Investing

JNJ has long been an investors’ favorite, with its impressive dividend program adding to the positive sentiment. However, there is growing concern over the hundreds of lawsuits filed against the company, alleging that some of its popular products contain carcinogenic asbestos.

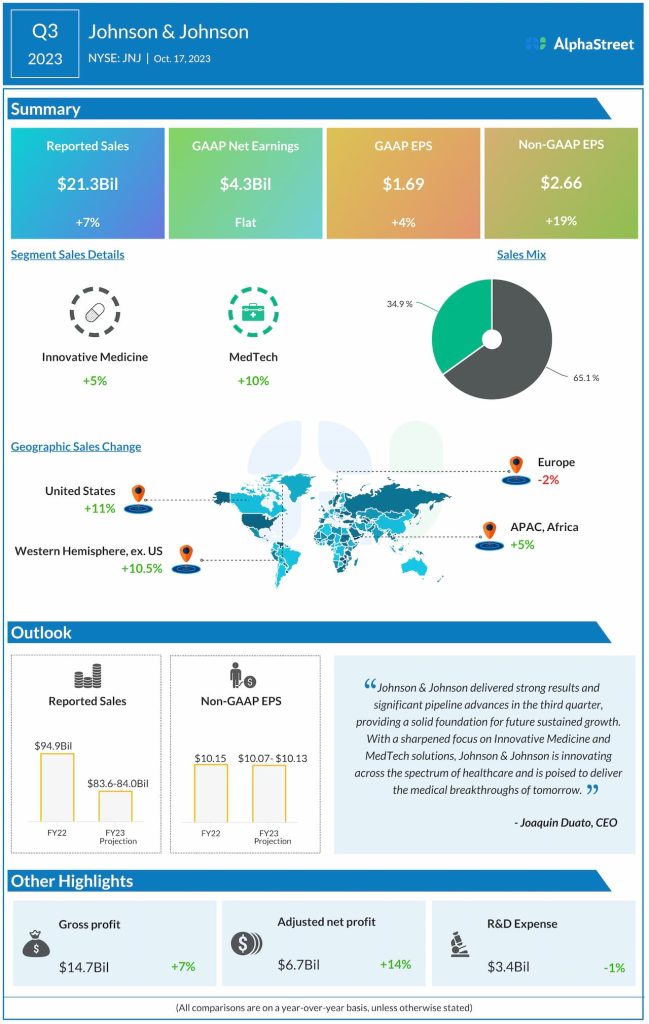

Meanwhile, encouraged by the strong performance of the medical device and pharmaceutical segments, the management recently raised its full-year guidance – currently predicts operational sales growth between 8.5% and 9%. The guidance for adjusted earnings per share is in the range of $10.07 to $10.13, which is up 13% year-over-year at the midpoint.

From Johnson & Johnson’s Q3 2023 earnings call:

“This quarter’s call marks a new era for Johnson & Johnson with a sharpened focus on Innovative Medicine and MedTech. What has remained consistent is our credo and our commitment to patients. We are privileged to build upon our 137 years of tackling the world’s most complex healthcare challenges and helping — with serious unmet health needs around the world. As we look forward, we are well-positioned to grow our business and innovate across the spectrum of healthcare. We are excited about what’s ahead and what we can achieve in the future.”

High Demand

There has been stable demand for the company’s products, thanks to the strong portfolio that includes top-selling Stelara, multiple myeloma drug Darzalex, and other oncology treatments like Erleada. Also, the company has a robust pipeline of drug candidates at advanced stages of development. The MedTech business received a boost from the acquisition of medical technology company Abiomed last year. Johnson & Johnson is also foraying into new areas like robotic surgical equipment, giving competition to the likes of Intuitive Surgical.

The company enjoys the rare distinction of delivering stronger-than-expected earnings in almost every quarter since it started reporting results. In the most recent quarter, the topline also came in above estimates. A 5% sales increase in the core Innovation Medicine segment and double-digit growth in the MedTech division drove up total revenues to $21.3 billion in Q3. As a result, adjusted earnings moved up 19% annually to $2.66 per share.

Spin-Off

In what could be the biggest organizational shakeup in its history, the company separated the Kenvue subsidiary a few months ago. Earlier, the consumer health business suffered a major setback after multiple lawsuits were filed alleging that its talc-based baby powder caused cancer. The company has committed to pay billions of dollars to settle the claims.

Johnson & Johnson’s stock began Tuesday’s trading slightly above $150. The shares are down a dismal 16% since the beginning of 2023.