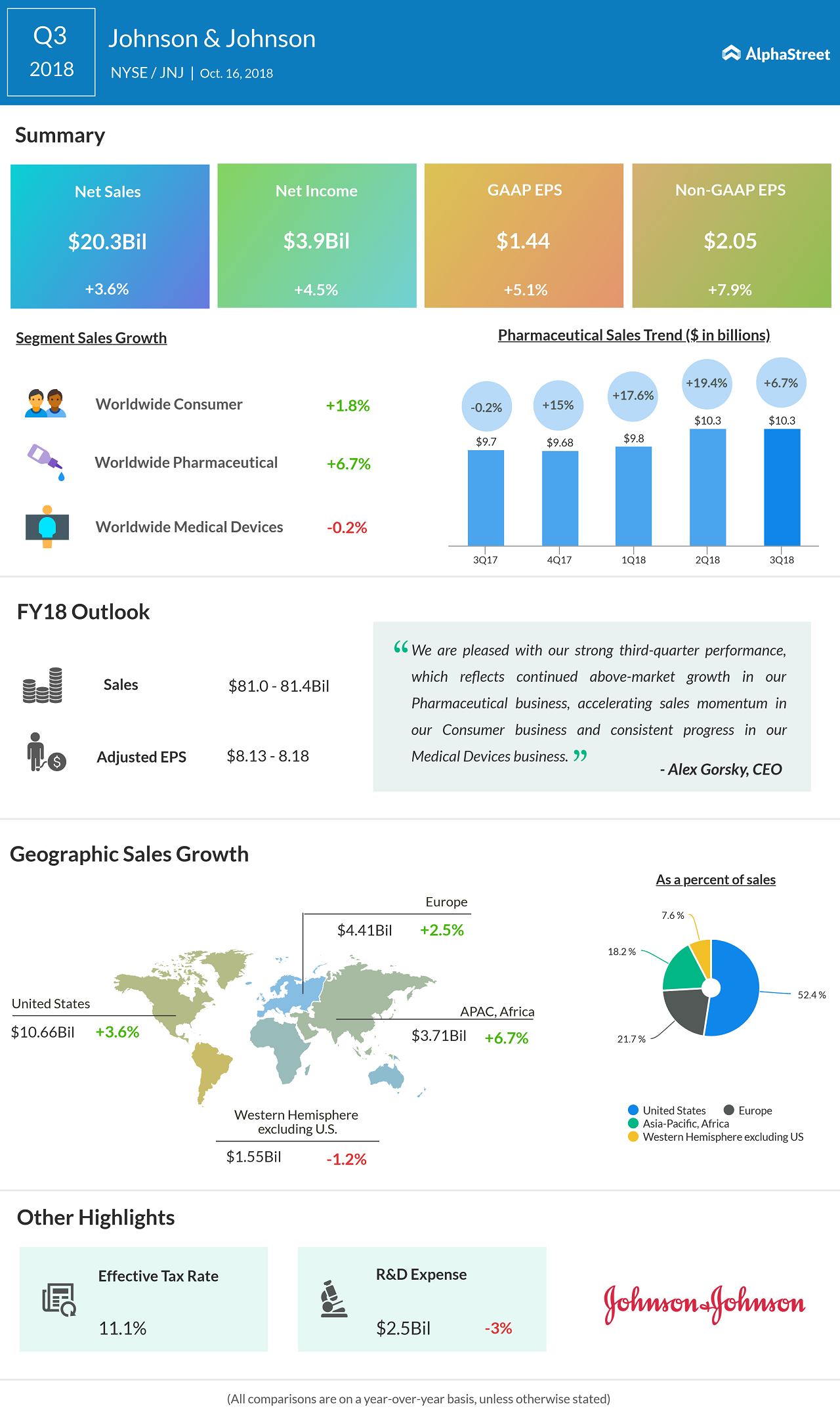

Medical devices giant Johnson & Johnson (JNJ) reported higher revenue and income in Q3, driven by strong sales of pharmaceuticals products. The company posted earnings of $2.05 per share during the quarter, two cents higher than what analysts had expected. On a reported basis, earnings rose to $3.93 billion, or $1.44 per share, from $3.76 billion, or $1.37 per share in the year-over period.

The company reported net sales of $20.35 billion, up 3.6%. Analysts had, on an average expected $20.05 billion. Pharmaceuticals unit posted a better-than-expected sales of $10.35 billion during the quarter, as cancer drugs — Zytiga and Darzalex — made up for the weakness in the blockbuster arthritis drug Remicade.

Buoyed by the higher sales and income, the New Brunswick, New Jersey-based pharma giant raised its earnings outlook for the full year from a range of $8.07 to $8.17 per share to a range of $8.13 to 8.18 per share.

The Q3 results and guidance update sent Johnson & Johnson shares up 0.56% during pre-market trading on Tuesday.

Chief Executive Alex Gorsky said, “We are pleased with our strong third-quarter performance, which reflects continued above-market growth in our Pharmaceutical business, accelerating sales momentum in our Consumer business and consistent progress in our Medical Devices business.”

JNJ stock has lost 3.7% of its value so far this year, trailing S&P 500 index, which has gained 2.6%.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.