Top-line Beats

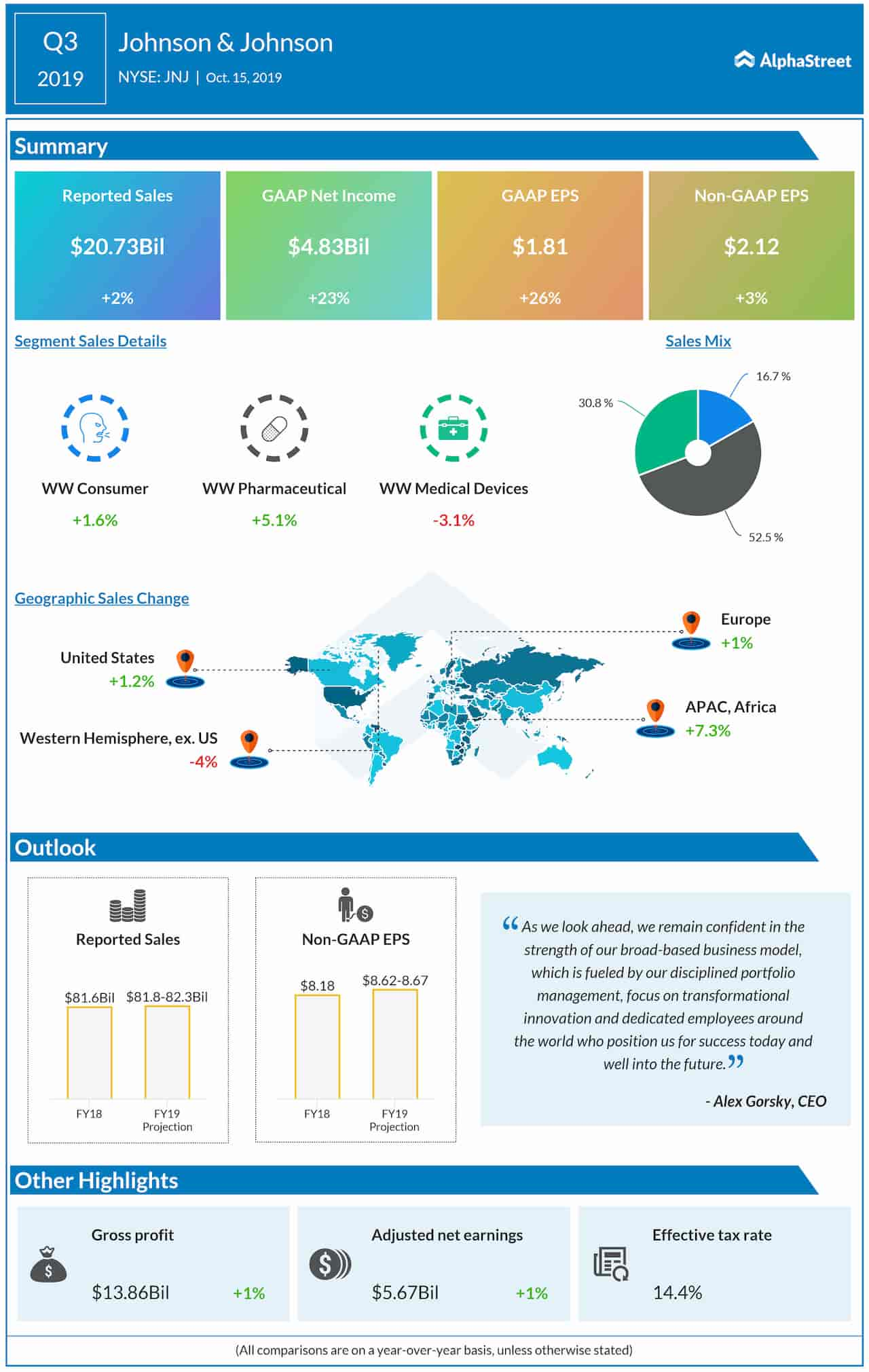

Net sales, meanwhile, moved up to $20.73 billion from $20.35 billion in the third quarter of 2018. Market watchers were looking for a lower top-line number. Sales grew 1.2% in the US and advanced 2.6% in the international market. Segment-wise, Consumer and Pharmaceutical sales grew 1.6% and 5.1% respectively, while Medical Devices sales dropped 3.1%.

“Our third-quarter results represent strong performance, driven by competitive underlying growth in Pharmaceuticals and Medical Devices, as well as continued optimization in our Consumer business,” said CEO Alex Gorsky.

Outlook

The company revised up its full-year 2019 sales outlook to the range of $81.8 billion to $82.3 billion from the previous forecast of $80.8-$81.6 billion, representing a 0.2-0.7% annual increase. The guidance for adjusted earnings has been raised to the range of $8.62 per share to $8.67 per share from $8.53-$8.63 per share, which represents a 5.4-6.0% growth.

To drive growth during the remainder of the year, the management bets on its broad-based business model, supported by disciplined portfolio management and focus on transformational innovation.

Also see: Johnson & Johnson Q2 2019 Earnings Call Transcript

After making a positive start to the year, Johnson & Johnson’s shares pared the initial gains in recent weeks and slipped below the $130-mark. The stock, which lost about 6% in the past twelve months, gained modestly during Tuesday’s pre-market trading session.