Membership services revenue jumped 38% to RMB 3.4 billion (US$497.1 million). Content distribution revenue declined 4% to RMB 517.9 million (US$75.4 million) due to the delay of certain content launches during the quarter.

Online advertising services revenue decreased 16% year-over-year to RMB 2.2 billion (US$320.6 million), hurt by the challenging macroeconomic environment in China, the delay of certain content launches and slower-than-expected recovery of in-feed advertising.

Read: Netflix stock plunges on big miss in paid subscriber additions in Q2

ADVERTISEMENT

At the end of the second quarter, iQiyi had 100.5 million subscribers, of which 98.9% were paid members.

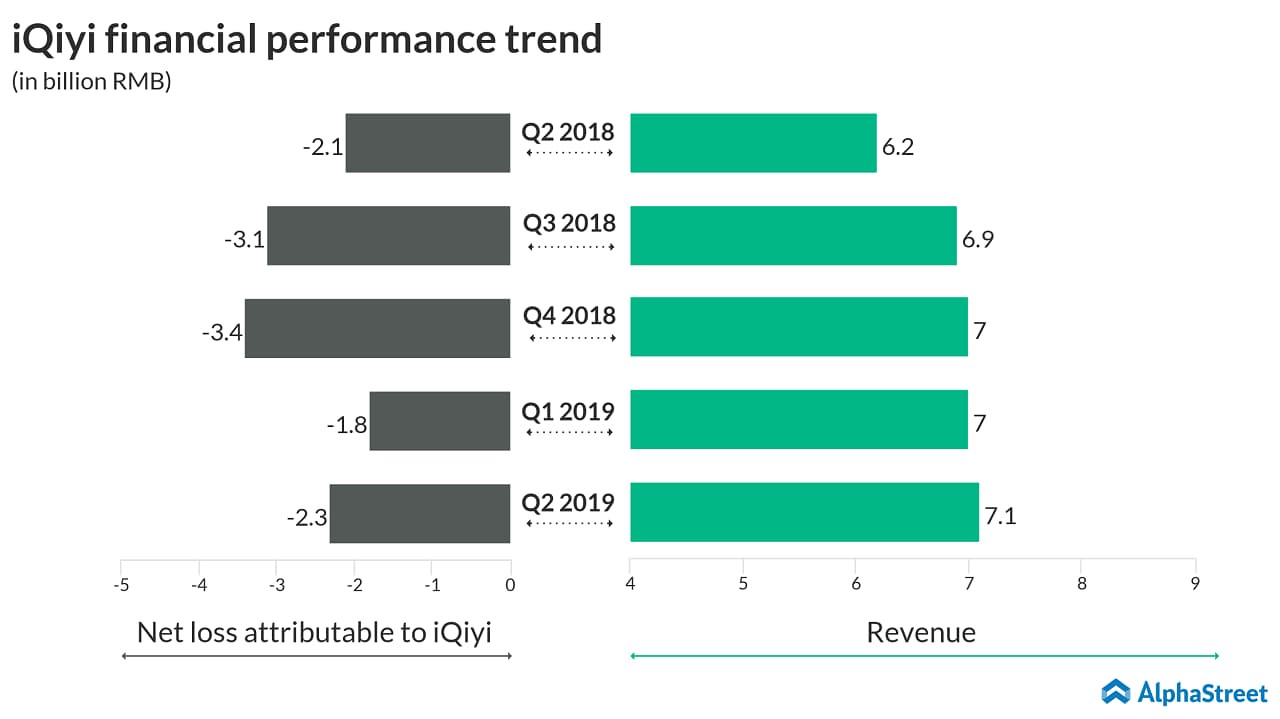

For the third quarter of 2019, iQiyi expects revenue to be between RMB 7.21 billion (US$1.03 billion) and RMB 7.63 billion (US$1.09 billion), representing a 4% to 10% growth from the third quarter of 2018.

“We achieved continued revenue growth in the second quarter despite some recent challenges facing our industry. Our membership business generated solid growth with subscription revenues increasing 38% year-over-year, driven by our strong content slate during the quarter,” said CFO Xiaodong Wang.

iQiyi’s parent Baidu also reported its second quarter results earlier today. Baidu stock rose about 9% in the extended trading hours as it posted better-than-expected results for the recently ended quarter.

Shares of iQiyi have gained 22% so far this year, while they have lost 31% in the trailing 12 months.