Healthcare giant Johnson & Johnson (JNJ) reported a beat on both the top and bottom line expectations as it posted its Q2 2018 earnings. This was aided by a double-digit growth in Pharmaceutical business and the accelerating sales momentum in the Medical Devices business.

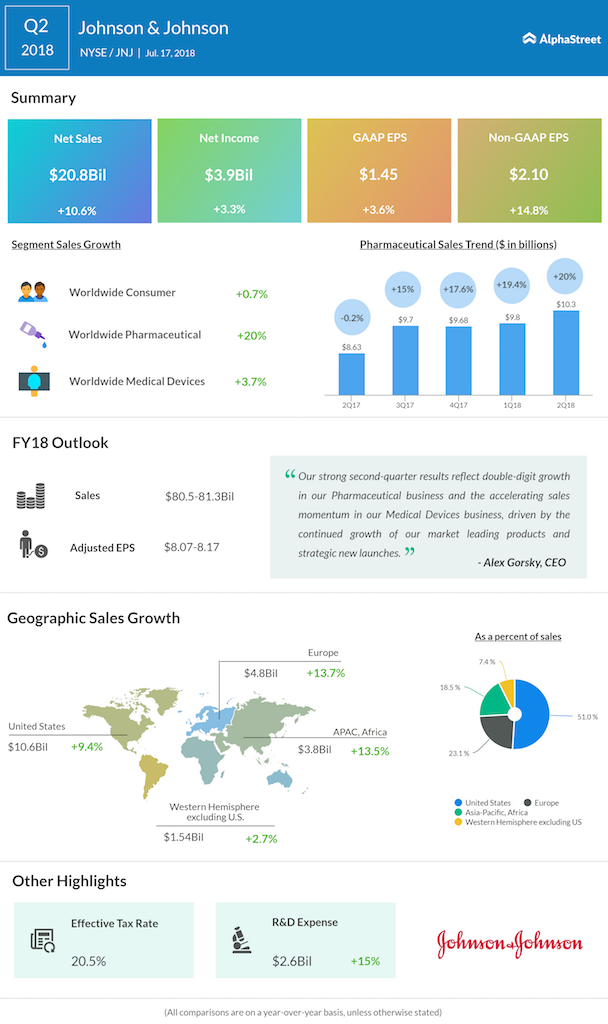

During the quarter, the company posted EPS of $1.45. Excluding items, EPS grew 14% to $2.10, topping analysts’ expectation of $2.06 per share. Revenue came in at $20.8 billion, beating the consensus of $20.37 billion.

For the past four quarters, the company has put together impressive earnings results topping analysts estimates, thanks to a booming pharmaceutical segment. Cancer drugs Imbruvica and Darzalex aided most of this growth. Despite stiff competition from biosimilars, the company managed to post a double-digit sales growth during the quarter. The pharma segment posted sales of $10.4 billion, an increase of 19.9% versus the prior year.

The firm updated its sales guidance for full-year 2018 to a range of $80.5 billion – $81.3 billion. Johnson’s also updated its adjusted earnings guidance for full-year 2018 to a range of $8.07 – $8.17 per share.

Separately, the company’s board declared a cash dividend of $0.90 per share for the Q3 2018 on the company’s common stock. The dividend is payable on September 11, 2018 to shareholders of record on August 28, 2018.

The company has a strong financial position and should not have much trouble paying $4.7 billion in damages for a lawsuit it lost recently over its talc products. However, there are about 9,000 more similar cases pending against the company.

During pre-market trading, JNJ shares rose 0.49% to $125.30.