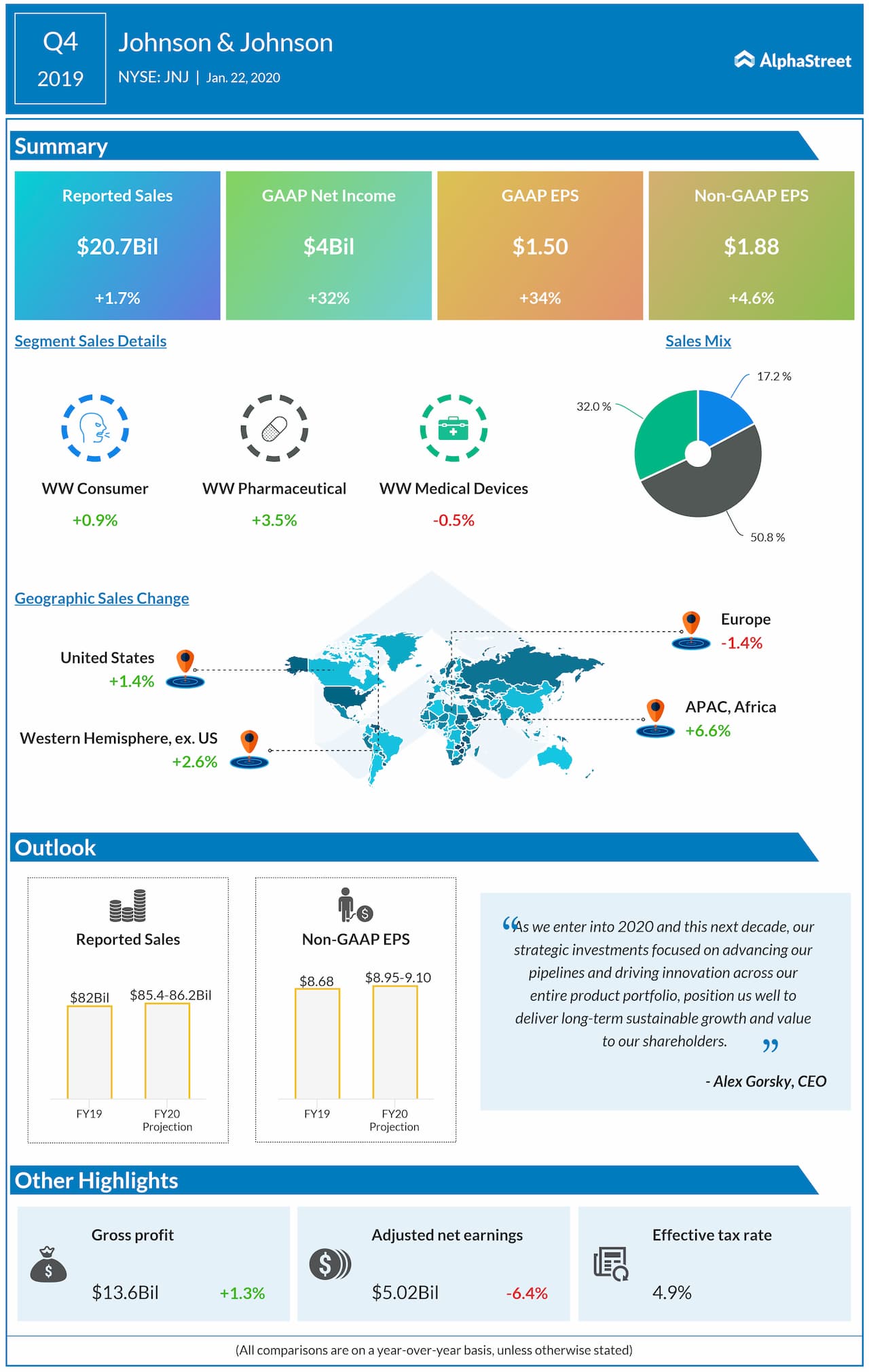

GAAP net income grew 31.8% to $4 billion and EPS improved

around 34% to $1.50. Adjusted net income fell 6.4% year-over-year to $5

billion. Adjusted EPS dropped 4.6% to $1.88 but beat estimates of $1.87.

Alex Gorsky, Chairman and CEO

stated, “We delivered strong underlying sales and earnings growth in 2019,

driven by the strength of our Pharmaceutical business, accelerating performance

in our Medical Devices business and improved profitability in our Consumer

business.”

Sales in the US increased 1.4% to $10.7 billion while international sales rose 2.1% to $9.9 billion. The Consumer and Pharmaceutical segments saw sales increases of 0.9% and 3.5% respectively, while sales in the Medical Devices segment was down 0.5%.

For the full year of 2020, the company expects reported

sales to grow 4-5% to $85.4 billion to $86.2 billion. Operational sales are

expected to grow 4.5-5.5% to $85.8-$86.6 billion. Adjusted operational sales

are expected to grow 5-6%.

Adjusted EPS is expected to increase 3.1-4.8% to a range of $8.95-9.10 and adjusted operational EPS is expected to rise 3.7-5.4% to a range of $9.00-9.15.

Listen to on-demand earnings calls and hear how management responds to analysts’ questions