The Stock

When the company reports December quarter results on January 23, before the opening bell, Wall Street will be looking for earnings of $2.28 per share, on an adjusted basis, vs. $2.05 per share in the prior-year period. On the other hand, revenues are expected to decline 11.5% year-over-year to $20.99 billion during the three months.

Restructuring

Recently, the company completed the separation of Kenvue, its consumer health subsidiary, generating cash and value for shareholders. The effect of the deal-related reduction in outstanding shares is expected to start reflecting on earnings per share this year.

From Johnson & Johnson’s Q3 2023 earnings call:

“For Innovative Medicine, we’re confident in our ability to deliver growth from key brands and anticipate continued progress from our newly launched — all advancing our robust pipeline with many exciting data readouts, filings, and approvals ahead of us… For MedTech, we expect our commercial capabilities and continued adoption of recently launched products across all MedTech businesses will continue to drive our growth and improve competitiveness while continuing to advance our pipeline programs, including innovation in pulse-field ablation, Abiomed, and surgical robotics.“

Strong Q3

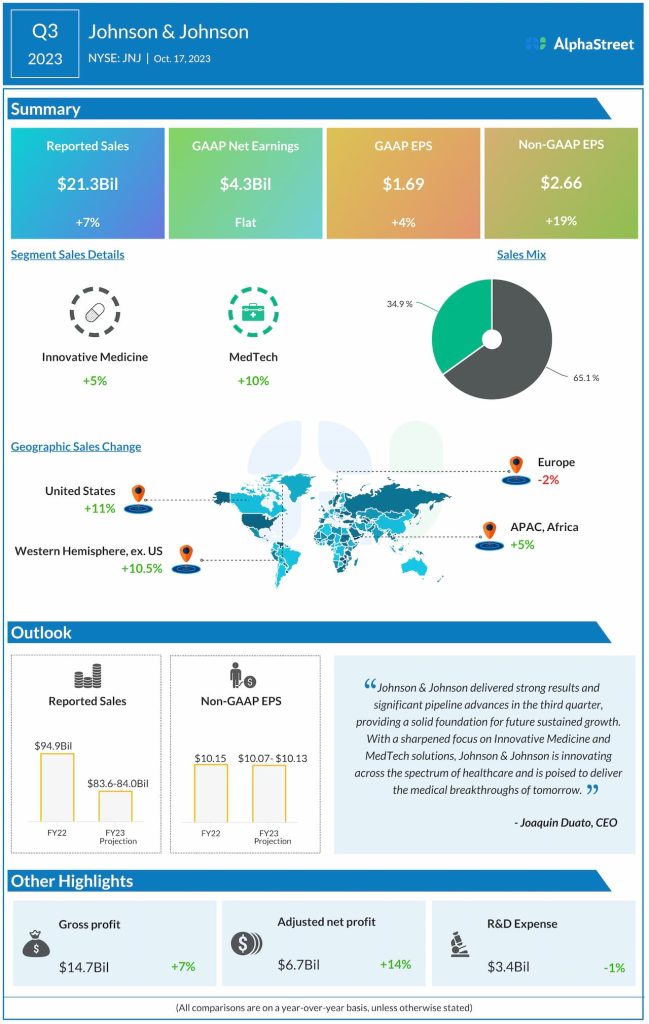

When it comes to profitability, Johnson & Johnson has long been delivering outstanding performance — reported stronger-than-expected earnings regularly for more than a decade. The trend is estimated to have continued in the most recent quarter. Third-quarter earnings, excluding special items, increased in double-digits to $2.66 per share. Driving the bottom-line growth, revenues rose 7% annually to $21.3 billion as both operating segments – Innovative Medicine and MedTech – expanded in double digits. For the full fiscal year, the management expects a decline in sales.

Shares of Johnson & Johnson traded above $160 on Thursday, after opening the session slightly higher. It has lost about 2% so far this week.