The Stock

Intuit Inc. Q2 2023 Earnings Call Transcript

However, the stock stabilized as the year progressed and outperformed the broad market quite often. INTU has good growth potential, thanks to the successful business model and growing demand for the company’s solutions. The stock is not cheap, and the value is unlikely to decline in the near future. Rather, it looks set for a major leap, thereby creating significant shareholder value. So, the time is ripe to buy the stock, though some investors would find it expensive.

Digital Shift

Intuit’s business is seasonal, characterized by high activity during the tax season that typically starts at the beginning of the year. Considering the rapid adoption of online tax filing solutions, in line with the ongoing digital transformation, Intuit’s business looks poised to expand significantly in the coming years. The management’s continued efforts to ramp up the portfolio with a focus on technological innovation — such as the AI-driven customer growth platform — should help the company expand its market share further.

“We’re seeing continued momentum as we execute on our strategy of being a global AI-driven expert platform and growing Intuit revenue double-digits with margin expansion. With our accelerated organic innovation and the additional – additions of Credit Karma and Mailchimp, we are the leading global financial technology platform that powers prosperity for people and communities. We’re proud that Intuit has been named number five on Fortune’s Most Admired Company in the software category…,” said Intuit’s CEO Sasan Goodarzi in a recent interaction with analysts.

Earnings

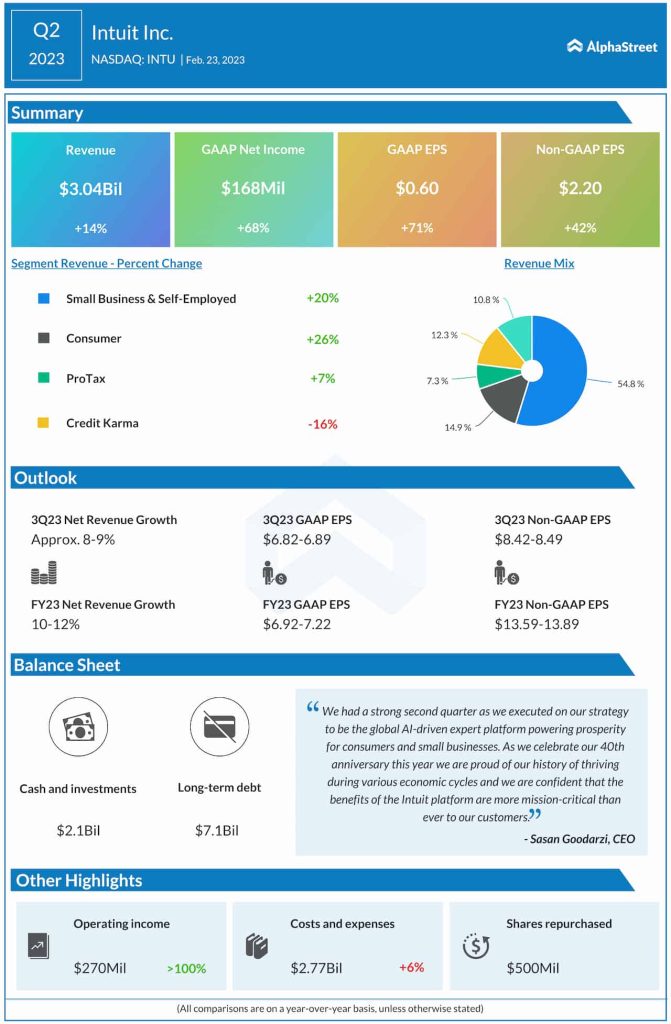

In the second quarter of 2023, Intuit’s adjusted earnings climbed 42% annually to $2.20 per share and came in above the forecast. Earnings had topped expectations in each of the trailing three quarters. At $3.04 billion, January-quarter revenues were up 14% and above the consensus estimates. The Small Business & Self-Employed segment, which accounts for more than 50% of total revenues, expanded by 20%.

Besides the strong revenue growth, the bottom line also benefited from a slowdown in expense growth. The company also provided earnings and revenue guidance for the third quarter and reaffirmed the outlook for fiscal 2023.

PayPal prepares to become more focused and agile this year

Separately, Intuit announced the appointment of Sandeep Singh Aujla as the new chief financial officer. Replacing Michelle Clatterbuck, who will be retiring mid-year after serving as the CFO since early 2018, Sandeep will assume the new role in August.

INTU opened Friday’s session slightly above $400 and traded higher most of the session, after paring a part of the post-earnings gains. It has moved up four percent in the past 30 days.