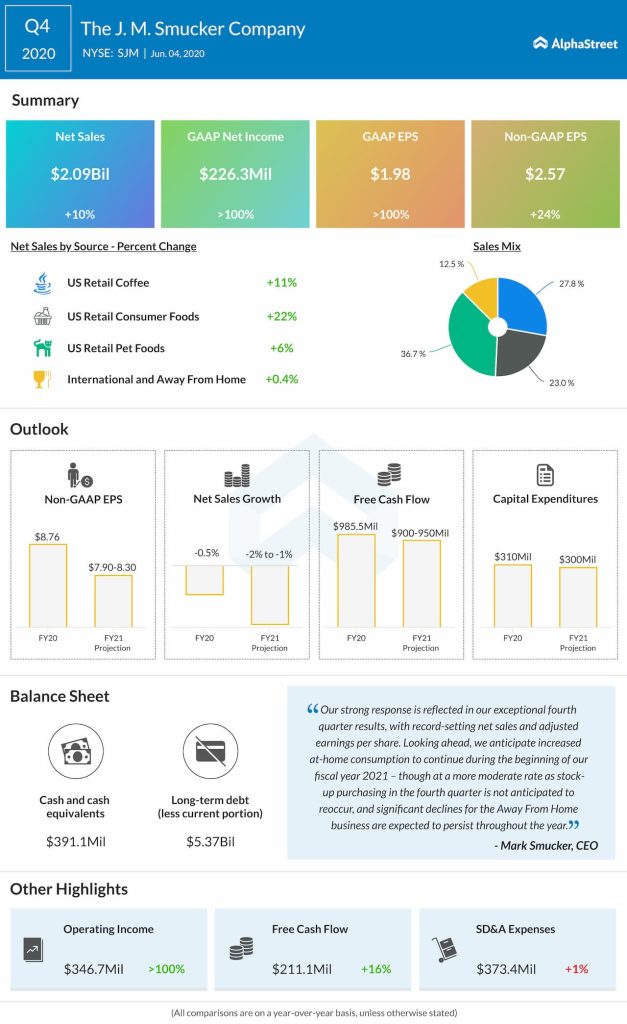

The company provided its fiscal 2021 outlook, with an expected net sales decline of 1-2%, adjusted earnings per share to range from $7.90-8.30, and free cash flow to range from $900-950 million. The outbreak of COVID-19 had a material benefit to fiscal 2020 results and has caused significant uncertainty for fiscal 2021 projections.

Looking ahead, the company anticipates increased at-home consumption to continue during the beginning of fiscal 2021, though at a more moderate rate as stock-up purchasing in the fourth quarter is not anticipated to reoccur, and significant declines for the Away From Home business are expected to persist throughout the year.