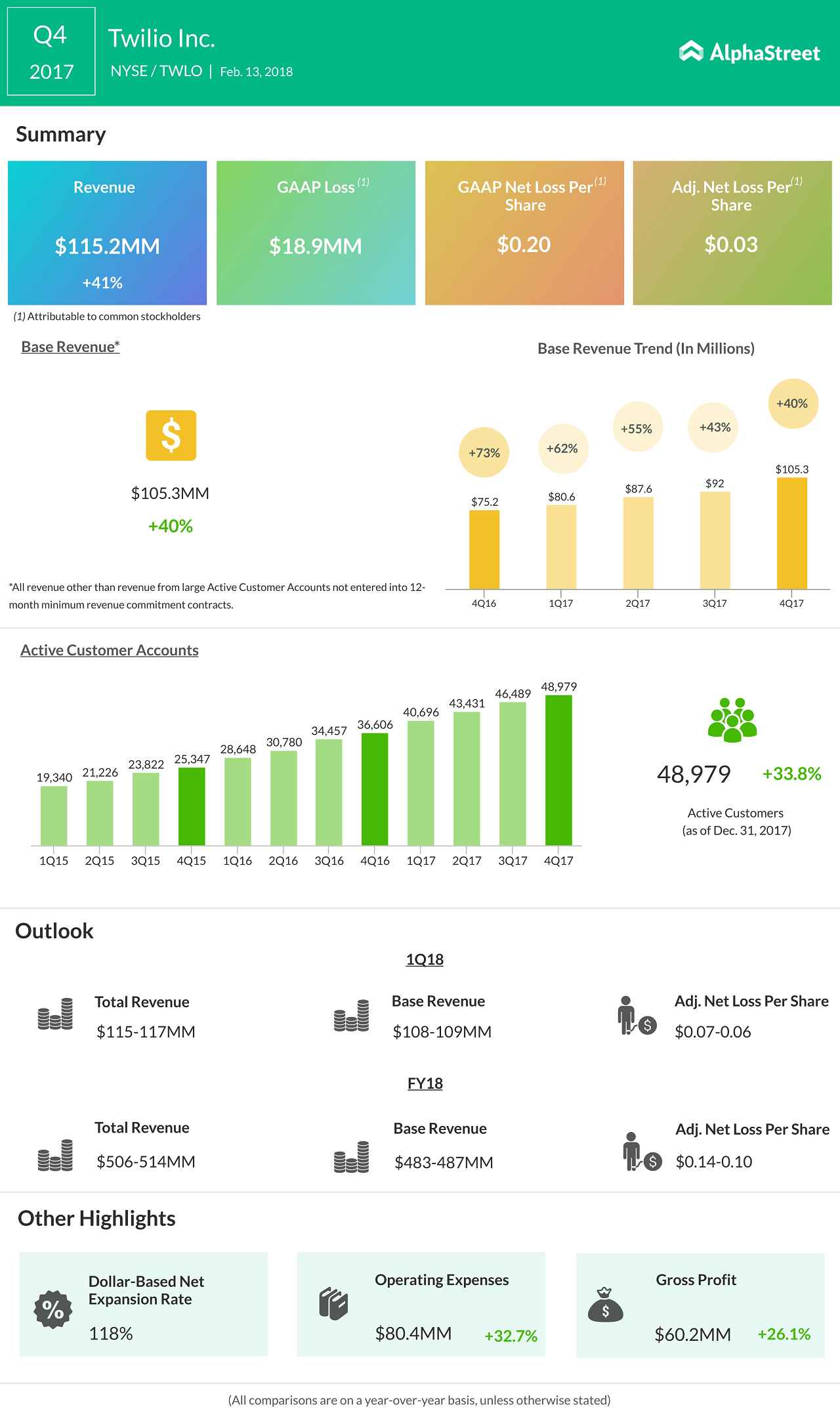

Looks like Twilio has no obvious path to profit. The cloud communication platform reported a net loss of $0.20 in the fourth quarter, despite a solid 41% growth in its revenue.

Twilio was a watched tech IPO and every investor clamored for a share of this high-growth unicorn back then. For a year since its debut, the company traded strongly, but soon tumbled back to the position it was on its opening day. And since then, the company has struggled to bounce back. But this boost in revenue is a positive sign for the investors as it indicates that Twilio is effectively working on retaining its customers.

Ever since the Uber news broke, investors feared that the company’s business would eventually die down, because Uber contributed to about 17% of the company’s total revenue. But by ramping up its marketing efforts and expense, Twilio has attracted many new customers. In fact, the recent appointment of Sara Varni, the former SVP of Marketing for Salesforce’s Sales Cloud business, as the Chief Marketing Officer, is aimed at scaling the marketing efforts around the world.

Currently, its customer WhatsApp accounts for just 7% of the revenue and Uber at 5%. This decline in revenue from Uber will no longer have a material impact on the company’s earnings.

With companies investing heavily in the latest tech trends, Jeff Lawson, co-founder of Twilio, has also joined race by investing in machine learning and artificial intelligence. Investing in these emerging trends can help Twilio grow its business and fetch more customers, making this as another intelligent move to attract investors’ attention. As of December 31, 2017, the number of active customers jumped to 48,979 compared to 36,606 in the prior year.

“We are poised for a stellar year ahead, built on our relentless focus on customer success, quality, and software-fueled innovation,” said Lawson.

What this means to the Twilio investor

Investor should notice that for the full-year guidance, Twilio expects its total revenue to grow by about $506-514 million compared to $399 million in 2017. This rise in number means Twilio sees its business grow in 2018.

Twilio has also effectively diversified its business concentration. Currently, its customer WhatsApp accounts for just 7% of the revenue and Uber at 5%. This decline in revenue from Uber will no longer have a material impact on the company’s earnings, though it continues to stay an important customer for Twilio.