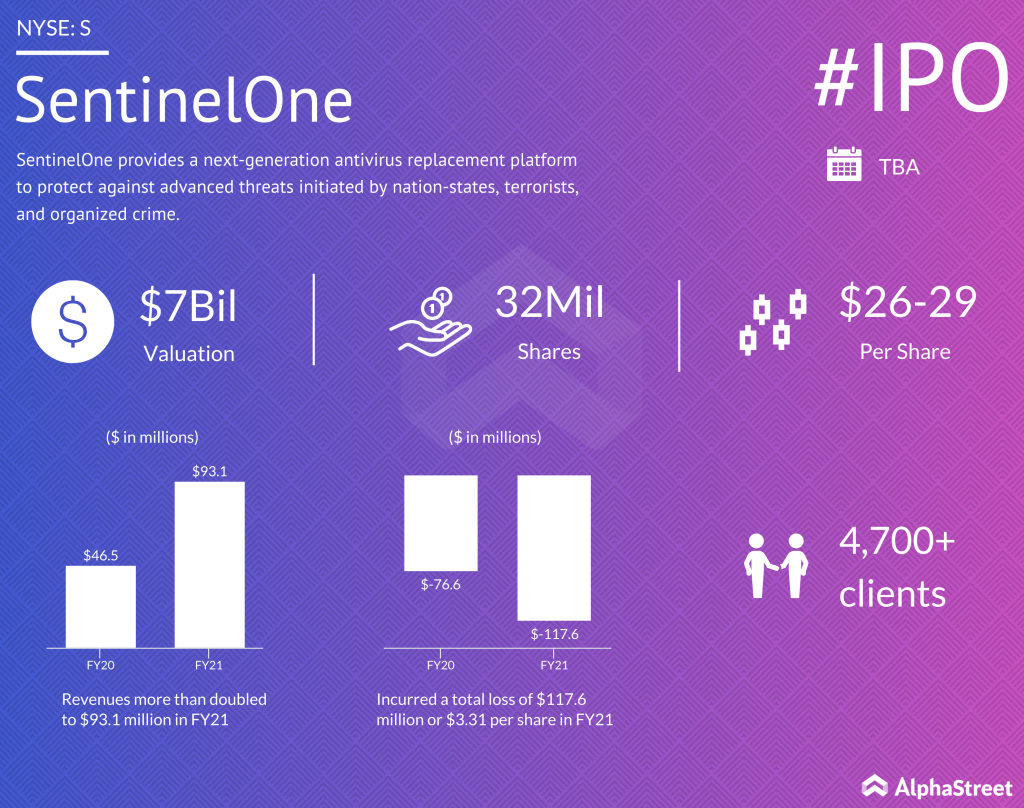

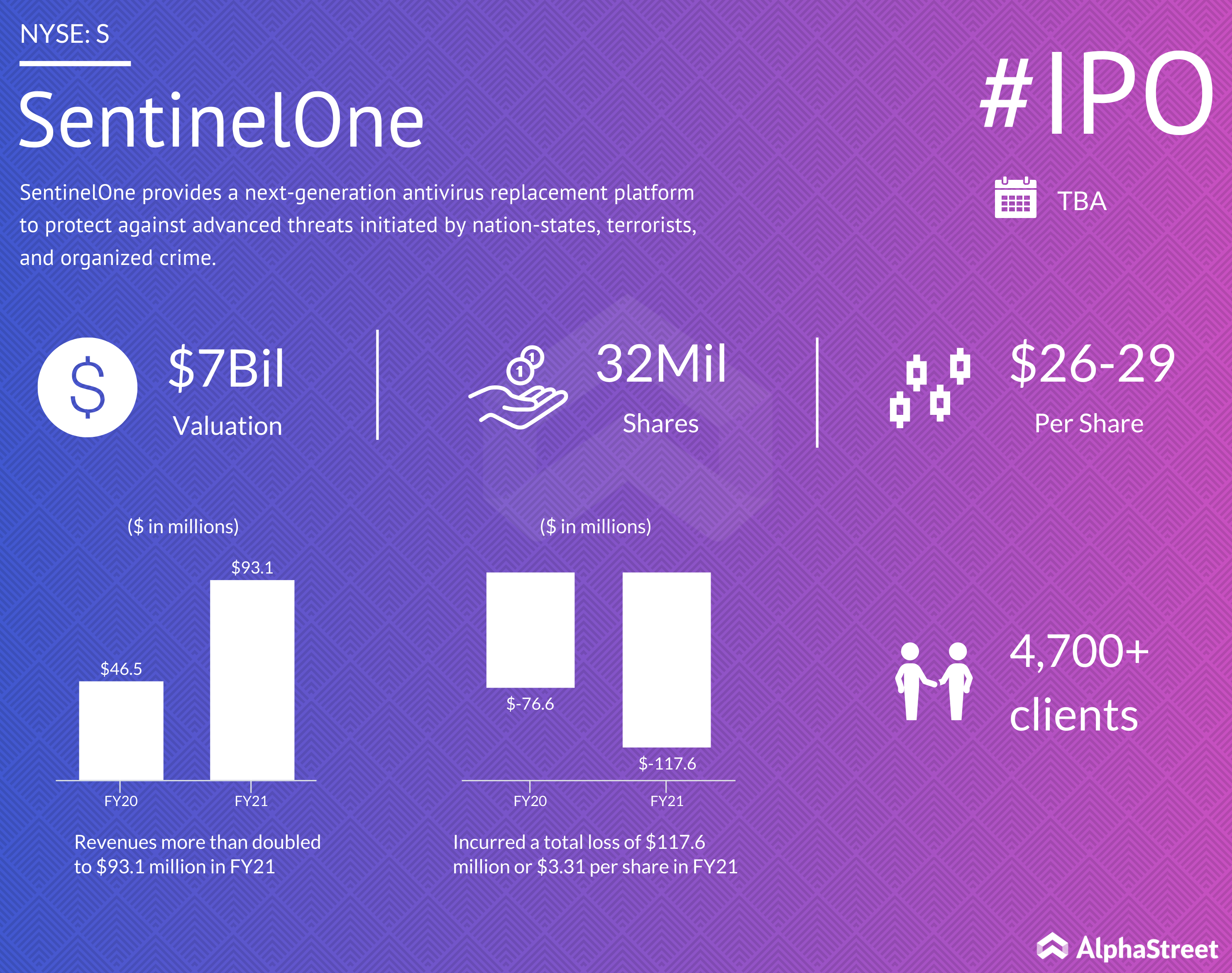

$26-29 Per Share

Read management/analysts’ comments on quarterly reports

As part of the preparations for going public, the company recently strengthened its leadership team. Oracle (NYSE: ORCL) veteran Siggi Petursson was named vice president of customer-centric engineering and Martin Matula was appointed vice president of engineering for Czech operations.

Latest Updates

Earlier this month, the company forged a partnership with cyber insurance provider Coalition to offer advanced threat monitoring and cyber insurance, in view of the growing threat of ransomware in the corporate world. Last year, it raised $267 million, reaching a valuation of about $3 billion.

The company, which has significant expertise in endpoint detection and response, is backed by hedge fund Third Point — a venture by high-profile investor Daniel Loeb. SentinelOne came into existence in 2013, offering AI-supported security solutions to protect computers and mobile phones from malware and other threats in cyberspace.

SentinelOne has more than 4,700 clients, which is nearly double that of the customer base it had a year ago. In fiscal 2021, it incurred a total loss of $117.6 million or $3.31 per share, wider than the loss of $76.6 million or $2.34 per share reported a year earlier. Meanwhile, revenues more than doubled to $93.1 million. There has been a steady increase in annual recurring revenues.

Outlook

In the run-up to the IPO, SentinelOne witnessed an improvement in financial performance in recent quarters as the pandemic-driven shift to remote work helped reduce operating expenses. However, being an emerging business that needs constant expansion, investment-related costs will put pressure on the bottom line, which is yet to come out of the negative territory.

All you need to know about Krispy Kreme’s return to public markets

New players are rapidly entering the cybersecurity market and many of them opt for public-listing to move to the next level — a trend that underscores the high demand for anti-virus products, especially at a time when businesses are going digital in a big way. It is estimated that the digital transformation boom set off by COVID-19 is going to stay here, which bodes well for firms like SentinelOne, given the growing relevance of cybersecurity.