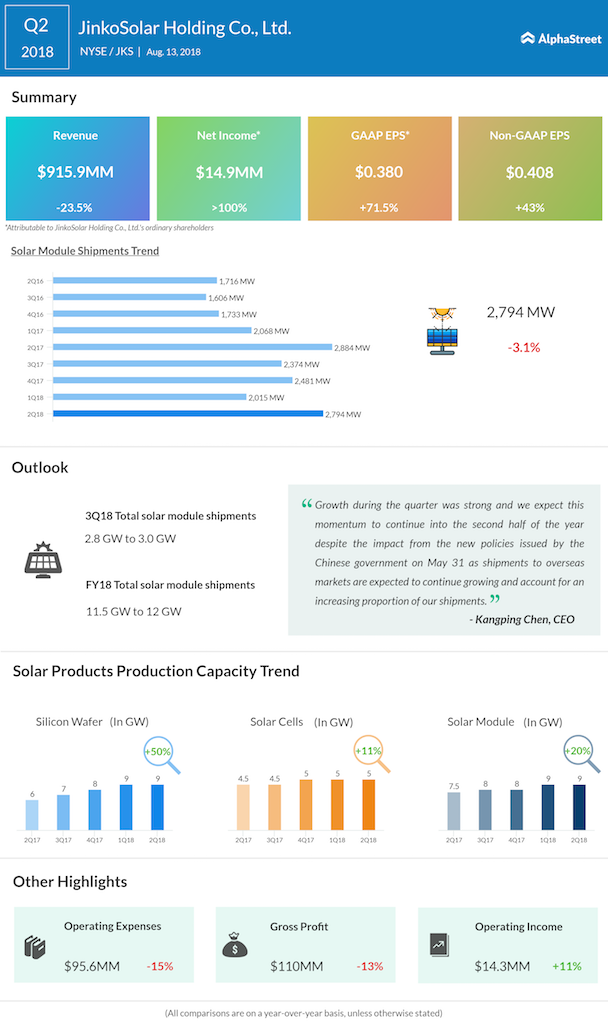

Jinko Solar Holding Co. Ltd. (JKS) beat market expectations on revenue numbers for the second quarter of 2018 but missed on earnings. The solar panel-maker reported total revenues of $915.9 million, a decrease of 23.5% from the same period last year, mainly due to declines in the average selling price and shipments of solar modules. Jinko Solar shares fell 5% during pre-market trading.

Net income attributable to ordinary shareholders was $15 million compared to $7 million last year. Diluted earnings per ordinary share were $0.095, which translates into earnings per ADS of $0.380.

Adjusted net income was $16.1 million, or $0.102 per ordinary share, while adjusted earnings per ADS was $0.408.

Total solar module shipments were 2,794 megawatts, down 3.1% from the prior-year period. At quarter-end, Jinko’s in-house annual silicon wafer production capacity was 9 GW while the solar cell and solar module production capacities were 5 GW and 9 GW respectively.

For the third quarter of 2018, Jinko estimates total solar module shipments to be 2.8 GW to 3 GW. For the full year of 2018, total solar module shipments are expected in the range of 11.5 GW to 12 GW.

In June, Jinko’s subsidiary JinkoSolar (US) Inc. entered into a three-year agreement to supply 1.43 GW of high-efficiency modules to sPower.