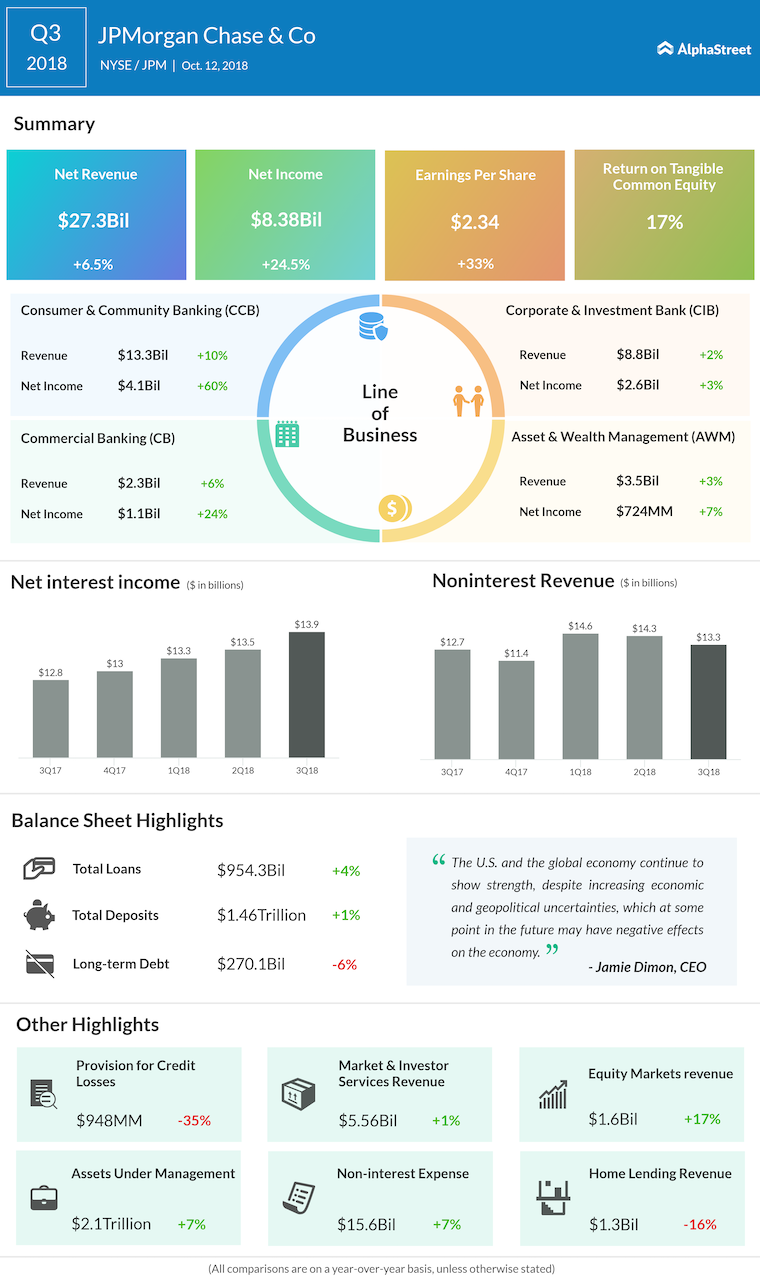

Revenues of the bank, one of the first among the major financial services firms to report earnings this season, advanced 5.2% annually to $27.8 billion, which was slightly above Wall Street estimates. Driving the growth, consumer banking revenues moved up 10% to $13.3 billion, which was partially offset by a 2% drop in trading revenues to $4.4 billion. During the quarter, the bank’s provision for credit losses decreased 58% year-on-year to $948 million.

“In Consumer & Community Banking we attracted record net new money this quarter, driving client investment assets up 14%, and we saw continued double-digit growth in card sales and merchant processing volume,” said CEO Jamie Dimon.

During the quarter, the bank’s provision for credit losses decreased 58% year-on-year to $948 million

For the whole of 2018, the management sees net interest income of about $55.5 million and expects a 7-8% growth in noninterest revenue. Average core loan growth, excluding CIB loans, is forecast at 6-7%.

Margins of banks are currently under pressure from the high interest rates, which weigh down on loan growth and push up interest expense. However, the growing economy brightens the long-term prospects of the sector.

Recently, Dimon announced the launch of AdvancingCities, a program with an outlay of $500 million to reach out to people who are yet to benefit from the economic growth. The bank has also unveiled an extensive plan to open about 400 new branches to expand its retail banking business.

Among others in the sector, Citigroup today reported better-than-expected earnings of $1.73 per share for the third quarter on revenues of $18.4 billion, which fell short of expectations.

JPMorgan shares gained about 2% in premarket trading Friday, after closing the previous session down. Over the past twelve months, the stock gained about 13%.

JPMorgan reports solid results for Q2 2018; beats analyst expectations

ADVERTISEMENT