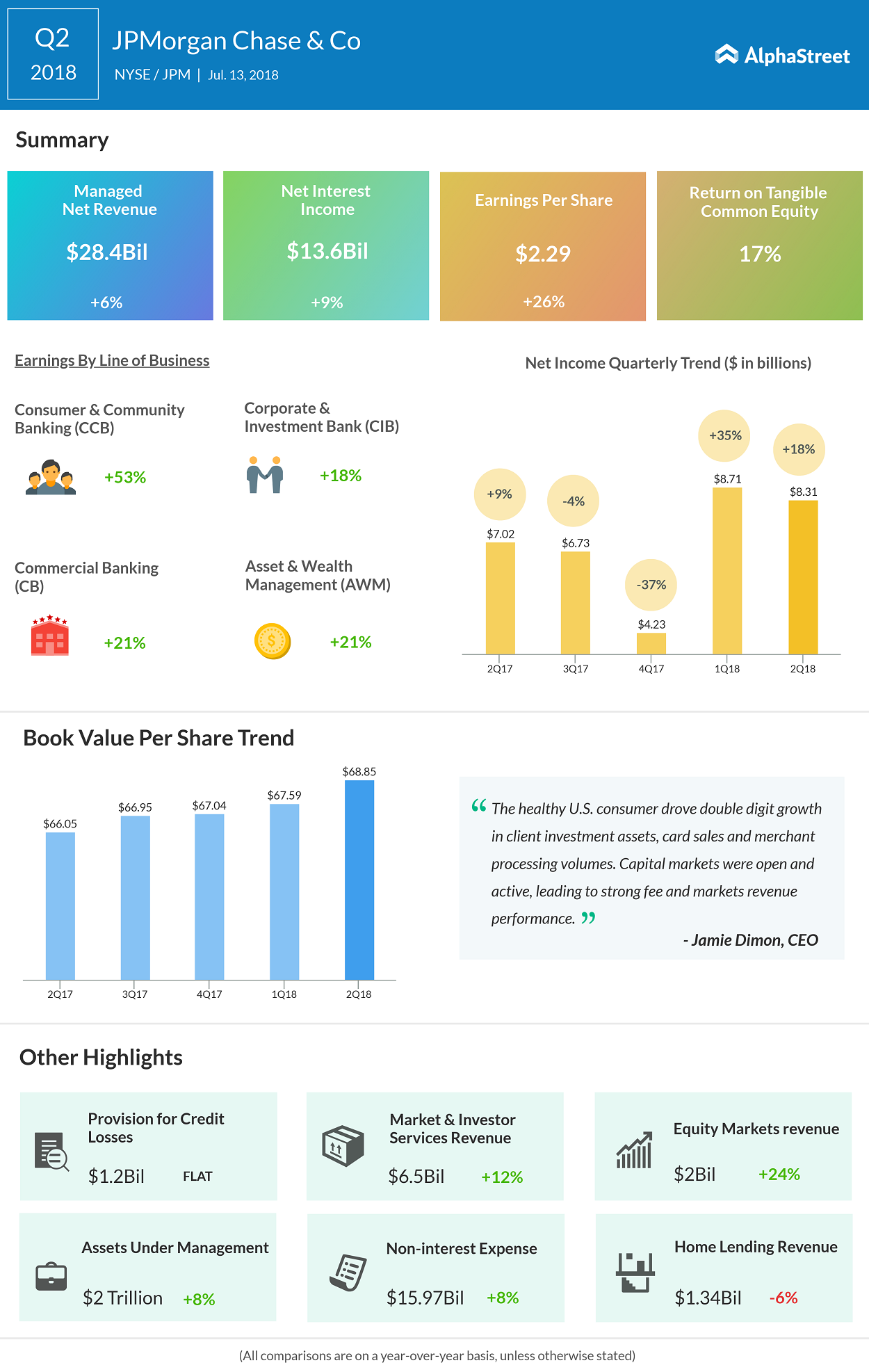

JPMorgan Chase & Co. (JPM) reported revenues of $27.8 billion for the second quarter of 2018, in line with analyst expectations, and above the prior-year period results. Net income grew 18% to $8.3 billion while diluted EPS came in at $2.29, beating analyst expectations.

Net interest income rose 9% during the quarter driven by higher rates and loan growth while non-interest revenue grew 4% driven by higher markets revenue, investment banking fees and auto lease income. Non-interest expense increased 8%.

Average core loans, excluding CIB, were up 7% year-over-year. The company distributed $6.6 billion to shareholders during the second quarter. Last month, JPMorgan received approval to increase its dividend to $0.80 per share from the third quarter of 2018. The company also authorized an equity repurchase program valued at $20.7 billion.

Total revenues in its CCB business increased 10% during the quarter. In the CIB business, revenues grew 11%. Commercial Banking (CB) revenues rose 11%, driven by higher net interest income and higher investment banking revenue. The AWM segment revenues improved 4%.

In the CCB segment, average loans were up 2%, and average deposits were up 5%. In the CB segment, average loan balances grew 4% while average client deposits were down 1% year-over-year. In the AWM business, average loan balances increased 12% while average deposit balances dropped 7%.

Related: JPMorgan Q2 Earnings Preview: Banking stocks might see green

Related: JPMorgan Q2 2018 Earnings Transcript

Related: JPMorgan Q1 2018 Earnings Infographic